Citywire MPS Forum North 2025

Following the success in the South, we’re heading North for our inaugural MPS North Forum and this is your exclusive opportunity to be a part of it. Keep the morning of 9 October free because you are not going to want to miss being at Grand Central Hotel, Glasgow for it!

Whether you already outsource client assets to discretionary managers and may be looking at other options, or are considering doing so for the first time, we are thrilled to be launching a half-day event just for you.

The forum proves to be a fantastic opportunity to meet with discretionary fund managers who will present their outsourced solutions that will allow you to focus on your holistic proposition and client relationships. Rather than a stage-based presentation, participants will have a workshop-based agenda, with an emphasis on meaningful, interactive conversation.

We will also be joined by former Royal Marines Commando officer, Phil Ashby. He will be using his experience of evading and escaping the jungles of Sierra Leone in particular to discuss resilience and teamwork in difficult situations.

As if all that wasn't enough, Citywire will also be hosting an interactive networking discussion on business development. With the addition of our post-lunch networking session, you will also be able to claim up to 4 hours towards the CII/Personal Finance Society member CPD scheme by attending the forum.

Learning Objectives:

- Identify and assess a variety of outsourced investment solutions, explaining their suitability for different types of client assets.

- Analyse the potential benefits and drawbacks of adopting a more outsourced investment strategy for your firm, and formulate actionable next steps for implementation.

- Evaluate how effective teamwork in high-demand situations contributes to operational success, and apply these principles to improve collaboration and efficiency within your own workplace.

- Describe the key issues facing the profession and evaluate a variety of solutions on how to build a business in financial planning.

Being our first event of its kind in the area, demand is already high. Register today to avoid disappointment!

-photoaidcom-cropped.jpg)

Agenda

08:30 - 09:20

Arrival and Registration

09:20 - 09:30

Welcome with Aidan Banks-Broome

09:30 - 10:00

Guest Speaker - Phil Ashby

10:00 - 10:30

Workshop 1

10:40 - 11:10

Workshop 2

11:20 - 11:50

Workshop 3

12:00 - 12:30

Workshop 4

12:40 - 13:10

Workshop 5

13:10 - 14:00

Buffet Lunch

14:00 - 15:00

Interactive content lead networking session

Register

Workshop hosts

.jpg)

Workshops

Workshops

Evelyn Partners Index Investing: Not all apples are the same

We are often subjected to the old saying “Its like comparing apples with pears” when discussing investment options, but what about when we are looking at a specific investment style?

Even when you are comparing ‘apples’ alone, such as the increasingly popular arena of index investing, it is important to acknowledge there are several approaches, and the need to peel back the skin to better appreciate the propositions suitability.

From its early days, we will look at the growth of index investing and the varieties available to investors. The topic of cost, a crunch issue for many, will be addressed alongside the fact that low cost doesn’t always mean good value.

Workshop Objectives:

- Learn about the evolution of index investing

- Identify the ‘core’ index investing approaches, highlighting their characteristics

- Highlight potential ways to squeeze a little more juice from index investing

Company Profile:

At Evelyn Partners, our primary objective is to provide you with an investment solution that complements the service you already deliver to your clients. We respect the integral role that you have as their adviser and appreciate that investment management represents one part of the financial plan you create. By working in partnership, we can help you provide your clients with a truly enhanced investment management service.

Outsourcing your clients’ investment management requirements can give you more time to focus on their strategic financial planning.

Backed by our investment expertise, we provide access to a number of portfolio services – saving you the time, resources and costs of doing it yourself.

Speakers

Dan Caps

Portfolio Manager

Dan joined Evelyn Partners in January 2019, when the Moore Stephens Wealth Management Team joined what was then Tilney. Prior to this, Dan ran the passive and factor-based investment proposition at Moore Stephens for 12 years.

Dan is the Portfolio Manager for MPS Index, he is a member of the Passive Fund Research Group and runs bespoke passive and factor-based portfolios for private clients, corporates, charities and trusts.

Dan is a Chartered Financial Analyst and holds the Diploma in Financial Planning.

Representatives

Crawford Armstrong

Regional Head of IFA Sales North

Crawford joined the firm in 2021 after spending 12 years at Quilter Cheviot where he was Regional Development Director in Scotland. Previously, Crawford worked for Scottish Life, National Mutual, @SIPP and Clerical Medical/Scottish Widows during his 30 year career supporting financial planners in Scotland.

He has a wealth of experience in developing partnerships with financial adviser businesses helping them benefit from bespoke financial solutions for their clients. Crawford brings with him experience and expertise in both corporate and personal pension, trust and investment solutions.

