Citywire Midlands Retreat 2023

Citywire Midlands has firmly established itself as the unmissable gathering for the region’s wealth management and financial advice professionals.

Join us on 15 - 16 June at The Belfry, Royal Sutton Coldfield, for a day and a half of invaluable insight offering cutting-edge investment strategy that is sure to be useful for your year ahead.

With available places in high demand, register today to ensure your participation.

There is no charge for attending (which is strictly by invitation only) and you will earn up to eight hours of structured CPD.

Once again, we will bring together the region’s key figures in wealth management for a full programme of keynote speakers, a huge selection of workshop sessions with leading fund managers, and of course, the opportunity to network with your peers.

Keynote speakers:

We kick things off on Thursday morning with Tim Marshall who, with thirty years’ experience in broadcasting, is well-placed to provide a sharp political commentary and analysis of global affairs. The former diplomatic editor and foreign correspondent for Sky News will employ his knack for boiling down big issues, to give us his up-to-the-minute perspective on geopolitics.

After lunch, we will revisit our most highly-rated session of 2022 in which Steven Chatterton will be in conversation with Tom Fletcher, foreign policy advisor to three prime ministers, Blair, Brown and Cameron. In this fully interactive session you will also be able to question Fletcher on a number of subjects, including the nature of leadership and the 21st century survival skills we will need as states, businesses and individuals.

On Friday morning, Kimberley Wilson will be showing us How to Build a Healthy Brain, drawing on her professional experience of integrating evidence-based nutrition and lifestyle factors with psychological therapy. Kimberley believes the way we think about mental health is flawed, and throughout this session will provide useful takeaways for us all to improve our effectiveness and wellbeing.

Learning objectives:

-

Investigate a variety of investment strategies from fund managers across multiple asset classes;

-

Gain an understanding of the current geopolitical landscape and its effect on markets;

-

Develop the necessary skills to improve effectiveness and build a healthier brain

On behalf of the entire Citywire team, we do hope you can join us and I look forward to seeing you at The Belfry.

All the best,

Agenda

08:30 - 09:20

Registration

09:20 - 09:30

Welcome with Katie Gilffillan

09:30-10:30

Conference Session 1 - Tim Marshall

10:30 - 12:20

Fund Group Workshops

12:20 - 13:40

Lunch

13:40-14:40

Conference Session 2 - Tom Fletcher

14:40- 17:10

Fund Group Workshops

19:30 - 20:00

Drinks Reception

20:00-23:00

Informal Dinner and After Dinner speaker Aaron Simmonds

09:30 - 10:30

Conference session 3 - Kimberley Wilson

10:30 - 12:20

Fund Group Workshops

12:20 - 13:30

Buffet Lunch

13:30

Event close

Keynote Speakers

Speakers

Tim Marshall

After thirty years’ experience in broadcasting, Tim Marshall is well-placed to provide a sharp political commentary and analysis of global affairs.

A generalist who is able to join the dots between specialisms in a wide field, the former Diplomatic Editor and foreign correspondent for Sky News has a knack for boiling down big issues, such as geopolitics and international diplomacy, to broad-brush terms.He has published several critically acclaimed books, including the 2015 New York Times best-seller Prisoner of Geography: Ten Maps That Tell You Everything You Need to Know About Global Politics.

Originally hailing from Leeds, Tim arrived at broadcasting from the road less travelled. He worked his way through newsroom nightshifts, and unpaid stints as a researcher and runner to the news producers. After three years as IRN's Paris correspondent and carrying out extensive work for BBC radio and TV, Tim joined Sky News. Reporting from Europe, the USA and Asia, he became the Middle East Correspondent based in Jerusalem, and his celebrated six-hour unbroken broadcasting stint as ground attack went in during the Gulf War made news reporting history.

Tim reported from the field in Bosnia, Croatia, and Serbia during the Balkan wars of the 1990s. He spent the majority of the 1999 Kosovo crisis in Belgrade, where he was one of the few western journalists who stayed on to report from one of the main targets of NATO bombing raids, and he greeted the NATO troops in Kosovo itself on the day that they advanced into Pristina.

