Citywire Iberia Retreat 2023

It is our pleasure to invite you to our inaugural Citywire Iberia Retreat, which is set to be one of the biggest-ever gatherings of fund selectors from Iberia.

We’ve designed a format to provide selectors from Iberia the best possible environment to gather together and evaluate new investment ideas. The line-up will include 12 portfolio managers from leading international asset managers.

As always, the event will feature keynote speaker sessions bringing you the views of leading thinkers and innovators offering valuable food for thought.

Citywire Iberia Retreat 2023 will also host a bespoke fund selector panel session featuring prominent fund selection professionals offering first-hand tips on fund selection best practices, unveiling how they have adapted their asset allocation and fund selection over the last few challenging years.

We look forward to a few days of intense ideas sharing and interaction with the fund selection community and we very much hope that you can join us in Cascais!

Sponsors

.png)

Keynote Speakers

Sponsors

.png)

Keynote Speakers

Speakers

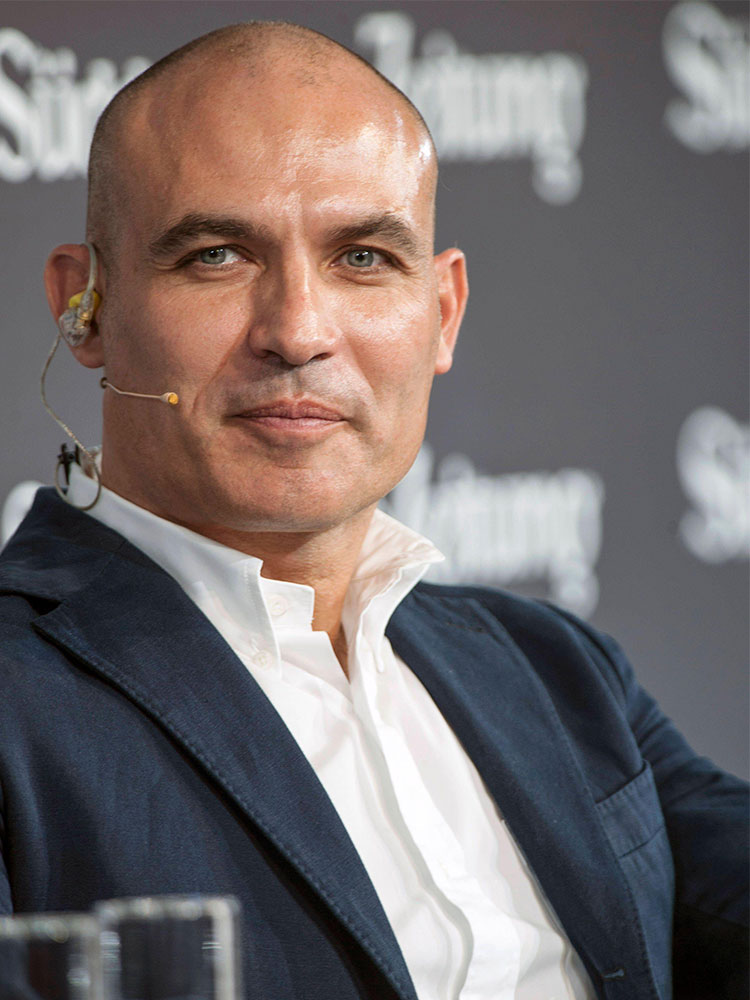

Bernardo Hernández

Spanish-born Bernardo Hernandez is a technology entrepreneur, innovator, and executive. He began his career as an analyst and asset manager, founding his first startup, idealista in 2000. Since then, he has participated in other companies as a business angel, including Tuenti, Glovo, Fever, Paack, Citibox and Wallapop .

Hernandez joined google in 2005, which first saw him as Director of Marketing and Product for Spain, after which he became the Google Director of Emerging Products, where he headed all the company’s consumer products. He was head of Flickr and Product Senior vice president of Yahoo! from 2013 to 2015.

He was also the founder and CEO of Verse, the leading payment app in Spain, that was sold in 2020 to Block, Inc formerly Square Inc.

Hernández brings his unique experience and skills as an entrepreneur, conceptualising and launching new projects. He believes that technological progress is faster than our ability to understand, his talk will help us to understand and assimilate.

Professor Florin Vasvari

Professor Florin Vasvari is Chair of Accounting Faculty and Academic Director of the Institute of Entrepreneurship and Private Capital at London Business School. He also serves on the School’s management board and finance committee. Florin teaches two electives, Private Equity and Venture Capital as well as Distressed Investing, to MBAs, Executive MBAs and Senior Managers. Florin is actively pursuing research on private equity topics and credit markets and has published over twenty articles in top tier business academic journals. He has been invited to present his research work at major global business schools and serves as an Editor at the Accounting Review. He co-authored a book entitled "International Private Equity" in 2011 and two volumes of a new textbook entitled “Private Capital (Vol1: Funds, Vol 2: Investments) ” in 2019, which has been endorsed by key private equity industry figures. On the professional side, Florin has been advising on private equity as well as mergers and acquisitions related issues many organizations, including family offices, fund-of-funds, large corporations and sovereign wealth funds in the Middle East. Florin currently sits on the advisory board and investment committee of Morphosis Capital (buyout manager, Eastern Europe) and is a senior advisor and member of the risk committee at Blantyre Capital (Special sits fund manager, Europe). He also serves on the supervisory boards of Banca Transilvania (Largest bank in South Eastern Europe), Alkeemia Spa (Chemical manufacturer, Italy) and Validus Risk Management (fintech supporting a large set of alternative asset managers, UK/USA/Canada). Florin holds a Ph.D. in Accounting and Finance from the University of Toronto, Rotman School of Management and a Master in Economics from University of Toronto, Department of Economics.

