Citywire Wealth Manager Conference and Awards 2025

Welcome to the Citywire Wealth Manager Conference & Awards 2025, taking place on 13-14 February at its new home, Grosvenor House.

We look forward to celebrating the investment management community once again, bringing together the best and the brightest fund researchers from across the UK and Channel Islands. Alongside a lineup of approximately 20 fund managers, we will hear from carefully selected keynote speakers to address some of the most pressing issues of our time, in what are challenging economic and societal conditions.

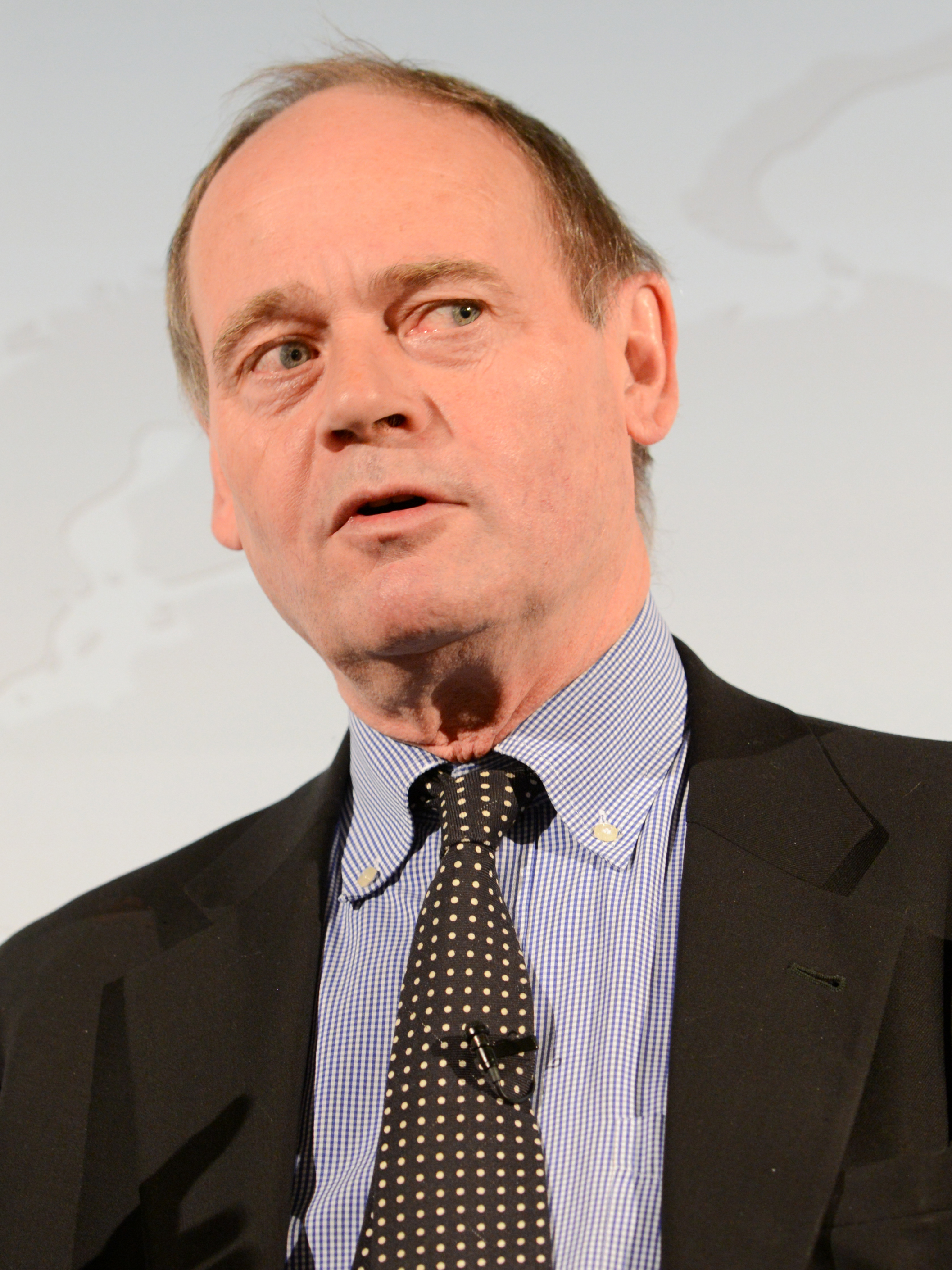

The Conference will be opened by Lord Kim Darroch KCMG, former British Ambassador to the United States and the European Union. Lord Darroch has navigated the UK’s diplomatic position through a number of complex geopolitical periods, including the Global Financial Crisis, the United Kingdom’s withdrawal from the EU, and the Russian annexation of Crimea. His tenure as British Ambassador to the United States, during a turbulent Trump presidency, was cut short after a much-publicised leak of diplomatic cables, and he is uniquely placed to offer rare insights into dealing with media scrutiny and coping under pressure.

We will also hear from Dr. Paul Morland, a leading expert in demography and the author of several acclaimed books, including No One Left: Why the World Needs More Children (2024). He will explore the implications of declining birth rates in developed economies and offer policy solutions to address these challenges. With a background in business consulting and a PhD in political demography, Morland has worked extensively with financial services firms, known for his insightful analysis of global demographic trends.

After dinner we will hear from comedian, GP, and ‘Chaser’ Paul Sinha. After trying stand-up comedy as a break from his studies as a junior doctor, he went on to become a practising GP, an Edinburgh comedy award nominee, and a key component of popular ITV quiz show The Chase. His wonderfully relaxed style of storytelling combines wry observations on life with beautifully crafted one-liners, along with a series of anecdotes from his experiences with patients and bureaucracy.

As ever, there will be an opportunity to engage with influential fund managers, providing insight into their strategies for navigating the present, and identifying opportunities as we consider what comes next.

As with all of our Retreats, attendance is strictly by invitation only.

Delegates participating in the accredited Wealth Manager Conference & Awards can claim up to 8 CPD hours towards the CII / Personal Finance Society member CPD scheme.

Learning Objectives

By the end of this event delegates should be able to:

- Describe the benefits and challenges of a variety of investment strategies across multiple asset classes and themes.

- Better manage high-pressure environments and perform well under a high level of scrutiny.

- Explain the demographic challenges facing developed economies, particularly the impact of declining birth rates on labour markets, pension systems, and national debt.

This year’s Conference will also see us present the Citywire Adviser Choice Awards during our black tie gala dinner. These awards recognise the most trusted discretionary fund managers across the country, as voted for by advisers. Alongside our regional winners, wealth managers will also be recognised across several other categories, from best reporting to best value for money.

We anticipate another lively and meaningful Wealth Manager Conference and Awards, and look forward to bringing the investment management community together once again. There is plenty to discuss!

Agenda

08:00 - 09:30

Registration

09:30 - 09:40

Welcome with Katie Gilfillan and Ross Miller

09:40 - 10:40

Conference Session 1 - Lord (Kim) Darroch KCMG

10:40 - 11:10

Fund Group Workshop - 1

11:20 - 11:50

Fund Group Workshop - 2

12:00 - 12:30

Fund Group Workshop - 3

12:30 - 13:50

Table Planned Lunch

13:50 - 14:50

Conference Session 2 - Paul Morland

14:50 - 15:20

Fund Group Workshop - 4

15:30 - 16:00

Fund Group Workshop - 5

16:10 - 16:40

Fund Group Workshop - 6

16:50 - 17:20

Fund Group Workshop - 7

19:30 - 20:00

Drinks Reception

20:00 - 23:00

Table Planned Dinner, Citywire Adviser Choice Awards and After Dinner Speaker Paul Sinha

07:00 - 09:30

Breakfast at Leisure

09:30 - 10:30

Conference Session 3 - Lucy Charles-Barclay

10:30 - 11:00

Fund Group Workshop - 8

11:10 - 11:40

Fund Group Workshop - 9

11:50 - 12:20

Fund Group Workshop - 10

12:20 - 14:00

Buffet Lunch

Keynote Speakers

Speakers

Helen Lewis

Helen Lewis is a staff writer at The Atlantic, host of the BBC podcast series The New Gurus and presenter of the BBC's longform interview series The Spark. Her first book, Difficult Women, was a Sunday Times bestseller and a Guardian, Times, Telegraph and Financial Times book of the year. She was formerly deputy editor at the New Statesman.

She has also written for the Sunday Times, Elle, the New York Times, Vogue, the Financial Times, the Observer, The Times, and The Guardian.