Tom Fletcher

Tom Fletcher was the UK’s youngest ever senior ambassador when he was appointed the country’s representative in Lebanon. Prior to his posting he worked as a foreign policy advisor in Downing Street under three Prime Ministers. As well as lessons from dealing with actors in the uniquely combustible region, he considers the nature of leadership and negotiation, the power of social media, and the future of engagement and education.

Tom’s work has taken him from leading reviews into modernising the UN and the UK Foreign Office to advising the Global Business Coalition for Education (which uses the private sector to help 59 million children into school) and teaching as a Visiting Professor of International Relations in New York University and the Emirates Diplomatic Academy. He has also debated with Hezbollah on Twitter, and job-swapped for a day with a teenage Ethiopian housekeeper to highlight the abuse domestic staff often suffer (she, on the other hand, grilled a senior politician and held a press conference).

Believing more of the world wish to co-operate than build walls, Tom looks at the big picture issues of global power structures. With examples (and anecdotes) from meetings with the likes of Merkel and Obama, Tom considers the importance of three elements of leadership – inspiration and vision, engagement, and implementation. His bestseller Naked Diplomacy: Power & Statecraft in the Digital Age looks at the opportunities and challenges a connected world presents to policy makers, asks whether companies like Google should be treated more like a nation than a business and examines the need to revolutionise education to reflect the advances of a digital world. He considers the effects of new technologies on everything from the Sustainable Development Goals to the threat of lethal autonomous weapons to building a stronger international community.

His book Ten Survival Skills for a World in Flux focuses on how ESG has become essential to how we make sense of human endeavours. Tom details what his experience advising the Prime Minister at G20 meetings and climate conferences taught him about the gap between geopolitics and sustainability, outlining a roadmap to more sustainable living in a post-lockdown world.

Aaron Simmonds

Aaron Simmonds has been failing to stand up for 32 years; luckily he is far better at comedy than standing up. Aaron has appeared on A-Z Horror Stories (Sky Studios), Russell Howard Hour (Sky), Undeniable (Comedy Central) and Guessable (Comedy Central) and has been heard on BBC Radio 4, BBC Radio 1 and BBC Radio Scotland. Aaron offers sharply-observed comedy which is grounded in his disability, but is by no means limited by it.

Aaron performed his critically-acclaimed debut shows, Disabled Coconut and Hot Wheels, at the Edinburgh Fringe in 2019 and 2022. He was an Amused Moose Comedy Award Best Show finalist and was nominated for Best Comedy Show in the Broadway World UK Edinburgh Fringe Awards in 2019. He also performed a work-in-progress show, Aaron Simmonds And The Person That He Loves, at the 2018 Edinburgh Fringe.

To his core, Aaron is a circuit comedian and performs at Comedy Clubs across the country, performing at the UK’s top nights such as The Comedy Store,Just The Tonic, Screaming Blue Murder, Glee and many more.

Kimberley Wilson

Chartered psychologist Kimberley Wilson is a governor of the Tavistock and Portman NHS Mental Health Trust and a former chair of the British Psychological Society Training Committee in Counselling. She authored How to Build a Healthy Brain, named by critics a practical manual for the brain and something to help understand mental health on a deeper level. Kimberley also led the therapy service at HMP & YOI Holloway.Kimberley believes the way we think about mental health – as separate from physical health – is flawed. Her philosophy of Whole Body Mental Health is a comprehensive approach to mental health care; integrating evidence-based nutrition and lifestyle factors with psychological therapy. Her degree in nutrition informs her approach of looking at the roles food and lifestyle play in our mental health, including disordered eating and the gut-brain axis and our emotional relationship with food.Passionate about the power of psychology to transform lives, Kimberley is committed to demystifying the theories and putting the information into the hands of the people who need it through social media, podcasts, television appearances, live events and regular appearances on expert panels.Kimberley hosts the podcast Made of Stronger Stuff alongside Dr Xand van Tulleken on BBC Radio 4. Its unique approach takes the pair on a journey around the human body exploring a different body part in-depth in each episode, asking what it can tell us about our innate capacity for change.