Looking under the bonnet of a globally diversified multi asset model portfolio service

Within this presentation, the investment team headed up by our CIO Laurence Boyle, will illustrate how the blending of both active and passive investment strategies can provide the best opportunity to generate positive performance for clients.

The team will also highlight that long term experience is key when researching and selecting these investments within a ‘truly diversified’ portfolio. Focus should be placed not just on asset class but, sub asset classes, geography, size and style of underlying holdings.

Finally, the team will show that investing with an active asset allocation, and rigorous, repeatable investment process is the best way to provide benchmark outperformance.

Workshop Objectives:

To illustrate how the blending of both passive and active investment strategies in an actively allocated, diverse global multi asset portfolio, provides investors with benchmark beating performance over time.

Company Profile:

MAIA Asset Management is a boutique investment company offering a range of risk-targeted managed portfolios, actively managed by highly experienced, specialist investment managers to ensure optimum performance.

We are an exclusive multi-manager specialist with over 100 years’ experience in this field, previously managing award winning funds within large investment houses. Building diversified, actively managed portfolios is in our DNA and we have an open-minded investment strategy.

Our team’s experience allows us to embrace more esoteric funds that some fund managers may find difficult to incorporate in their asset allocations, and we don’t avoid funds that are young or below a pre-determined size. We believe each fund should be examined on its merits and performance, an approach that has led to our success in the past.

Our experience, reputation and many years spent working in the industry positions us well within the marketplace, giving us access to the best fund managers on a regular basis.

Speakers

Laurence Boyle

Chief Investment Officer

With over 30 years of fund management experience Laurence is perfectly positioned to manage your clients’ money effectively and successfully. Laurence managed multi-manager funds for Williams de Broe and latterly Investec where he received numerous Gold S&P awards as well as ranking in the top 100 European fund managers by Citywire and, whilst at MAIA, being named Citywire Wealth Manager top 100 fund selectors. In addition to this, Laurence also brings years of research experience with him having chaired the research team at both Investec and Williams de Broe.

Representatives

Simon Jackson

Investment Manager

Simon has worked in financial services for over 15 years, specialising in the development and management of CIPs for IFAs. Simon first started his career at an IFA firm in Worcester before setting up his own independent investment consultancy business. In these roles, Simon extensively researched and helped manage individual propositions for financial advisory firms. At MAIA, Simon works within the investment team and actively engages with IFA firms to promote the model portfolio solutions we provide.

Gary Shipway

Sales Director

With 39 years in senior financial services roles, I now support MAIA’s MPS sales growth to financial advice firms. MAIA’s 9-year track record of service and performance has driven strong results. I began my career at Abbey National and was Director of Acquisition & Growth at Quilter Plc until 2018. A strategic thinker with a people-focused approach, I'm always open to discussing how I can support your business—feel free to connect.

Let’s Talk Retirement: Decumulation Done Differently

Decumulation isn’t just accumulation in reverse – it comes with its own set of risks that need a different mindset.

In this session, Tim will unpack the challenges clients face when taking withdrawals in retirement. Tim will share his philosophy and practical approaches to tackling these issues, giving you new ways to think about delivering better client outcomes.

You’ll leave with a clearer understanding of why decumulation requires a distinct strategy, and how you can build more robust retirement plans that meet both client needs and regulatory expectations.

Workshop Objectives:

Explore the unique risks of decumulation and why they demand a different approach.

Learn how to address these challenges to deliver more robust retirement strategies and improved outcomes for clients.

Company Profile:

Parmenion is an award-winning investment platform, home to our in-house DFM – Parmenion Investment Management.

Since launching our first solution in 2008, we’ve grown to become one of the UK’s leading discretionary managers of multi-asset investments, offering a broad range of solutions to meet different client needs.

We’re proud to have successfully supported financial advisers and their clients through many economic, market and political cycles, to help deliver positive outcomes through our disciplined, risk focused approach.

Working together, we can make a real difference for your clients.

Speakers

Tim Willis

Investment Director at Parmenion Investment Management

Tim is a key member of Parmenion Investment Management, bringing valuable breadth and depth to our asset allocation committee. His varied experience across the investment industry adds real weight to our fund research, while his strong risk analysis skills play an important role in monitoring and managing our risk graded investment solutions.

Tim also focuses on developing our retirement proposition – researching, stress testing and progressing solutions, including the evolution of our drawdown capabilities.

He holds a degree in Economics and a Masters in Economics and Finance from the University of Bristol. Tim began his career at Mitsubishi, the Japanese investment bank, before moving to Barclays Wealth as a portfolio manager and later joining Parmenion.

Representatives

Alasdair Marwick

Regional Sales Manager (Scotland & Northern Ireland)

.jpg)

Alasdair has a proven track record of helping support businesses grow through regulatory changes, new technology adoption and driving high-quality client outcomes.