Helen is an accomplished interviewer. Her viral encounter with Jordan Peterson has been viewed more than sixty-five million times on YouTube. She is also a regular panellist on Have I Got News For You; and the Private Eye podcast, Page 94.

Dan McCrum

Dan McCrum is multi-award winning journalist and author. In 15 years at the Financial Times he has covered business and finance from New York and London, helping to uncover fraudulent accounting at several listed companies. He is currently a member of the investigations team, and his reporting on Wirecard was recognised with more than a dozen awards and prizes, including journalist of the year at the 2020 British Press Awards. Dan got a taste for newsprint as a paperboy in his family’s newsagent. Before becoming a journalist he tried his hand at painting and decorating, selling cook books door-to-door, and learned a thing or two about finance in the research department of an investment bank.

John Lloyd

John Lloyd has been behind some of the most successful and well-loved TV and radio (and adverts) of the last three decades. He’s also written or co-authored over 30 books, and is the driving force behind developing a new concept of education based on his BBC panel show, QI.

At BBC radio John helped create shows that have become national institutions with The News Quiz (which John also briefly hosted), Quote...Unquote, The News Huddlines, and the original incarnation of To The Manor Born. Switching to TV, John’s first major production was the satirical Not the Nine O'Clock News with Mel Smith and Griff Rhys Jones, Rowan Atkinson, and Pamela Stephenson.

John then went on to produce Blackadder, working again with Rowan Atkinson and writer Richard Curtis, creating arguably one the greatest sit-coms ever. At the same time he worked on Spitting Image alongside a host of comic writers and performers from Harry Enfield to Ian Hislop to Jo Brand. John remained behind the camera and created the panel show QI.

John is at the forefront of looking at what real knowledge is and how it can be imparted. Reacting against the idea that Google and Wikipedia offer free access to knowledge, John considers what really is interesting, and useful, alongside tales from his varied and often surprising career.

Sarah Furness

After graduating from Cambridge University, Sarah Furness followed her dream to become an RAF helicopter pilot and Squadron leader. She led operational combat tours in Iraq and Afghanistan. During her experiences at home and at war, she learnt that tough capable people don’t always feel as strong as they look. This prompted her to re-train and harness her experience and passion to help people use their impressive (but often mischievous) brains as a force for good.

Sarah's experiences as a combat operational commander, helicopter pilot, mother and mindfulness coach has led her to develop her own unique Healthy Automatic Behaviours In Threatening Scenarios (H.A.B.I.TS.) Formula, a way to train the mind to be a Jedi master under pressure and accomplish zen like levels of self-belief and inner calm.

In her book Fly Higher, Sarah looks at how to train and ultimately rewire the mind in order to feel in control and resilient in adversity, and how to leverage these skills to relate to others and lead others skilfully and authentically.

Her speaking style is robust (she is combat helicopter pilot and fluent in alpha male), science-based and good-humoured.

Workshops

Workshops

Profitable Growth: Providing Stability and consistency in Uncertain Markets

US equity market returns were extremely concentrated in 2023. The so-called Magnificent Seven stocks, dominated market returns while many other companies were left behind. Historically, these extreme levels of concentration have not been sustainable. This concentration, paired with normalizing inflation and economic growth, requires investors to be more discerning in their search for growth moving forward.

The AB American Growth Portfolio takes a differentiated approach to large-cap growth investing, aiming to identify exceptional businesses that exhibit two key characteristics: high and improving levels of profitability, and ample opportunity for reinvestment. Businesses that exhibit these characteristics can unlock the power of compounding, delivering persistent, profitable growth, and support more consistent risk-adjusted returns over time, regardless of the macroeconomic backdrop.

Workshop Objective: Introduce the AB American Growth Portfolio, highlight points of differentiation within the US Large Cap Growth space, and provide an update on where we see opportunities in today’s uncertain markets.

Company Profile: AllianceBernstein is a leading investment-management firm with $725 billion in client assets under management, as of 31 December 2023. With a unique combination of expertise across equities, fixed-income, alternatives and multi-asset strategies, we aim to deliver differentiated insights and distinctive solutions to advance investors’ success. Across our global network, we’re fully invested in delivering better outcomes for our worldwide clients, including institutional, high-net-worth and retail investors. By embracing innovation, we seek to address increasingly complex investing challenges and opportunities. And we pursue responsibility at all levels of the firm—from how we work and act to the solutions we design for clients.

Speakers

Robert Milano

Senior Investment Strategist and Head-EMEA Equity Business Development

Robert Milano is a Senior Investment Strategist and Head of EMEA Equity Business Development. He is responsible for partnering with regional sales leadership to set strategic priorities and goals for the EMEA Equities business, develop new products, and engage with clients to represent the market views and investment strategies of the firm. Previously, Milano was a senior investment strategist supporting AB's Select US Equity and US Growth Portfolios. He joined the firm in 2013 as a product analyst on our Fixed Income Business Development team, where he supported the firm's taxable and municipal funds for the US Retail market. Milano holds a BS in finance from Manhattan College. Location: London

Equity Income in the age of the Magnificent Seven

Even as the Magnificent Seven power the S&P500, a focus on free cash flow and dividend growth can generate not just income for clients today, but also meaningful capital appreciation. By venturing beyond the sectors that are most traditionally associated with income investing, clients benefit from:

• Dividend growth that may outpace inflation and help maintain income in real terms.

• Low overlap with conventional income holdings that may help diversify portfolio risk.

Richard Saldana will explain how his team's approach to income investing is differentiated and has delivered 1yr, 3yr, 5yr and 10yr top decile returns whilst achieving portfolio dividend growth of 9.4% p.a. over the last 10 years.

Workshop Objective:

Understand:

• How equity income may offer not just downside protection but also upside capture.

• Sectors and companies that may underpin this.

• How this allocation may sit in a diversified portfolio.

Speakers

Richard Saldanha

Portfolio Manager, Global Equities

Richard is the lead portfolio manager for the Global Equity Income Strategy and co-manager for the Global Equity Endurance Strategy and the Social Transition Global Equity Strategy.

Richard joined Aviva Investors in 2006 and has been managing a range of global portfolios since 2009. Richard, holds a Masters in Chemistry from the University of Oxford. He also holds the UKSIP Investment Management Certificate.

Representatives

Jerome Nunan

Investment Director, Multi- Assets

Michael Ryan

Client Solutions Manager

Exploiting attractive opportunities across the global short-dated bond market

Fixed-income markets continue to be very volatile as the economic outlook remains uncertain due to high interest rates, sticky inflation, slowing growth and tighter lending conditions. Nicolas will present his outlook for 2024 covering economics, geopolitics, valuations, and asset allocation. With global yield curves still inverted, Nicolas will also explain why he believes short-dated bonds represent a compelling opportunity for investors.

Workshop Objective: Understanding fixed-income market drivers and benefits of short-dated bonds.

Company Profile: AXA Investment Managers (AXA IM) is a responsible asset manager, actively investing for the long term to help its clients, its people and the world to prosper. Our high conviction approach enables us to uncover what we believe to be the best global investment opportunities across alternative and traditional asset classes, managing approximately €842 billion in assets as at the end of September 2023.

We are committed to reaching net zero greenhouse gas emissions by 2050 across all our assets, and integrating ESG principles into our business, from stock selection to our corporate actions and culture. Our goal is to provide clients with a true value responsible investment solution, while driving meaningful change for society and the environment.

At end of December 2023, AXA IM employed over 2,700 employees around the world, operated out of 23 offices across 18 countries and is part of the AXA Group, a worldwide leader in insurance and asset management.

Speakers

Nicolas Trindade

Senior Portfolio Manager

Nicolas is a Senior Portfolio Manager and forms part of the Investment Grade Credit team within our global Active Fixed Income platform. He is responsible for managing both global and sterling credit portfolios. He is the lead portfolio manager of the AXA Sterling Credit Short Duration Bond Fund, the AXA Global Short Duration Bond Fund and AXA WF Global Short Duration Bonds fund. In addition to his portfolio management responsibilities, Nicolas heads the Sterling Credit Alpha Group during the Fixed Income Department’s quarterly Forecasting Forum and is responsible for providing relative value coverage of various sectors within AXA IM’s Portfolio Manager Analyst credit research organisation. Nicolas initially joined AXA IM in 2006. Prior to his appointment within the investment team, he was a fixed income product specialist responsible for the development of the UK, US, and high yield product ranges. Nicolas holds two master’s degrees, one in Diplomacy and International Strategy from the London School of Economics and one in IT Engineering from Telecom Sud Paris. He is also a CFA Charterholder. In August 2017, Nicolas was among 25 European investment professionals named a “Rising Star of Asset Management” by the Financial News.