Sponsors

Workshops

Workshops

China – (un)investable no more?

2022 has been another volatile year for China equities; one of significant change and, perhaps, under-appreciated continuity. Market sentiment, as ever, has proven fickle: headlines announcing the “un-investableness” of the asset class appeared to be replaced by frantic calls to reposition oneself for the great reopening post zero-Covid. With nearly three decades of investment experience in China, we believe a patient approach in the least patient market is the key for long-term success. We aim to look through the noise and identify long-term structural trends and the companies that benefit from them. China remains home to many of such companies.

Workshop Objective:

• To build a conceptual framework for investing in China: how shall we understand China’s system of governance, regulatory scheme, and geopolitical position?

• To explore some of the big opportunities that Baillie Gifford approach could take advantage of via active stock-picking

• To discuss various options of accessing China: via global, emerging markets, Asia or dedicated China strategies; offshore vs onshore shares; domestic vs multinational companies, etc.

Company Profile: Baillie Gifford’s sole business is investment management. Since the company was founded in 1908 it has been a partnership. Today it is owned by 51 partners all of whom work in the business.

We currently manage or advise some £227.5bn on behalf of clients worldwide.

Speakers

Qian Zhang

Client Service Director

Qian Zhang joined Baillie Gifford in 2021 as an Investment Specialist and Client Service Director in the Emerging Markets Client team. Previously, Qian worked as a Senior Client Portfolio Manager covering emerging markets strategies at Pictet Asset Management and JPMorgan Asset Management. She began her career at Merrill Lynch in 2008. Qian graduated MSc in Mathematical Risk Management from Georgia State University and BSc in Economics and Statistics from Peking University. Qian is a native mandarin speaker and a CFA Charterholder.

Qian Zhang joined Baillie Gifford in 2021 as an Investment Specialist and Client Service Director in the Emerging Markets Client team. Previously, Qian worked as a Senior Client Portfolio Manager covering emerging markets strategies at Pictet Asset Management and JPMorgan Asset Management. She began her career at Merrill Lynch in 2008. Qian graduated MSc in Mathematical Risk Management from Georgia State University and BSc in Economics and Statistics from Peking University. Qian is a native mandarin speaker and a CFA Charterholder.

Representatives

Harry Driscoll

Client Service Manager

Harry is a client service manager and a member of the UK intermediary sales team. He joined Baillie Gifford in 2020. Prior to joining Baillie Gifford, Harry spent nine years as a fund research analyst. Harry is a CFA charter holder.