He holds a degree in Accountancy and Finance from Heriot-Watt University and a Diploma in Regulated Financial Planning. This, alongside his years of experience working with adviser busineses and genuine passion for excellent customer care within the industry, makes him the ideal person to support our customers across Scotland and Northern Ireland.

Rethinking your Traditional Portfolio: A Case for Alternatives

Alternative investments have traditionally been an Achilles heel for MPS providers as they pose significant challenges, primarily due to limited access, liquidity mismatches, and a tarnished reputation. Despite these difficulties, this presentation will illustrate how our innovative approach to alternative investments, can enhance a client's overall portfolio, especially in an environment where traditional bond / equity portfolios display higher correlations and may lead to unintended consequences. We hope you find the insights valuable and look forward to your participation.

Workshop Objectives:

To examine the constraints of traditional bond / equity portfolios and understand how alternative investments within an innovative MPS can help mitigate risk, while offering additional opportunities.

Company Profile:

As one of the largest discretionary investment management firms across the UK, Ireland and Channel Islands, we have managed investment portfolios for individuals and families for generations. We are focused on helping your clients invest for a lifetime of opportunities and challenges.

How we can help you:

We fundamentally believe in the value of financial advice and have developed our services and strategies alongside the financial advice community, to make it easier for you to deliver exceptional client outcomes.

With over 25 years’ experience working with financial advisers, we know that building a close relationship with you and understanding your client’s financial goals is key to successful investment management. Thousands of advisers are already benefitting from:

- a range of solutions designed to meet your clients' needs;

- a dedicated business development team to support you and your business;

- a well-resourced research team and a robust, effective investment process.

About our MPS:

Our Managed Portfolio Service (MPS) is designed to provide your clients with a straightforward, cost-effective way to benefit from our investment experience, so that they can make the most of their investments for generations to come.

We offer seven actively managed, multi-asset strategies constructed using our unique ‘Building Blocks’ approach. This pioneering approach offers clients exposure to a greater range of investment opportunities and asset classes than is possible within a ‘traditional’ MPS.

Speakers

Oswald Oduntan

Investment Manager

Oswald joined Quilter Cheviot as an Investment Manager in 2023, where he assists the team in the running of the MPS 'Building Blocks', while also contributing to the construction of the MPS strategies.

Oswald has a degree in MORSE (Mathematics, Operational Research, Statistics & Economics) from the University of Southampton, has passed the Investment Management Certificate and is a Chartered Financial Analyst (CFA) Charterholder.

Representatives

Hazel Willox

Business Development Manager

My career in financial services started in a sales support role with Scottish Amicable where I gained a strong foundation in client service. I was promoted to Business Development Manager, marking the start of a career that has now spanned over 25 years. Since then, I have worked with leading organisations including Prudential, Zurich and 7IM.Throughout my career, I have built a reputation for developing long-standing, collaborative relationships with advisers. I believe that integrity and trust are the foundations of successful partnerships, and I am committed to bringing those values into every interaction. My goal is to support advisers in delivering the best possible outcomes for their clients by combining experience, insight, and a service-driven approach.

.jpg)

Active vs. Passive

This session explores the enduring debate between active and passive investment strategies in today’s market. We begin with a brief historical overview, examining the rise of ETFs, current global fund allocations, and the growing share of company ownership held by passive vehicles.

We then assess market dynamics, including the concentration within major indices and the cyclical nature of active outperformance. Industry issues such as “active washing” (active fees for passive holdings), “diworsification” (over-diversification), and risks in passive fixed income will also be discussed.

Finally, we outline Waverton’s approach—integrating alternatives, applying rigorous stock selection, and highlighting that an optimal portfolio may blend both active and passive strategies.

Workshop Objectives:

Understand the evolution, strengths, and limitations of active and passive investment strategies, evaluate related risks and industry practices, and explore how combining both can enhance diversified client portfolios.

Company Profile:

W1M is a leading wealth and investment management firm with offices in London, Edinburgh, Glasgow, Barcelona and Barbados with over £22bn AUM. Placed independently within the broader business, our Adviser Solutions team focuses exclusively on designing and managing high-quality investment solutions for Financial Advisers.

We aim to deliver attractive long-term real returns professional advisers, charities and institutions. Our team adopts an active, flexible approach to portfolio construction, offering both bespoke mandates and specialist funds. We place strong emphasis on investing in what we believe are the best global opportunities across individual equities, fixed income, third-party funds, and alternative assets. The investment team’s philosophy is built on high-conviction, research-led decision making, drawing on deep expertise to navigate changing market conditions and align portfolios with our clients’ objectives.