Representatives

Simon King

Sales Director

Simon joined AXA Investment Managers in November 2022 as Sales Director within the UK Wholesale team responsible for promoting AXA IM Fund ranges. Simon joined from Bellevue Asset Management, a specialist healthcare asset manager and has held senior sales roles at T. Rowe Price, Woodford Investment Management, and Thames River Capital (F&C). Simon started his career at Cazenove Fund Management working in institutional marketing and client services. Simon received a BA Hons in French Studies from Manchester University and holds the Investment Management Certificate.

Simon joined AXA Investment Managers in November 2022 as Sales Director within the UK Wholesale team responsible for promoting AXA IM Fund ranges. Simon joined from Bellevue Asset Management, a specialist healthcare asset manager and has held senior sales roles at T. Rowe Price, Woodford Investment Management, and Thames River Capital (F&C). Simon started his career at Cazenove Fund Management working in institutional marketing and client services. Simon received a BA Hons in French Studies from Manchester University and holds the Investment Management Certificate.

Ozan Kazim

Sales Manager

Ozan joined AXA Investment Managers in September 2022 and works on the UK Wholesale Team, responsible for promoting the AXA Investment Managers Fund range. He previously was responsible for the distribution of the Mirabaud Asset Management fund range and was Head of Distribution at Slater Investments. Prior to his career in Asset Management, he has worked for various city firms as a Private Client Stockbroker. He achieved the CISI Investment Advice Diploma and received a BA (Hons) in Business Management (Marketing) from the University of Westminster.

Ozan joined AXA Investment Managers in September 2022 and works on the UK Wholesale Team, responsible for promoting the AXA Investment Managers Fund range. He previously was responsible for the distribution of the Mirabaud Asset Management fund range and was Head of Distribution at Slater Investments. Prior to his career in Asset Management, he has worked for various city firms as a Private Client Stockbroker. He achieved the CISI Investment Advice Diploma and received a BA (Hons) in Business Management (Marketing) from the University of Westminster.

US Growth Investing: what's next?

The era of cheap capital is over, and companies are adapting to a ‘new normal’. Macroeconomic and geopolitical concerns abound. Are we out of the woods yet? Kirsty Gibson will discuss how a combination of resilience, growth, adaptability and focus on efficiency will help distinguish companies in this new economic landscape. She will highlight those companies poised for sustained growth, an opportunity often overlooked in news headlines, and share our approach to identifying these opportunities.

Workshop Objective:

• Identify the key features of company adaptability in a tougher environment: don't mistake maturity for safety.

• Explore the next phase of disruptive growth that will power returns for companies that can keep investing.

• Uncover what sets the US apart from everywhere else and why it is continually underestimated.

Speakers

Kirsty Gibson

Investment Manager

Kirsty joined Baillie Gifford in 2012 and is an investment manager in the US Equity Growth Team. She has been involved in running the North American portfolio of the Managed Fund and Global Core Fund since 2021. Prior to joining the US Equity Growth Team, Kirsty also spent several years in the small and large-cap global equities departments. She graduated MA (Hons) in Economics in 2011 and MSc in Carbon Management in 2012, both from the University of Edinburgh.

Representatives

Simon Gaunt

Client Relationship Director

Simon joined Baillie Gifford in 2015 and is a client relationship director, Intermediary Clients, covering the London area. Simon has over 20 years’ experience, and prior to Baillie Gifford he worked at Panmure Gordon in investment trust sales. Prior to investment banking, Simon was also a sovereign risk analyst at Dun & Bradstreet. Simon graduated in Economics and Geography from the University of Middlesex in 1989.

Simon joined Baillie Gifford in 2015 and is a client relationship director, Intermediary Clients, covering the London area. Simon has over 20 years’ experience, and prior to Baillie Gifford he worked at Panmure Gordon in investment trust sales. Prior to investment banking, Simon was also a sovereign risk analyst at Dun & Bradstreet. Simon graduated in Economics and Geography from the University of Middlesex in 1989.

Samantha Crawley

Client Relationship Manager

%20(1).jpg) Samantha joined Baillie Gifford in 2021 and is a member of the UK Intermediary Team within the Clients Department, with a focus on the South East. Prior to joining Baillie Gifford, Samantha spent eight years predominantly within institutional sales roles across Janus Henderson and Insight Investment. Samantha graduated from the University of Reading in 2013 with a Bachelor of Science degree in Economics and holds both the IMC and CFA Level I.

Samantha joined Baillie Gifford in 2021 and is a member of the UK Intermediary Team within the Clients Department, with a focus on the South East. Prior to joining Baillie Gifford, Samantha spent eight years predominantly within institutional sales roles across Janus Henderson and Insight Investment. Samantha graduated from the University of Reading in 2013 with a Bachelor of Science degree in Economics and holds both the IMC and CFA Level I.

Why we see favourable entry points emerging for international REITs in 2024

We anticipate the Fed will end the rate hiking cycle allowing tactical entry points within international REITs to continue to emerge. The vast performance dispersion between real estate regions and sectors requires a specialist, active, and global approach and during the presentation, we will highlight how our team leverages their information advantage to deliver consistent alpha.

Workshop Objective: To understand the key strategic benefits of real estate, why an allocation will be critical and Cohen & Steers’ unique real estate investment approach.

Company Profile: Founded in 1986 as the first investment company in the world to specialize in listed real estate, Cohen & Steers today has $83 billion assets under management.

Cohen & Steers is a leading global investment manager specializing in real assets and alternative income, focused on delivering attractive returns, income and diversification.

Speakers

Brian Cordes, CAIA

Head of Cohen & Steers’ Portfolio Specialist Group

Brian Cordes, CAIA, Senior Vice President, is the head of Cohen & Steers’ Portfolio Specialist Group, which represents the company’s investment teams in interactions with institutional and retail clients. He has 25 years of experience. Prior to joining Cohen & Steers in 2012, Mr. Cordes was a product manager at Columbia Management. Previously, he was with New York Life Investment Management and Morgan Stanley Dean Witter. Mr. Cordes has a BS from Rider University and is based in New York.

Representatives

Sean Cooney

Head of U.K. Wealth

Sean Cooney, Senior Director, Head of U.K. Wealth, is responsible for developing strategic relationships and growing market share across the U.K. Wholesale investment landscape. Prior to joining the firm in 2021, Mr. Cooney was a client director at GAM Investments covering a variety of client segments. Previously, he was a sales manager at Neptune Investment Management and a financial planner at ABSA Bank. Mr. Cooney has a BSc. from Rhodes University, South Africa and the Investment Management Certificate. He is based in London.

Sean Cooney, Senior Director, Head of U.K. Wealth, is responsible for developing strategic relationships and growing market share across the U.K. Wholesale investment landscape. Prior to joining the firm in 2021, Mr. Cooney was a client director at GAM Investments covering a variety of client segments. Previously, he was a sales manager at Neptune Investment Management and a financial planner at ABSA Bank. Mr. Cooney has a BSc. from Rhodes University, South Africa and the Investment Management Certificate. He is based in London.

Luke Kariniemi-Eldridge

Director, EMEA Wholesale Distribution

Luke Kariniemi-Eldridge, Director, has 6 years of experience in the Asset Management Industry and is helping to build out the Wholesale business within EMEA. He has worked a variety of roles at his previous employer, Premier Miton Investors, including on the Broker Desk as part of the Sales team, and also in the Marketing team. Luke graduated from Royal Holloway, University of London with a BSc degree in Economics, and is based in London.

Luke Kariniemi-Eldridge, Director, has 6 years of experience in the Asset Management Industry and is helping to build out the Wholesale business within EMEA. He has worked a variety of roles at his previous employer, Premier Miton Investors, including on the Broker Desk as part of the Sales team, and also in the Marketing team. Luke graduated from Royal Holloway, University of London with a BSc degree in Economics, and is based in London.

Helping Uncertain Investors Target Better Outcomes

Global equity markets, particularly the S&P 500, have seen a strong start to the year. Yet uncertainty persists due to numerous global macro events. Factors such as fluctuating interest rates, the US election landscape, geopolitical tensions, and concerns about valuations and recession risks coexist with an AI-driven productivity surge, a potential bottom in Earning Per Share, and optimism that the worst economic challenges are in the past. Long-term investors face the dual possibility of a 15% market correction or a 15% rally from here. Can investors strategically position themselves for either outcome? First Trust addresses this challenge by unveiling a solution tailored for investors seeking to capitalise on market upswings while incorporating a level of protection against potential downturns.