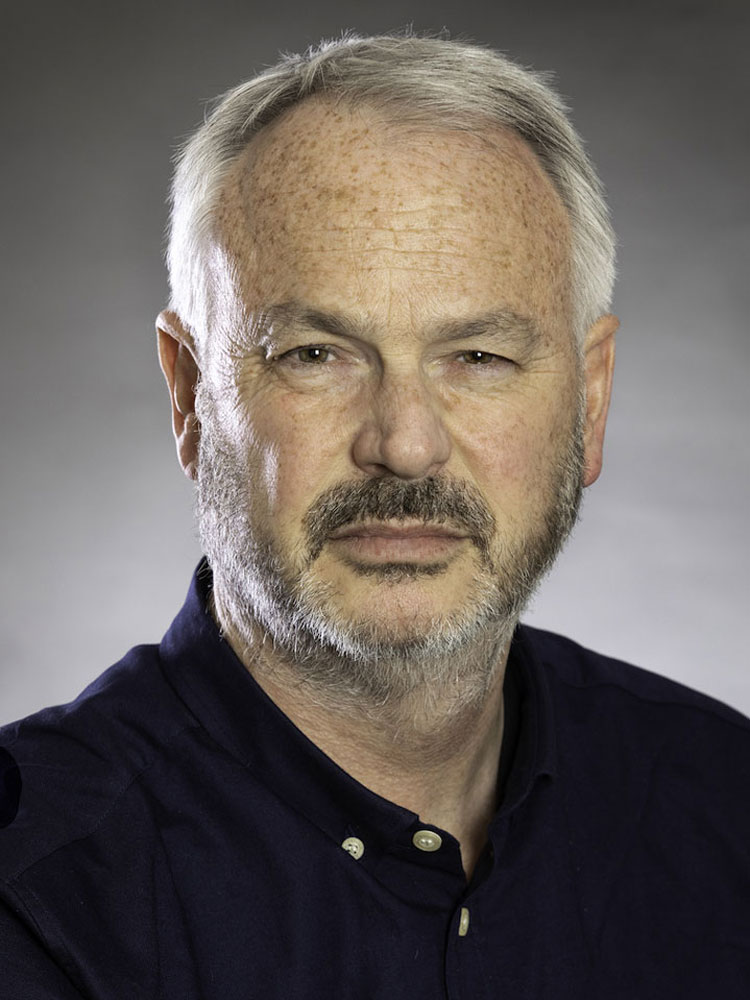

Chris Whittingslow

Director

.jpg)

Chris joined Baillie Gifford in 2013 and is Director in the Clients Department, with responsibility for intermediary client relationships in South West England, South Wales and the Channel Islands. He has been involved with collective investment vehicles for many years on both the buy and the sell side, focusing on Investment Trusts whilst at Canaccord and latterly Cantor Fitzgerald where he was Managing Director, Investment Company Sales. Chris is an Economics graduate and a Fellow of the Chartered Institute of Securities and Investment.

BB Biotech - challenges and opportunies for a biotech focused investment company in today's world

Claude Mikkelsen will elaborate on the challenges and opportunities for BB Biotech going forward. BB Biotech invests in companies in the fast growing market of biotechnology and is one of the world's largest investors in this sector with 30 years of experience. The shares of BB Biotech are listed on the SIX Swiss Exchange, the Frankfurt Stock Exchange and the Stock Exchange in Milan. Investments are focused on listed companies that are developing and commercializing novel drugs.

Workshop Objective: Bringing the futue potential of the biotech sector to the attention of investors despite recent years' challenges in the stock market.

Company Profile: BB Biotech is managed by Bellevue Asset Management in Switzerland. We take an active, bottom-up investment approach in managing a focused portfolio of approximately 30 stocks. Our stated aim is to invest in the medicines of tomorrow and, by extension, in the most promising and fastest growing companies in the biotech sector. Our investment philosophy is focused on innovative drugs and therapies that offer sound value for the healthcare system. In the construction of the portfolio and the selection of core positions, we carefully consider risks associated with asset allocation and portfolio composition.

Speakers

Claude Mikkelsen

Director

Claude Mikkelsen has been responsible for investor relations for BB Biotech in the UK and other countries since 2012. Claude have worked in the biotech sector for more than two decades. Claude was instrumental in the succesful IPO of Bellevue Healthcare Trust on the London Stock Exchange in 2016. Since 2019, Claude has focused solely on investor relations for BB Biotech AG.

Representatives

Representative Name

CEO, Barclays

Active stock selection in US Small Caps: aiming for predictable and consistent returns in turbulent times

The US equity market is having to contend with the twin issues of high inflation and slowing growth. To deal with the inflation problem the Fed is rapidly tightening financial conditions by aggressively raising interest rates and unwinding its vast balance sheet. In order to navigate these difficult conditions, a truly active approach that can discern between the winners and losers in this environment is as important as ever.

Hear how our team adds value through the cycle using a process that opens up the entire small cap investment universe and that aims to deliver predictable and consistent returns for investors. We will explain how the fund has historically navigated different market environments using a concentrated, fundamental bottom-up approach which predominantly derives alpha from stock selection and how we view the outlook for US small caps.

Workshop Objective:

• Understand the macroeconomic backdrop for US small cap stocks

• Understand what sectors make up the small cap market

• How is ESG factored in when managing US small caps

Company Profile: Investing smarter for the world you want

At Columbia Threadneedle Investments, we invest to make a difference in your world, and the wider world. Millions of people rely on us to manage their money and invest for their future; together they entrust us with £485 billion. Whatever world you want, our purpose is to help you achieve it. We do this by being globally connected, intense about research, having a responsible ethos and a focus on continuous improvement.