Speakers

Derek Mclay

Business Development Manager

Derek Joined the company in 2021 having spent the last 10 years representing Investment Management within the Financial Adviser community, with Standard Life Investments, Cornelian Asset Managers and more recently with Fundamental Asset Management. Derek is responsible for supporting Financial Advisers in Scotland and Northern Ireland with their client solutions and assisting in creating their Centralised Investment Proposition. Derek graduated with BA and an LL.B degrees in Scots Law.

Representatives

Craig Donaldson

Business Development Consultant

Craig joined the company in June 2025 as a Business Development Consultant covering Scotland and Northern Ireland, Supporting new business opportunities and developing existing relationships.

Prior to joining us, Craig spent several years working in financial services as a Business development consultant at Aberdeen and Royal London. Craig gained a certificates in Financial Services, Regulation and Ethics (RO1) and Financial Protection (RO5).

Workshops

Workshops

Fund Group Workshop

Workshop Objective:

Company Profile:

Keynote Speaker

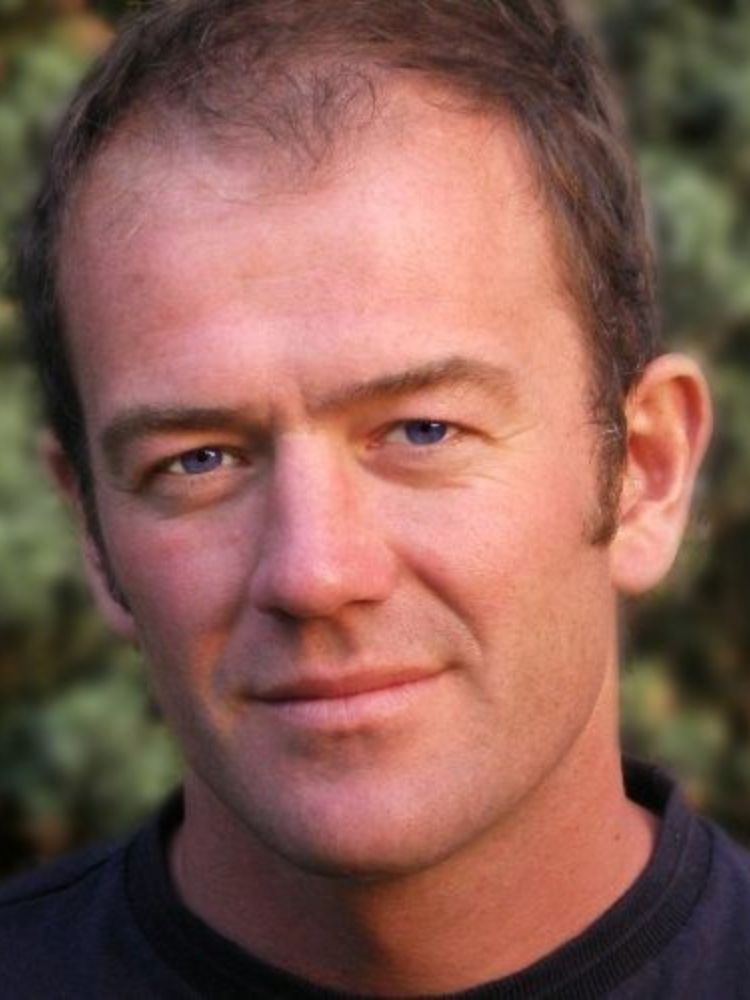

Phil Ashby

Phil is a British Mountain Guide and a member of the International Federation of Mountain Guides Association. He was brought up in the Scottish Highlands, educated at Glenalmond and sponsored by the Royal Marines to read Engineering at Pembroke College, Cambridge (1988-1991). On completion of Royal Marines Commando Officer training in 1992, he was awarded the Commando Medal as one of the top recruits. Phil served on operations and training exercises around the world, undergoing a further year of arduous training to become a Mountain Leader Officer in 1996. When promoted in 1999, Phil was the youngest Major in the UK. In May 2000, Phil was awarded the Queen’s Gallantry Medal (QGM) after leading an audacious escape out of captivity from the clutches of the Revolutionary United Front in war-torn Sierra Leone. Badly injured during escape and evasion in the jungle, Phil spent a difficult period recovering from partial paralysis and was forced to leave the Marines in 2003. His autobiography ‘Unscathed’ (published by Macmillan in May 2002) rocketed into the bestseller list.

Content Lead Networking

Get to know your peers while tackling the key issues in advice

Following feedback from advisers and planners across the country, Citywire will also be hosting an interactive networking discussion. Starting with time for introductions, we will open the floor to all things business development delving deep into:

- the role of tech in growing the profession

- recruitment strategies

- the future of the profession.

We will also hear from top advisers about their personal experiences with key challenges and opportunities facing the community.

Speakers

Roger Jackson