Workshop Objective: Communicating First Trust’s economic forecast

Understanding the mechanics of target outcome ETFs

Highlight Vest Strategy’s potential downside protection and upside participation

Introduce First Trust’s suite of Target Outcome UCITS ETFs

Company Profile: First Trust is a privately owned U.S. based financial services firm established in 1991. Our mission and approach are simple. We aim to offer investors a better way to invest by providing transparent and innovative solutions - through knowing what we own, investing for the long term, employing discipline and rebalancing our portfolios.

These core principles are taken into consideration in all aspects of our business and are the building blocks of our reputation. It is through these principles that First Trust’s specialist investment managers apply a robust and disciplined approach to a range of methodologies. We have a strong track record in providing a variety of rules-based, thematic and actively managed strategies investing across a range of equities, fixed income and alternatives.

In delivering our message, our regional sales teams work closely with prospects and clients to distribute First Trust’s range of single-country, regional and global solutions across the world.

Speakers

Benjamin Weisbarth

Senior Product Specialist

Benjamin Weisbarth is a Senior Product Specialist for First Trust Global Portfolios. Benjamin’s career started at Citigroup Global Markets Europe AG in 2014 within the public distribution team for listed warrants and investment products. Following this, Benjamin moved within Citigroup to build and launch the sales of the new product offering in structured derivatives for the German and Austrian markets from their inception. Benjamin is a graduate of the Karlsruhe Institute of Technology (KIT) where he received an M.Sc. in Econmathematics.

Representatives

Rupert Haddon

Managing Director

Rupert is head of the sales and distribution for First Trust’s UCITS platform globally and was a founding team member in Europe. He has over 15 years’ experience working in the financial services industry and graduated with honours from the University of Leeds having read Ancient History and Classical Literature.

Rupert is head of the sales and distribution for First Trust’s UCITS platform globally and was a founding team member in Europe. He has over 15 years’ experience working in the financial services industry and graduated with honours from the University of Leeds having read Ancient History and Classical Literature.

Amit Gohil

Senior Sales Associate

%20(1)%20(1).jpg) Amit is a Senior Sales Associate at First Trust and has been working with the company since 2015 handling UK ETF distribution. Previously, he has worked for Morgan Stanley within Institutional Sales & Trading on both the Exotics & ETF businesses and at Marex Trading as a Propriety Trader. Amit holds a BSC in Economics and an MSC in Investments from the University of Birmingham Business School.

Amit is a Senior Sales Associate at First Trust and has been working with the company since 2015 handling UK ETF distribution. Previously, he has worked for Morgan Stanley within Institutional Sales & Trading on both the Exotics & ETF businesses and at Marex Trading as a Propriety Trader. Amit holds a BSC in Economics and an MSC in Investments from the University of Birmingham Business School.

The Energy Transition - can your clients afford to miss it

Jonathan will be discussing the transition to a sustainable energy system, driven by economics as much as by climate change. During the presentation he will cover:

- What the energy transition looks like and why it is occurring

- The likely path for oil & gas markets

- The outlook for renewable energy & energy efficiency

- How we invest in these themes

Workshop Objective: Familiarity with the Sustainable Energy investment process

Company Profile: Guinness Global Investors was established in 2003 by founder and chairman Tim Guinness. Its specialist disciplines of equity income, energy, innovation and Asia offer exposure to key themes to help investors achieve their investment goals. Its in-house economic, industry and company research allows it to take an independent view and not be led by the market. Its size and specialist nature also enables it to respond quickly and efficiently to market movements. It incorporates ESG factors into all its equity strategies and embraces the stewardship responsibilities which it assumes as an investment manager. Active management, high conviction and identifying value are the central pillars of its philosophy and they are delivered in the form of concentrated, equally weighted portfolios.

Speakers

Jonathan Waghorn

Portfolio Manager

Jonathan is portfolio manager on the Guinness Global Energy strategy and the Guinness Sustainable Energy strategy. Prior to joining Guinness Jonathan has 20 years’ experience in the energy sector. He was a Shell drilling engineer in the Dutch North Sea and worked as an energy consultant with Wood Mackenzie before becoming co-head of Goldman Sachs energy equity research in 2000. He joined Investec as co-manager on the Investec Global Energy Fund in 2008 where he helped grow the energy franchise at Investec to a peak of nearly $3.5bn in 2011. Jonathan then joined Mercuria in 2012 to build an equities and fund management business based around the provision of external funds before joining Guinness Global Investors in 2013.

Representatives

Alex Hall

Sales Manager

Alex is a sales manager with responsibility for financial advisers in the UK and joined Guinness in 2017. Alex graduated from the University of Exeter in 2016 with a degree in History and holds the IMC.

Alex is a sales manager with responsibility for financial advisers in the UK and joined Guinness in 2017. Alex graduated from the University of Exeter in 2016 with a degree in History and holds the IMC.

Tom Pearson

Sales Manager

Tom is a sales manager with responsibility for clients in the South of England and Midlands. Prior to joining Guinness in 2023, Tom was UK nationwide sales director at CRUX Asset Management. Previously he was head of wholesale sales at Alliance Trust Investments, head of UK discretionary sales at Jupiter Asset Management, and UK sales manager at Baillie Gifford. He started his career at James Capel Unit Trust Management in 1989.

Tom is a sales manager with responsibility for clients in the South of England and Midlands. Prior to joining Guinness in 2023, Tom was UK nationwide sales director at CRUX Asset Management. Previously he was head of wholesale sales at Alliance Trust Investments, head of UK discretionary sales at Jupiter Asset Management, and UK sales manager at Baillie Gifford. He started his career at James Capel Unit Trust Management in 1989.

Rupert Bosner

Sales Manager

Rupert is responsible for Family Offices and wealth managers for Guinness Global Investors. Prior to joining Guinness in 2020, Rupert worked at New Star Asset Management, Crux, Premier and Jupiter Asset Management

Rupert is responsible for Family Offices and wealth managers for Guinness Global Investors. Prior to joining Guinness in 2020, Rupert worked at New Star Asset Management, Crux, Premier and Jupiter Asset Management

Making the case for UK equity income

UK companies are boosting dividends and buybacks, which means careful investors can generate mid-single-digit yields from a portfolio of undervalued, growing, cash-rich companies. Jupiter investment manager Adrian Gosden will discuss these market dynamics and why easing inflation and monetary policy may provide further support. Adrian also will explain why he believes the unloved UK equity market may be poised to inflect due to a confluence of trends such as surging stock buybacks, repositioning by large UK institutional investors and renewed M&A activity. Adrian also will talk about how the Jupiter UK Equity Income Fund that he manages is positioned to benefit from these trends.

Workshop Objective: To explain how investors can benefit from robust dividends and buybacks, a favourable macro backdrop and technical trends that may help to improve sentiment for UK equities.

Company Profile: Jupiter is a specialist, high conviction, active asset manager. We exist to help our clients achieve their long-term investment objectives. From our origins in 1985, Jupiter now offers a range of actively managed strategies available to UK and international clients including equities, fixed income, multi-asset and alternatives. Jupiter is a constituent member of the FTSE 250 Index, and has assets under management of £52.3bn /$66.5bn /€60.3bn as at 31/12/2023.

Speakers

Adrian Gosden

Investment Manager

Adrian Gosden is an Investment Manager at Jupiter, responsible for the fund management and investment strategy of UK equities.

Prior to joining Jupiter in January 2024, Gosden was a fund manager at GAM since 2017. Prior to that he was at Artemis for 13 years, managing a £10bn UK income franchise. Before that he was a fund manager of UK equities at Société Générale Asset Management for four years.

From 1996 to 1998, Gosden worked as an investment analyst at Fleming Investment Management, responsible for pharmaceutical and telecoms sector research. He started his career as a strategic consultant at Andersen Consulting.

Gosden holds a first-class degree in chemistry from Oxford University. He is based in London.

Representatives

John Shepherd

Sales Director

John joined Jupiter in 2020 as Director, London. Prior to this he was a key account director at Merian Global Investors which was previously Old Mutual Global Investors (OMGI) where he had been Head of Discretionary Sales since 2013. He arrived at OMGI from UBS, where he held a similar position since 2007 during a 10-year tenure with the Company. Prior to joining UBS, he was a member of the National and Networks team at Schroders.

John joined Jupiter in 2020 as Director, London. Prior to this he was a key account director at Merian Global Investors which was previously Old Mutual Global Investors (OMGI) where he had been Head of Discretionary Sales since 2013. He arrived at OMGI from UBS, where he held a similar position since 2007 during a 10-year tenure with the Company. Prior to joining UBS, he was a member of the National and Networks team at Schroders. John holds the Investment Management Certificate (IMC).