Source: Columbia Threadneedle Investments as of 31 December 2022.

Speakers

Louis Ubaka, CFA

Portfolio Analyst, US Equities team

Louis focuses on the EMEA US Small-Mid Cap strategy. He joined the London-based US Equities team in July 2021. Prior to joining Columbia Threadneedle, Louis was employed as a Fund Manager’s Assistant on the European Equities team at Schroders in London. Prior to Schroders, he was a Fund Manager’s Assistant on the Multi-Asset Fund of Funds team at Sarasin & Partners. Louis has a BA in Business Management from Middlesex University, holds the Investment Management Certificate and has obtained the Chartered Financial Analyst designation.

Louis focuses on the EMEA US Small-Mid Cap strategy. He joined the London-based US Equities team in July 2021. Prior to joining Columbia Threadneedle, Louis was employed as a Fund Manager’s Assistant on the European Equities team at Schroders in London. Prior to Schroders, he was a Fund Manager’s Assistant on the Multi-Asset Fund of Funds team at Sarasin & Partners. Louis has a BA in Business Management from Middlesex University, holds the Investment Management Certificate and has obtained the Chartered Financial Analyst designation.

Andrew Smith

Client Portfolio Analyst, US Equities team

Andrew Smith is a Client Portfolio Analyst within the US Equities team. In this role, he is responsible for providing detailed information on the company’s US equity capabilities and investment views to existing and prospective clients as well as to consultants and other intermediaries.

Before joining the US Equities team in 2018, Andrew worked as a Product Manager where he was involved in a number of product change initiatives across the fund range. Prior to this, he worked as a Market Intelligence Analyst in Distribution and as a graduate Business Analyst in the Technology department.

Andrew has an MA in Geography from the University of Cambridge. He also holds the Investment Management Certificate.

Representatives

Richard Borthwick

Head of UK Regional Sales

Richard joined the company in 2014 as a Regional Sales Manager in the UK Sales team, becoming Head of UK Regional Sales in 2023.

Richard has over 15 years’ experience in the asset management industry having previously been a Regional Sales Manager at AEGON Asset Management (then Kames Capital).

Richard graduated from the University of Edinburgh with an MA Hons degree in English and History. He also holds the Investment Management Certificate and the CFA Certificate in ESG Investing.

Mark Sharman

Regional Sales Manager

Mark joined Columbia Threadneedle Investments in June 2017 and works in the regional sales team, responsible for managing relationships with intermediary clients in the Midlands. With over 16 years in the industry, some of his previous experience was gained during 8 years as an investment analyst and prior to that, teaching political science in the United States.

Mark joined Columbia Threadneedle Investments in June 2017 and works in the regional sales team, responsible for managing relationships with intermediary clients in the Midlands. With over 16 years in the industry, some of his previous experience was gained during 8 years as an investment analyst and prior to that, teaching political science in the United States.

The compelling value in UK equities

The past year has been particularly challenging for a wide range of major asset classes. However, one area that has exceeded expectations is the UK, with domestic equities proving to be resilient through recent market uncertainty relative to other regions.

In this session, Jonathan Winton, portfolio manager of the Fidelity UK Smaller Companies Fund and co-portfolio manager of the Fidelity Special Situations Fund & Fidelity Special Values PLC, will delve into the outlook for UK equities. He will review the opportunity set across the market cap spectrum, outlining why the current environment represents a unique opportunity to invest in quality companies at historically low valuations.

Within this, Jonathan will outline how he leverages Fidelity’s extensive research resources to construct a diversified portfolio of unloved companies which offer the greatest potential for future upside, with a particular focus on small and medium-sized companies.

Workshop Objective:

Understand the fundamental outlook for UK equities and the unloved areas which offer the greatest potential for positive change and strong returns going forward.

Company Profile: Fidelity International offers investment solutions and services and retirement expertise to more than 2.87 million customers globally. As a privately held, purpose-driven company with a 50-year heritage, we think generationally and invest for the long term. Operating in more than 25 countries and with $663.1 billion in total assets, our clients range from central banks, sovereign wealth funds, large corporates, financial institutions, insurers and wealth managers, to private individuals.

Our Workplace & Personal Financial Health business provides individuals, advisers and employers with access to world-class investment choices, third-party solutions, administration services and pension guidance. Together with our Investment Solutions & Services business, we invest $493.5 billion on behalf of our clients. By combining our asset management expertise with our solutions for workplace and personal investing, we work together to build better financial futures.

Data as of 31 December 2022.

Speakers

Jonathan Winton

Portfolio Manager, Equities

Jonathan Winton joined Fidelity as an analyst in 2005, and has covered pan European Support Services, Small Cap Technology and Beverages & Tobacco stocks. He was promoted to co-portfolio manager of FIF UK Smaller Companies in February 2013, and since then has been gradually increasing his responsibility for the day-to-day management of the fund. He was appointed as the co-portfolio manager of the FIF Special Situations portfolios, managed by Alexander Wright, in February 2020.

Representatives

James Wardle

Sales Director

James has 25 years of experience in UK financial services across banking, life insurance and asset management. James joined Fidelity in 2005 and has worked with all client types within the wholesale team. James’ day to day focus since 2011 has been on open and closed ended sales to discretionary clients in the southern half of the UK including the Channel Islands. He holds the Investment Management Certificate and CISI Diploma.

James has 25 years of experience in UK financial services across banking, life insurance and asset management. James joined Fidelity in 2005 and has worked with all client types within the wholesale team. James’ day to day focus since 2011 has been on open and closed ended sales to discretionary clients in the southern half of the UK including the Channel Islands. He holds the Investment Management Certificate and CISI Diploma.

Callum Drage

Sales Manager

Callum is a sales manager in the Strategic accounts team at Fidelity, responsible for looking after a number of research agencies, advisory firms and national & network clients across the UK. He joined the firm in 2017 and has previously worked as an equity investment specialist.

Callum is a sales manager in the Strategic accounts team at Fidelity, responsible for looking after a number of research agencies, advisory firms and national & network clients across the UK. He joined the firm in 2017 and has previously worked as an equity investment specialist.

Concrete & Cables – The Foundations of Our Digital Future

The transition from analogue to digital has been underway for some time, with this only set to continue. Supporting this digital revolution is critical physical infrastructure, the concrete and cables enabling our digital interactions.

From data centres to telecom towers, logistics warehouse supporting e-commerce, to fibre optic networks, Gravis will explore the opportunities for predictable long-term income that can be found by investing in the companies which own these physical infrastructure assets, vital to the transition to a digital world.

Speakers

Matthew Norris

Head of Real Estate Securities and Fund Adviser

Matthew is responsible for the oversight of the VT Gravis UK Listed Property Fund and the VT Gravis Digital Infrastructure Income Fund.

Matthew has more than two decades investment management experience and has a specialist focus on real estate securities and digital infrastructure investments. He served as an Executive Director of Grosvenor Europe where he was responsible for global real estate securities strategies. He joined Grosvenor following roles managing equity funds at Fulcrum Asset Management and Buttonwood Capital Partners.

Representatives

Robin Shepherd

Sales Director

Robin is a sales director with responsibility for Northern England, Scotland and Northern Ireland.

After a short service commission in the British Army, Robin spent 7 years in IFA sales with Scottish Life in Edinburgh before moving south to join Threadneedle where he helped launch their retail IFA investment proposition in the northern region. After 5 years in this role, he moved to Fidelity and spent 10 years selling to the discretionary investment market.

Ollie Matthews

Sales Director

Ollie is a sales director responsible for the south of England.

For over 20 years, Ollie has been an investment fund promoter and distributor in the South of England.

He has worked extensively with independent financial advisers, private banks, wealth managers, family offices, stockbrokers and discretionary fund managers. During this time, Ollie launched Threadneedle into the UK retail market, launched the industry’s first dedicated television channel, Asset.tv, raised AUM for various boutiques and developed innovative investment funds.