Victoria Glatman

Sales Manager

Victoria Glatman is a Sales Manager at Jupiter Asset Management covering London based clients. Prior to working at Jupiter she worked in Equity Sales and Trading at Societe Générale.

Victoria Glatman is a Sales Manager at Jupiter Asset Management covering London based clients. Prior to working at Jupiter she worked in Equity Sales and Trading at Societe Générale. Victoria graduated from Durham with a First in Economics and is also a CAIA charterholder.

The Compelling Investment Case for Small Cap Equity Investing

An actively managed small cap strategy with a disciplined investment approach to stock selection, risk management, and a long-term time horizon offers a compelling investment opportunity.

In this session, we will discuss the reasons why U.K. investors should consider an allocation to this asset class. Topics include:

1. The small cap “premium”—Evidence that it still exists.

2. 40% of the index is unprofitable. Why active management and high-quality matters.

3. 2024 outlook—Why now may be a good opportunity for the asset class.

Workshop Objective: Educate investors on the benefits of adding small capitalization stocks to an asset allocation with an actively managed, high-quality investment approach and the value in adding the asset class now.

Company Profile: Kayne Anderson Rudnick Investment Management, LLC (“KAR”), headquartered in Los Angeles, CA, was founded in 1984 by two successful entrepreneurs, Richard Kayne and John Anderson, to manage the funds of its principals and clients.

Since its inception, the firm has followed a philosophy of investing in “high-quality” companies resulting in high conviction portfolios. KAR now manages over $50bn AUM entrusted by multiple client types including corporate and public pension plans, foundations, endowments, brokerage firms, and high-net-worth individuals. The firm’s range of investment strategies all embody its unified high-quality investment approach.

KAR is a wholly owned subsidiary of Virtus Partners, Inc. (NSYE: VRTS)

Speakers

Jon Christensen

Portfolio Manager

Representatives

Barry Keane

Managing Director, European Business Development, Virtus International Fund Management Limited

Barry earned a B.A. in economics and English from the University of Galway, Ireland, and an M.B.A. from the University of Durham, UK.

Stephen A. Rigali, CFA

Executive Managing Director Kayne Anderson Rudnick, Investment Manager of the Virtus GF U.S. Small-Mid Cap Fund

Liontrust European Dynamic Fund

The Liontrust European Dynamic Fund is an equity fund managed in accordance with the Cashflow Solution investment process by co-managers Samantha Gleave and James Inglis-Jones, launched in 2006. The presentation will illustrate how the team analyse company cashflows and why they are the key determinant to future success and failure. Samantha will share the indicators used by the team to determine the style bias that enables the fund to be dynamic and deliver through the cycle.

Workshop Objectives: To understand the Cashflow Solution investment process and how it is applied to a European equity fund. To see the portfolio's current style positioning, the companies it is invested in and portfolio construction.

Company Profile: Liontrust is a specialist asset manager that takes pride in having a distinct culture and approach to running money. The company launched in 1995 and listed on the London Stock Exchange in 1999. We are an independent business with no corporate parent. Our purpose is to enable investors to enjoy a better financial future.

We believe investment processes are key to long-term performance and effective risk control. Our fund managers are truly active in applying their investment processes. There is no house view - our fund managers have the freedom to manage their portfolios according to their own investment processes and market views.

Speakers

Samantha Gleave

Co-Head Cashflow Solutions Team

Samantha joined Liontrust in 2012 and manages the Cashflow Solution range of funds in conjunction with James Inglis-Jones. She began her career at Sutherlands Ltd as a Consumer Analyst before moving on to Fleming Investment Management as senior Investment Analyst covering Pan Europe where she worked with James Inglis-Jones. Samantha moved to Credit Suisse First Boston (Europe) Ltd in 2000 and was in a No 1 ranked equity research sector team (Extel & Institutional Investor Surveys). In 2005, she moved to Bank of America Merrill Lynch and became a Senior Equity Analyst and Director and won awards for Top Stock Pick and Earnings Estimates.

Representatives

Tim Hooton

Single Strategy Sales Manager

Tim joined Liontrust in May 2015 and is a Single Strategy Sales Manager across the London, the South and the South East of the UK. Tim joined from JP Morgan where he was a Corporate Financial Analyst. Before that Tim was a Senior Associate at TACTICA Fund Management.

Tim joined Liontrust in May 2015 and is a Single Strategy Sales Manager across the London, the South and the South East of the UK. Tim joined from JP Morgan where he was a Corporate Financial Analyst. Before that Tim was a Senior Associate at TACTICA Fund Management.

Martin Weisinger

Single Strategy Sales Manager

Martin joined Liontrust in January 2016 and is a Single Strategy Sales Manager across London and the Channel Islands. Prior to Liontrust Martin was Head of Fund Distribution at Matterley Funds and Co-Head of UK Wholesale at F&C.

Martin joined Liontrust in January 2016 and is a Single Strategy Sales Manager across London and the Channel Islands. Prior to Liontrust Martin was Head of Fund Distribution at Matterley Funds and Co-Head of UK Wholesale at F&C.

Innovative and agile – the long-term growth potential of UK smaller companies

Eustace Santa Barbara is a passionate believer in the long-term growth potential of the UK’s innovative and agile smaller companies – and their ability to outperform the corporate giants.

He will focus on the factors that can drive this outperformance, highlight a number of smaller companies he believes have outstanding growth prospects and explain why, in his view, current valuations present an exceptional long-term opportunity.

Workshop Objectives:

● Learn why smaller companies have the potential to outperform larger ones

● Hear about smaller companies the team believe have excellent growth prospects

● Understand why experienced smaller companies investors believe current valuations offer a rare long-term opportunity

Speakers

Eustace Santa Barbara

Fund Manager

Eustace, a graduate of Harvard University, joined the investment team from Close Brothers in December 2013. He has worked as both an analyst and fund manager and has over 19 years’ experience on the buy side. Working with Guy Feld, Eustace co-manages Special Situations, UK Micro-Cap Growth and Nano-Cap Growth.

Brad Weafer

Manager, Marlborough US Multi-Cap Income

Brad Weafer is Co-Manager of the Marlborough US Multi-Cap Income Fund. His career encompasses roles as Chief Investment Officer at Boston Financial Management and as an investment manager and equity research analyst. He is a Chartered Financial Analyst and has a degree in economics from the University of Vermont and a master’s degree in business from Babson College.

Brad Weafer is Co-Manager of the Marlborough US Multi-Cap Income Fund. His career encompasses roles as Chief Investment Officer at Boston Financial Management and as an investment manager and equity research analyst. He is a Chartered Financial Analyst and has a degree in economics from the University of Vermont and a master’s degree in business from Babson College.

Representatives

Kevin Addison

Head of Wholesale & Institutional Distribution

Kevin was appointed Marlborough’s Head of Wholesale & Institutional Distribution in May 2023. He joined from Downing Fund Managers, where he was Head of Sales & Distribution. Before that Kevin was Head of Funds Distribution at Brooks Macdonald.

Kevin was appointed Marlborough’s Head of Wholesale & Institutional Distribution in May 2023. He joined from Downing Fund Managers, where he was Head of Sales & Distribution. Before that Kevin was Head of Funds Distribution at Brooks Macdonald.

James Walkin

Business Development Manager – Wholesale & Institutional Sales

James joined Marlborough in 2023 and is part of the Wholesale & Institutional Distribution team covering the Midlands, North of England and Scotland. James has been in the investment industry for over 20 years and previously held roles at Natixis Investment Managers, GLG Partners and SWIP.

James joined Marlborough in 2023 and is part of the Wholesale & Institutional Distribution team covering the Midlands, North of England and Scotland. James has been in the investment industry for over 20 years and previously held roles at Natixis Investment Managers, GLG Partners and SWIP.

Martin Jenkins

Business Development Manager – Wholesale & Institutional Sales

Martin joined Marlborough in 2024 and is part of the Wholesale & Institutional Distribution team covering the South of England. With nearly two decades of experience in the Asset management industry Martin has also held previous roles at Edentree IM, Liontrust and SWIP/Aberdeen Asset Management where he was a Regional Sales Director predominantly covering London, South East & South West regions. Martin holds the CFA Certificate in ESG Investing.

Martin joined Marlborough in 2024 and is part of the Wholesale & Institutional Distribution team covering the South of England. With nearly two decades of experience in the Asset management industry Martin has also held previous roles at Edentree IM, Liontrust and SWIP/Aberdeen Asset Management where he was a Regional Sales Director predominantly covering London, South East & South West regions. Martin holds the CFA Certificate in ESG Investing.

Reasons to Believe in UK Mid caps

Investors overwhelmed by negative UK headlines are at risk of missing out on the wealth of opportunities offered by UK mid caps. Richard Bullas, Portfolio Manager of the UK’s largest mid cap fund, believes that when markets are driven by indiscriminate selling pressure, it broadens the scope for a rebound among stocks which retain their fundamental attractiveness. Richard will discuss the reasons you should believe in UK mid caps and demonstrate where he and his team are finding opportunities from the bottom up for their clients.

Workshop Objective: During the workshop, Richard Bullas, Portfolio Manager, will highlight the key characteristics of the FTSE 250 and showcase how top-down macro pressures can lead investors to wrongfully overlooking UK mid caps. From the bottom up, opportunities are revealed.

Company Profile: At Franklin Templeton we offer our clients a gateway to investment excellence backed by a global organization and delivered through a consistent, coordinated client experience. We’ve broadened our capabilities by attracting leading public and private market investment managers to our firm. Today we are among the world’s largest asset managers with offices in major financial markets, serving clients in more than 150 countries, and managing nearly $1.6 trillion in assets*.

* AUM is in USD as of 31 December 2023 and has been restated to include proforma AUM from Putnam Investments at the same date. Franklin Templeton acquired Putnam Investments on 1 January 2024.

Speakers

Richard Bullas

Co-Head, UK Equities (Small & Mid-Cap) Portfolio Manager

Richard is Co-Head, UK Equities (Small & Mid-Cap) at Martin Currie, leading the FTF Martin Currie UK Mid Cap Fund and managing the mid cap portion of the FTF Martin Currie UK Manager's Focus Fund. With over 20 years of experience, he specializes in UK small and mid-cap companies, previously working at Rensburg Fund Management and AVIVA Plc. He holds a BSc (Hons) in business and management studies and is a Chartered MCSI with the IMC qualification.

Representatives

Michael Woodrow

Business Development Director

Michael is a Business Development Director within the UK Retail Distribution Team. He is responsible for managing relationships and developing new business, predominantly in the Wealth Manager and Discretionary Management segment of the UK Retail Market, for London and East Anglia. Michael joined Franklin Templeton in 2004 and holds the Investment Management Certificate.

Michael is a Business Development Director within the UK Retail Distribution Team. He is responsible for managing relationships and developing new business, predominantly in the Wealth Manager and Discretionary Management segment of the UK Retail Market, for London and East Anglia. Michael joined Franklin Templeton in 2004 and holds the Investment Management Certificate.

Sam Collett

Business Development Director

Sam Collett is a Business Development Director covering clients across London and the Channel Islands. He joined Franklin Templeton in 2018. Sam started his career in Investment Management Sales covering Institutional and Sovereign Wealth relationships both in the UK and Middle East for Federated Hermes. Sam holds a BSc in Business Marketing from the University of Newcastle upon Tyne.

Sam Collett is a Business Development Director covering clients across London and the Channel Islands. He joined Franklin Templeton in 2018. Sam started his career in Investment Management Sales covering Institutional and Sovereign Wealth relationships both in the UK and Middle East for Federated Hermes. Sam holds a BSc in Business Marketing from the University of Newcastle upon Tyne.

Global Bonds: You ain’t seen nothing yet!

Global bonds firmly turned the corner in Q423, but continue to have huge potential for above inflation returns while acting as a reliable hedge to other more risky assets such as equities. With a wide range of Federal Reserve outcomes in 2024 and a myriad of other risks ranging from a Chinese slowdown to US elections, we feel bonds should play a central role in client’s portfolios.

The unsynchronized nature of the monetary cycle around the world should provide a strong backdrop for active rates and FX decisions. At the same time, clients need to closely navigate areas like lower quality corporate bonds which provide little protection outside of a soft-landing scenario.

We believe our Global Opportunistic Bond Fund, with its proven track record and strong risk management provides a great means for UK clients to access global bond markets and benefit from MFS’s world-renowned research platform.

Company Profile: In 1924, MFS launched the US’ first open-end mutual fund to give everyday investors access to the markets. One hundred years later, as a full-service global investment manager serving financial advisors, intermediaries and institutional clients, we celebrate a century of active management. Tested and refined across market environments, our investing approach combines collective expertise, long-term discipline and thoughtful risk management to create value responsibly for clients. Supported by our culture of shared values and collaboration, our teams of diverse thinkers actively debate ideas and assess material risks to uncover what we believe are the best investment opportunities in the market.

Speakers

Owen Murfin

Institutional Fixed Income Portfolio Manager

Owen Murfin, CFA, is an investment officer and institutional fixed income portfolio manager. He participates in portfolio strategy discussions, customizes portfolios to client objectives and guidelines and communicates portfolio investment strategy and positioning.

Prior to joining MFS in 2017, Owen served as managing director and global fixed income portfolio manager at BlackRock for 15 years. Before that, he worked as an associate and global fixed income portfolio manager at Goldman Sachs Asset Management for five years. Owen earned a Bachelor of Science degree with first class honors from University College London. He holds the Chartered Financial Analyst designation.

Representatives

Adam Greenwood

Director - UK, Ireland and Channel Islands

Stephanie Harper

Retail Internal Team Lead

Sarah Morrissey

Relationship Manager, Global Strategic Accounts

Sarah joined MFS in 2014 as an assistant vice president and international operations manager and assumed her current role in 2020. She previously worked as a project lead for shareholder services at BlackRock Investment Management for one year in Australia. She began her career in the financial services industry in 2006 as an AVP investor services manager for Credit Suisse Administration Services in Ireland.

Sarah earned a bachelor’s degree in commerce from University College Dublin. She holds the

Certificate in ESG Investing and the Investment Management Certificate (IMC) from the CFA UK.

More Bang For Your Bonds: Hitting the Sweetspot with Global High Yield

The opportunity to earn real income is finally back & investors should be looking to maximise this opportunity through high yield bonds. Historically, the level of starting yields correlate positively with higher, long term total returns and the best time to start adding to the asset class has been as elevated default rates get priced in. As investors try to navigate a range of potential ‘landing’ scenarios, high yield is poised to perform well, regardless of the macro outcome.

We will discuss the nature of the high yield market, how we are positioned and why investors should be allocating to high yield now, in the context of their multi-asset portfolios.

Workshop Objectives:

• Today’s case for investing in High Yield bonds vs. other fixed income assets and equities

• Opportunities and risks around the High Yield market

• Summary of Morgan Stanley’s High Yield offering

Company Profile: Morgan Stanley Investment Management offers a broad range of specialized solutions to a diverse client base that includes governments, institutions, corporations and individuals worldwide.

Our independent investment teams are empowered to think differently and strive to provide investment excellence, diversity of perspective and a comprehensive suite of specialized investment solutions. With a focus on serving clients, these teams have access to deep resources to provide value-added services and support. Established in 1975 as a subsidiary of Morgan Stanley Group Inc., Morgan Stanley Investment Management has provided client-centric and risk management solutions to investors and institutions for more than 45 years.

Speakers

Bo Hunt

Managing Director, Portfolio Manager of High Yield Team

Bo Hunt is a portfolio manager on the High Yield team. He is responsible for buy and sell decisions, portfolio construction, and risk management for the team’s European and global high-yield strategies. Bo began his career in the investment industry in 2002. He joined Eaton Vance in 2016. Morgan Stanley acquired Eaton Vance in March 2021. Previously, he was a credit analyst at Fidelity International in London and a distressed debt analyst at Bank of America Merrill Lynch. Bo earned a B.S. in economics from the Wharton School at the University of Pennsylvania.

Representatives

Daniel Hawkes

Executive Director, UK Sales

Daniel is a member of the UK Intermediary Distribution team at Morgan Stanley Investment Management. He joined Morgan Stanley in 2015 and has 24 years of related industry experience. Prior to joining MSIM, Daniel worked at Columbia Threadneedle Investments for 11 years and both Cofunds and Fidelity before that. Daniel holds a degree in Criminology and Criminal Justice from the University of Wales, Bangor and holds the Investment Management Certificate (IMC) Level 6.

Harvey Lewis

Vice President, UK Sales

Harvey is a member of the UK Intermediary Distribution team at Morgan Stanley Investment Management. He joined Morgan Stanley full time in 2015, having interned in 2014, and has nine years of industry related experience. Harvey received a B.A in Economics and Politics from the University of Nottingham and holds the Investment Management Certificate (Level 6).

NB Global Equity Megatrends: A high conviction approach, aligned to long term structural change.