Taking advantage of attractive opportunities in bond markets

After several challenging years for bonds, Stuart will address several key questions facing investors now:

-Where are we in the monetary policy cycle?

-Why now is a more attractive backdrop

-Where do the opportunities lie?

-Why not all strategic bond funds are the same

-How he has sought to limit risk in difficult times and take advantage when opportunities exist

Workshop Objective: Understand the current environment for bond investors and the opportunities now available

Company Profile: Over the years, Invesco has grown to become one of the largest investment managers in the UK, and currently manages over $1.4 trillion in assets globally.

Key to our success has been a relentless commitment to investment excellence. With clients sitting at the heart of the business, our capabilities have expanded to encompass a wide variety of investment styles, asset classes, geographies and products. To meet the changing needs of financial advisers, we now also offer a suit of adviser investment solutions, designed to make managing a well-diversified portfolio easy.

We have significant depth in resources, with more than 8,000 investment professional employees worldwide all focused on delivering the best outcomes for our clients.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

This content is for Professional Clients only and is not for consumer use.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

Issued by Invesco Asset Management Limited, Perpetual Park, Perpetual Park Drive, Henley-on-Thames, Oxfordshire RG9 1HH, UK. Authorised and regulated by the Financial Conduct Authority.

Speakers

Stuart Edwards

Fund Manager

Stuart is a fund manager for the Henley-based Fixed Interest team and manages total return and global bond portfolios. He began his investment career in 1997 at Standard & Poor’s as an economist. He joined Invesco in 2003 and transferred to the Henley Fixed Interest team in 2006 as a fixed income strategist. He has been a fund manager since 2010. He holds a BSc (Honours) in Business Economics with Computing from the University of Surrey and an MSc in Finance from Birkbeck College, University of London.

Representatives

Liam Wynne

Regional Sales Manager

David Lee

Regional Sales Manager

Richard Twitchen

UK & Ireland ETF Business Development

Active income investing – balancing dividend growth and yield in today’s environment

Against a backdrop of rising uncertainty, investors are increasingly looking to the broader global equities market as a source of diversification, with the equity income category, in particular, seeing strong interest. Join Portfolio Manager, Michael Rossi from the International Equity Group, as he discusses the prospects for the category in the context of broader markets and where he continues to find opportunities across the yield spectrum. Michael will explain why the JPM Global Equity Income Fund, with its balance of dividend quality and growth, is well suited to navigate today’s market environment.

Workshop Objective: Explain how, given sticky inflation and a volatile macro backdrop, the category still offers an attractive proposition

Explore how our philosophy allows us to balance dividend yield, dividend growth and dividend resilience leading to non-traditional portfolio outcomes.

Describe where the investment team is currently finding the best opportunities

Speakers

Michael Rossi

Associate Portfolio Manager

Michael Rossi is an Associate Portfolio Manager within the J.P. Morgan Asset Management International Equity Group, based in London. An employee since 2019, Michael was previously with HSBC Global Asset Management. He holds a Masters in Finance from the London School of Economics and Political Science, and a first class Bachelor’s degree in Economics and Finance from the University of Exeter.

Representatives

Representative Name

CEO, Barclays

From 007 to 007%. Bonds have been shaken and stirred. However, it’s worth remembering - they still have a license to thrill!

Much like the James Bond franchise, the bond market entered a transitional period throughout 2022. This transitional period has reset yields at the highest levels for a decade with bonds now looking alluring again. In this presentation, PIMCO will explore the key macro-themes and considerations at this stage of the cycle whilst also considering the forward looking opportunity set across the fixed interest spectrum. Within this context, they’ll also introduce their flagship Income strategy.

Workshop Objective:

• Explore market dynamics and returns for the bond market in 2022.

• Consider the current macro-environment and core factors at play within the bond markets for 2023.

• Explain current valuations and the forward looking opportunity set within the bond market.

• Introduce the PIMCO GIS Income fund and explain how it would be utilized within portfolios.