Predicting economic and business cycles can be futile – equity markets’ performance in 2023 is a case in point. Given that inherent uncertainty, is there an advantage to investing in companies aligned to powerful secular shifts that potentially insulate these businesses from economic cycles?

We believe global Megatrends – not simply AI! – combined with a disciplined approach to valuation can increase visibility & predictability of outcomes when running a high conviction global equity portfolio and ultimately deliver long term outperformance for investors.

Workshop Objective: To demonstrate the strong returns that can be delivered from a disciplined, high conviction approach underpinned by structural shifts in the global economy.

Company Profile: Neuberger Berman was founded in 1939 to do one thing: deliver compelling investment results for our clients over the long term. This remains our singular purpose today, driven by a culture rooted in deep fundamental research, the pursuit of investment insight and continuous innovation on behalf of clients, and facilitated by the free exchange of ideas across the organization.

As a private, independent, employee-owned investment manager, Neuberger Berman is structurally aligned with the long-term interests of our clients. We have no external parent or public shareholders to serve, nor other lines of business to distract us from our core mission. And with our employees and their families invested alongside our clients—plus 100% of employee deferred cash compensation directly linked to team and firm strategies—we are truly in this together.

Speakers

Maximiliano Rohm

Portfolio Manager

Maximiliano Rohm, Senior Vice President, Portfolio Manager for the Global Equity Megatrends team, joined the firm in 2006. Before joining the Global Equity

Megatrends team in 2017, Maxi was the Head of Corporate Development for Latin America, overseeing Neuberger Berman’s client efforts in the region. Prior to this,

Maxi was a member of Neuberger Berman’s Corporate Strategy team, focusing on business development and strategic acquisitions for the firm. Maxi began his

career at Credit Suisse First Boston in their Investment Banking Division. He earned an MBA from MIT Sloan and a BA in Busine ss and Economics from Universidad Torcuato di Tella, Buenos Aires, Argentina.

Representatives

Ollie Meyer

Relationship Manager

Tom Skinner

Relationship Manager

Fund Group Workshop

Speakers

Claus F. Nielsen

Head of Diversified Equity

Claus F. Nielsen is the Head of Diversified Equity in Nordea Asset Management. He attended the University of Aarhus where he gained an MSc in Mathematics & Economics. Claus started his career in 1987 as an analyst at Statsanstalten for Livsforsikring. Between 1991 and 1998 he worked for Baltica, Danica and Danske Capital as a portfolio manager and in 1998 he joined Tryg-Baltica in the same position. Claus joined Nordea in 1999 as a portfolio manager and since 2004 he has been Head of the Diversified Equity team. Claus has been managing funds for over 30 years (24 years in Nordea).

Representatives

Scott Hardie

Business Development

Jamie Hayes

Business Development

2024: A year of volatility and opportunity for Credit

2024 promises to be a banner year, whether we think of politics, geopolitics or economics, and it’s likely to be a rollercoaster for markets. Nonetheless, the unprecedented tightening cycle over the last two years means that fixed income more broadly, and credit in particular, will remain in the spotlight. The next cycle will likely be characterised by increased uncertainty and hence it’s highly likely volatility will remain elevated from a historical perspective. That said, with yields and breakevens at generational highs, opportunities are plentiful to generate long term equity-like returns in debt instruments. We believe a contrarian and value-driven approach is vital to protecting and appreciating capital in this environment. Markets have evolved, and so now must the way we approach investing in credit and fixed income.

Workshop Objective: How to generate equity-like returns with bond-like risk: demonstrating that a contrarian, value-driven and nimble approach to credit investing is needed for better risk-adjusted returns

Company Profile: Pictet Asset Management is a specialist asset manager offering investment solutions and services to investors around the world.

As at 31 December 2023, we manage GBP 215 billion of assets across our range of pioneering and differentiating investment capabilities. Our investment resources are focused around our strategic capabilities: Alternatives, Thematics, Emerging Markets and Multi Asset.

Our purpose is to build responsible partnerships with our clients, colleagues, communities and the companies in which we invest. Our clients include some of the world’s largest pension funds, financial institutions, sovereign wealth funds, intermediaries and their clients.

We are part of the Pictet Group, founded in Geneva in 1805, which also specialises in Wealth Management, Alternative Investments and Asset Services. Privately owned and managed by eight partners, the Pictet Group has more than 5400 employees in 30 offices around the world.

Speakers

Jon Mawby

Co-Head of Absolute & Total Return Credit

Jon Mawby joined Pictet Asset Management in 2018 and is Co-Head of Absolute & Total Return Credit. At the time of joining, he was Senior Investment Manager in the Developed Markets Credit team.

Before joining Pictet, he was a Senior Portfolio Manager at ManGLG where he was lead portfolio manager for the unconstrained bonds and investment grade strategies. Jon worked at GLG Partners for 6 years having joined to build out their capability in unconstrained bonds. In a career spanning 24 years Jon has also worked at ECM, Gartmore, Morley (Aviva Investors) and Goldman Sachs primarily managing credit portfolios across the full product spectrum from long only to long/short.

Jon holds a B.A. (Hons), Economics from Durham University and is a CFA Charterholder.

Representatives

Tim Edmans

Senior Sales Manager

Tim Edmans joined Pictet Asset Management in 2011 and is responsible for the Midlands. Prior to joining Pictet, Tim worked for three years at Towry Law in Birmingham as part of the employee benefits practice. Before that he spent three years at SBJ Benefit Consultants during which time he worked on both the corporate and private pensions team. Tim holds the Diploma in Financial Planning, the Investment Management Certificate and is an associate member of the CISI.

Tim Edmans joined Pictet Asset Management in 2011 and is responsible for the Midlands. Prior to joining Pictet, Tim worked for three years at Towry Law in Birmingham as part of the employee benefits practice. Before that he spent three years at SBJ Benefit Consultants during which time he worked on both the corporate and private pensions team. Tim holds the Diploma in Financial Planning, the Investment Management Certificate and is an associate member of the CISI.

Gary Anderson

Sales Manager

Granolas and Beyond: The Opportunity in European Small and Mid Cap Companies

European smaller companies have delivered exceptional long-term outperformance of larger European companies. Within this trend there have been periods of underperformance. We are currently in one of these periods - this is nothing out of line with historical patterns. The ability to construct a portfolio which is expected to deliver strong sales and self-funded cash flow growth from a moderate starting valuation is what gives the managers confidence about the future. Corporate and private equity buyers have noticed too.

Workshop Objective: To discuss the opportunities the managers see in European small and mid cap companies, and how the Chelverton European Select Fund is well positioned to capture them.

Company Profile: Chelverton is a boutique asset management firm with a limited range of strategies overseen by dedicated teams of specialised fund managers. When Chelverton was established in 1998, their initial focus was on UK small and mid-cap income stocks, with the launch of an Investment Trust and subsequent open-ended fund. Over time, they have expanded their offering to include expertise in UK small and mid-cap growth and European multi-cap investments. More recently, they've introduced a global sector team with a specific focus on consumer staples.

Spring Capital is an independent distribution partner that offers capital raising, marketing and client service for open-ended funds managed by boutique asset managers including Chelverton.

Speakers

Gareth Rudd

Portfolio Manager

Gareth joined Chelverton in 2017. He began his career in financial services in 1996 at Edinburgh Fund Managers. He then moved to ABN Amro where he was a long/short investor within Principal Strategies until 2009. Before joining Chelverton, Gareth was a partner at Willis Welby, a boutique research house.

Representatives

Joanna Stephenson

Sales – UK Discretionary

Joanna joined Spring Capital in 2008 as a member of the UK distribution team with responsibility for many of our key clients. She has worked in investment management sales for the majority of her career including a long spell at Morgan Grenfell (which subsequently became Deutsche Bank) and a few years at Walker Crips, a boutique asset management firm.

Joanna joined Spring Capital in 2008 as a member of the UK distribution team with responsibility for many of our key clients. She has worked in investment management sales for the majority of her career including a long spell at Morgan Grenfell (which subsequently became Deutsche Bank) and a few years at Walker Crips, a boutique asset management firm.

Harriet Beeton

Sales – UK Discretionary

Harriet is a member of the UK sales team and focuses on UK & Channel islands based discretionary clients. She joined Spring Capital in 2022 after 4 years at Incisive Media, where she was Head of Delegate Relations for all fund manager events at Investment Week.

Harriet is a member of the UK sales team and focuses on UK & Channel islands based discretionary clients. She joined Spring Capital in 2022 after 4 years at Incisive Media, where she was Head of Delegate Relations for all fund manager events at Investment Week.