Company Profile: PIMCO is a global leader in active fixed income. With our launch in 1971 in Newport Beach, California, PIMCO introduced investors to a total return approach to fixed income investing. In the 50+ years since, we have worked relentlessly to help millions of investors pursue their objectives – regardless of shifting market conditions. As active investors, our goal is not just to find opportunities, but to create them. To this end, we remain firmly committed to the pursuit of our mission: delivering superior investment returns, solutions and service to our clients.

Speakers

Gordon Harding

Vice President, Fixed Income Strategist

Representatives

Marginal gains not stamp collecting

The benefits of marginal gains have been used in sport for years. Our philosophy is to use marginal gains in the fixed income markets to drive similarly successful outcomes and consistent outperformance. We will describe how portfolio optimisation helps navigate changing market environments.

Workshop Objective: We aim to provide a useful insight into current macro trends within the Fixed Income markets and how our process helps us overcome these challenges.

Company Profile: Premier Miton is a genuinely active investment manager offering a range of funds and investment trusts, as well as a portfolio management service, covering equity, fixed income, multi asset and absolute return investment strategies.

Our clients’ investments with us are actively managed by our different specialist investment teams, who are empowered to employ their own proven and distinctive investment approaches; with the aim of generating good investment outcomes. In total we are responsible for £11.1bn of client assets under management (as of 31 Dec 2022), split across 18 differentiated investment teams managing 48 distinct investment products (as of 30 Sep 2022).

Speakers

Lloyd Harris

Fund manager and Head of Fixed Income

Lloyd Harris joined Premier Miton in August 2020. He was previously at Merian Global Investors (2012-2020), where he was manager of the Merian Corporate Bond Fund and co-manager of the Merian Financials Contingent Capital Fund. He has also worked at Cutwater Asset Management (2007-2011), initially as an asset-backed CP/MTN trader, then as a European financials credit analyst, and before this, he worked in structured capital markets at Deutsche Bank (2002-2007).

Representatives

Mark Mack

Regional Sales Director

Mark is responsible for the development of Premier Miton's fund & portfolio distribution with firms across his region.

Georgi Koutsoumbos

Regional Sales Manager

.png)

Is now the time to allocate to US Small Cap?

With 2022 being the worst year since 1940 for both stocks and bonds, why is now the best time to consider the opportunity in Small Cap?

Inflation Concerns?

Why have Small-Caps beaten Inflation in every decade since the 1930’s

- Value or Growth?

We see opportunities across all factors, how we balance this opportunity set.

- What to expect when the Fed stops Hiking

We consider the impact and historical performance of Small – Mid Caps through 2023 and beyond

We will discuss how bear market recoveries and slow inflation historically has favoured Investing in the Small Cap space.

Workshop Objective: Understanding the current macro landscape in the US and the

case for investors in US Small Cap.

Company Profile: Founded in 1937 during the Great Depression, T. Rowe Price is built on the enduring philosophy of our founder; meeting clients’ individual needs. For over 80 years and through changing investment and

economic environments, the core principles that guide our business have remained the same. Today, T. Rowe Price is one of the largest investment firms in the world, managing £1.05 trillion for clients in 56

countries.

Figures as at 31 December 2022.

Speakers

Michele Ward

Portfolio Specialist

Michele is a portfolio specialist working with the US small-cap equity strategies in the US Equity Division. She also is a vice president of T. Rowe Price Investment Management, Inc. Michele's investment experience began in 1983, and she has been with T. Rowe Price since 2014, beginning in the T. Rowe Price Associates US Equity Division.

Prior to this, Michele was employed by Hewitt EnnisKnupp as an associate partner, where she advised and educated plan sponsor

investment committees on investment policy, plan structure, and regulatory and fiduciary issues. Michele earned a B.A., magna cum

laude, in political science from Yale University and an M.B.A. from the

Yale School of Management. She also has earned the Chartered Financial Analyst® designation.

Representatives

Steve McShane

Relationship Manager, Central and North

Steve has 24 years of experience in financial services. He joined T. Rowe Price in March 2017 from Neptune Investment Management.

Prior to that, Steve has worked at Axa, Architas and Norwich Union.

Steve has earned a diploma in financial services from the Chartered Institute of Insurance and has completed paper one of the Investment

Management Certificate.