Consistent outperformance with Economic Moats, based on Warren Buffet's Time-Tested Strategy

Outperforming the S&P 500 is the benchmark of success for US Large Cap fund/index. VanEck, with Morningstar's Equity Research, has beaten this standard in 6 of the last 8 years. Last year alone, the index outperformed the S&P 500 by over 6%, even with ~22% less total exposure in the “Magnificent 7”. (6% vs 28%)

How? By rigorously analysing over 1,500 stocks for long-term competitive advantages (Moats) and fair value, then incorporating them into a passive equal-weight index that VanEck's ETF tracks. This approach has led to a ~275% outperformance over the S&P 500 since 2007 (LIVE INDEX).

In this session, we'll delve into why our MOTU ETF, its emphasis on long-term competitive advantages, fair valuations, and careful index construction, should be a core part of your portfolio.

Workshop Objective: Investors will gain insight into Morningstar's equity research, identifying Wide Moat firms, Fair-Value assessments, index performance highlights, and why our suite of Wide Moat philosophy ETFs belongs in core portfolios.

Company Profile: Established in 1955, VanEck is a prominent global ETF and fund provider with nearly $100 billion in assets. As one of the top 10 ETF providers in the US, our reach extends across Asia, Australia, and Europe. Committed to enhancing investor portfolios, we pioneer ventures in sectors like Gold Mining, Defence, Video Gaming & Esports, Semiconductors, Rare Earths, and MOATS. Early adoption of international markets underscores our belief in the transformative potential of diverse investments. Today, our offerings encompass core strategies and specialised exposures, empowering clients with a comprehensive toolkit for diversification.

Speakers

Ahmet Dagli

Head of UK, Ireland & Channel Islands

Ahmet heads VanEck’s ETF distribution within the UK, Ireland & Channel Islands. With a background in Investment Analysis in the UK and Wealth Management within Switzerland and Malta, Ahmet joined VanEck in January 2018. He holds a degree in Business Economics from Hertfordshire University.

Jelena Sokolova

Morningstar, Senior Equity Analyst

Jelena, a senior equity analyst at Morningstar in London, specializing in the consumer discretionary/luxury goods sector. As a Moat Committee member, she brings extensive experience, having previously worked at CE Asset Management in Zurich for six years, covering European large caps. With a master's degree in international business from Riga International School of Economics and Business Administration (RISEBA) and holding the Chartered Financial Analyst® designation, Jelena is well-equipped to provide valuable insights.

Representatives

Roman Poole

VanEck, Associate Director

Roman heads VanEck's distribution for the Swiss wealth management channel specifically. Prior to VanEck, Roman was a corporate sales trader at Ebury dealing G-10 and EM currencies for Swiss based firms. Roman holds a Bachelor of Arts in Banking and Finance and is a CFA level III candidate.

Roman heads VanEck's distribution for the Swiss wealth management channel specifically. Prior to VanEck, Roman was a corporate sales trader at Ebury dealing G-10 and EM currencies for Swiss based firms. Roman holds a Bachelor of Arts in Banking and Finance and is a CFA level III candidate.

High Dividend ESG – the multitool for 2024?

Equity investors do not have to go far to find risks in 2024 – even though we seem to have avoided a hard landing, volatility in the equities space has subsided for now and potential rate cuts could support equities, growth is expected to be subdued. Geopolitical tensions and continuing wars add to the uncertainty of a US election year. At the same time crowding in only a handful of megacap growth companies is reaching new extremes. Quality-orientated high dividend yield strategies could offer an opportunity to navigate this environment, focusing on income and quality factors while controlling for other factors and ensuring a high level of diversification. Optimised rules-based solutions that are well established in the institutional space could offer a transparent and cost-effective way of simultaneously targeting multiple goals. We combine high dividend yield with an ESG overlay to further reduce risk and also satisfy the increasing demand for solutions with environmental and social characteristics.

Workshop Objective: Position dividend solutions and provide insights into potential add-ons and pitfalls while also presenting ETFs as an efficient implementation tool.

Company Profile: Xtrackers, the passive solutions platform by DWS has one of the largest and most established product ranges in Europe, with a global presence and more than £147 billion [incl. mandates] in assets under management (as of month 01, 2024). Xtrackers has an index track record going back over 20 years and offers a broad range of efficient, high-quality ETFs and ETCs on all major asset classes – equities, bonds, money market and commodities, as well as bespoke strategies through index funds and segregated mandates. Xtrackers provides numerous building blocks across all wrappers for traditional investment strategies, ESG strategies (environmental, social, governance), sector and factor investments, as well as innovative products on thematic investments and future trends.

Speakers

Frederike Bauer

Product Specialist Xtrackers

Frederike Bauer joined DWS in 2020. As a member of the passive products team, she focuses on indexing with Sustainability and Climate topics as her primary areas of expertise. Frederike holds a master’s degree in financial economics from Maastricht University.

Representatives

Jasdeep Hansra

Senior Coverage Specialist Xtrackers

Jasdeep Hansra began working with the Passive team at Deutsche in 2013, and works primarily with private banks, asset managers, family offices and wealth managers on the db X-trackers ETF and ETC products. He works closely with structuring and strategies team to construct new products and solutions for clients, and is a contributing writer to bi-weekly research from the Passive Investments desk. Prior to joining Deutsche, Jasdeep studied at the University of Oxford, with a focus on Politics and Economics.

Jasdeep Hansra began working with the Passive team at Deutsche in 2013, and works primarily with private banks, asset managers, family offices and wealth managers on the db X-trackers ETF and ETC products. He works closely with structuring and strategies team to construct new products and solutions for clients, and is a contributing writer to bi-weekly research from the Passive Investments desk. Prior to joining Deutsche, Jasdeep studied at the University of Oxford, with a focus on Politics and Economics.

Alex Boggis

Sales Representative

Alex has spent the last 4 years working at a boutique manager Alquity Investment Management covering UK sales for their ESG products. Before that, he was at Aberdeen Asset Management for 24 years initially in the UK but heading their Hong Kong business from 2000 until 2019.

Based in the South, Alex’s role as Business Development Manager, South of the UK ex-London focuses on supporting national & regional discretionary wealth managers, managed portfolio service providers and Independent financial advisers.

.png)

.png)

.jpg)

Workshops

Workshops

Opportunities in Europe for the Growth Investor

As growth investors have been primarily focused on the US in recent years, it's time to explore growth opportunities closer to home. In this presentation, portfolio manager Marcus Morris-Eyton will outline his investment strategy that seeks to benefit from the compounding power of owning shares in structurally growing, high-quality companies over the long term. With years of experience, the strategy has been relaunched at AllianceBernstein. Marcus will explain how his team looks for visibility in companies’ long-term earnings and cash flow growth, supported by sustainable competitive advantages and high barriers to entry. The presentation will highlight a focused and disciplined approach to investing in high-quality companies for long-term growth.

Workshop Objective: Delegates will hear about growth opportunities in European (ex-UK) companies. They will learn how this team find and invest in structurally growing, high quality companies, a process honed over many years.

Company Profile: AllianceBernstein is a leading investment-management firm with $792 billion in client assets under management, as of 31 December 2024. With a unique combination of expertise across equities, fixed-income, alternatives and multi-asset strategies, we aim to deliver differentiated insights and distinctive solutions to advance investors’ success. Across our global network, we’re fully invested in delivering better outcomes for our worldwide clients, including institutional, high-net-worth and retail investors. By embracing innovation, we seek to address increasingly complex investing challenges and opportunities. And we pursue responsibility at all levels of the firm—from how we work and act to the solutions we design for clients.

Speakers

Marcus Morris - Eyton

Portfolio Manager—Europe and Global Growth

Marcus Morris-Eyton is a Portfolio Manager for Europe and Global Growth. Prior to joining AB in 2024, he was a portfolio manager at Allianz Global Investors, which he joined in 2011. Morris-Eyton also worked as a discretionary sales manager at Allianz Global Investors in London, and in equity research at Credit Suisse. He was named one of the Top 40 Under 40 Rising Stars in Asset Management by Financial News in 2015. Morris-Eyton holds a BA with first class honours in English and philosophy from the University of Leeds. He is a CFA charterholder. Location: London

Representatives

John Lancashire, CFA

UK Retail Sales Director

John Lancashire joined AllianceBernstein in August 2015 within the Multi Asset team, focusing on efforts to deliver AB’s Target Date Funds to the UK market. He then moved to the Client Group at the beginning of 2017, initially supporting GFI and Sub-Advisory clients, later moving to his current role as Sales Director covering both Advisory & Discretionary channels. John was previously at AXA and then Friends Life, managing relationships with third party fund managers. John holds the IMC, and is a CFA Charterholder.