Selector Hard Talk

Evolution of best practices in fund selection: what have we learned over the years?

Citywire Iberia Retreat 2023 will also host a brand-new bespoke fund selector panel session featuring prominent fund selection professionals offering first-hand tips on fund selection best practices and providing new ideas to take back to your office and put into practice moderated by Gisela Medina, Executive Director, Head of Funds & ETFs Selection at BBVA Quality Funds.

Our guests are: Eduardo Nuno Alecrim Ferreira, Head of Discretionary Portfolio Management at BPI Gestão de Ativos; Rui Castro Pacheco, Head of Investment at Novobanco; Ghezlane El Khourouj, Portfolio Manager & Fund Analyst at Amundi Spain, and Juan Hernando, Head of Fund Selection at Morabanc.

Workshops

Workshops

More sustainable returns in volatile times

Europe and the world face new challenges – geopolitical risks with China and Russia, environmental threats, reemergent inflation and interest rates, potential recession. The European Select strategy is well-placed to address these. Our focus on business models with pricing power and competitive advantage has helped us generate strong long-term returns. The current environment – with more uncertainty and more challenges – makes this approach even more important for delivering attractive client outcomes. Francis aims to discuss our stock-picking, focusing on examples of companies which are positioned to thrive against a more volatile and less predictable backdrop. Europe is full of great companies – mixed in with some less successful ones too – and navigating this diverse universe can continue to produce good returns.

Company Profile: Columbia Threadneedle Investments is a global Asset Management company that looks after investments for individual investors, financial advisers and wealth managers, as well as insurance firms, pension funds and other institutions. All together it manages €559 billion with 2,500 people including more than 650 investment specialists. The company has presence in 19 countries across Europe, Middle East, Asia Pacific, North America and South America.

Columbia Threadneedle Investments is the global asset management group of Ameriprise Financial, Inc. (NYSE:AMP), a leading US-based financial services provider.

Speakers

Francis Ellison

Client Portfolio Manager

Francis Ellison is a client portfolio manager. He joined the company in 2007 and provides information on capabilities and investment views, particularly for European equities, to existing and prospective clients as well as to consultants and other intermediaries.

Francis Ellison is a client portfolio manager. He joined the company in 2007 and provides information on capabilities and investment views, particularly for European equities, to existing and prospective clients as well as to consultants and other intermediaries.Francis started his career in the financial sector as a portfolio manager, first at MIM Britannia and then at Kleinwort Benson Investment Management. In 1992 he became Managing Director for Bank of Ireland Asset Management (UK). Francis was Head of Institutional Sales and Client Servicing at Jupiter Asset Management from 2000 to 2005, and then moved to SEI as Head of UK Institutional Sales.

Francis holds a Law degree from Durham University and speaks German, French and Italian.

Representatives

Greta Galdós

Wholesale Client Manager

Greta Galdós is a Wholesale Client Manager at Columbia Threadneedle Investments. She joined the company in 2017 and is in charge of managing the relationship with clients for the Spanish and Portuguese markets.

She holds a Master's degree in Stock Exchange and Financial Markets from EAE Business School. She has over 6 years of experience in the asset management industry.

Rogerio Arndt

Sales Manager Iberia

Rogerio Arndt, CFA, tiene más de 10 años de experiencia en el sector de la gestión de inversiones. En 2015 se incorporó al departamento de ventas de Columbia Threadneedle Investments (BMO Global Asset Management antes de ser adquirido en 2021 por dicha compañía) cubriendo los mercados español y portugués.

Rogerio Arndt, CFA, tiene más de 10 años de experiencia en el sector de la gestión de inversiones. En 2015 se incorporó al departamento de ventas de Columbia Threadneedle Investments (BMO Global Asset Management antes de ser adquirido en 2021 por dicha compañía) cubriendo los mercados español y portugués. Anteriormente fue representante de ventas en Pioneer Investments, y también apoyó al equipo de gestión de carteras en Amundi en Madrid.

Es licenciado en Económicas de Empresa y Finanzas por la Universidad de Surrey y es miembro de la CFA Society Spain.

Investing in European equities with a quality growth approach

We are focused on quality growth, over the long-term. We are unconstrained by benchmarks, countries and sectors, allowing us to purely focus on bottom-up stock selection, driven by fundamental research. We seek to invest in companies with durable competitive advantages and to construct portfolios that can deliver sustainable, double-digit aggregated earnings per share growth over a five-year investment horizon.

Workshop Objective: Present our approach, team and track record over more than 20 years’ experience in European equities. We will also present some stock picks of the portfolio.

Company Profile: Comgest, with 30 bn of asset under management is an independent asset management company. Our strategy, values and objectives are the same today, as they will be tomorrow, as they were when the company was founded over 35 years ago. Comgest has always been 100% owned by employees and founders – as a partnership, our interests are aligned with those of our clients. We showed a continuity of our investment approach, style and team philosophy - across the globe - since inception. We are bottom-up stock pickers for non-benchmarked, concentrated and unconstrained strategies that have a long-term investment horizon.

Speakers

William Bohn

Analyst

William Bohn joined Comgest in 2019 as an Analyst specialising in European equities.

William contributes to idea generation, researching quality-growth companies within a broad range of sectors. Prior to joining the firm, William undertook internships at Comgest, Alphavalue (European Independent Equity Research) and The Rock Creek Group (Global Asset Management Firm) during his year abroad in Washington D.C.

William graduated top of his class at Sciences Po Strasbourg with a Master’s degree in Law, Economics, and Finance and also holds a Master’s degree in Corporate Finance from ESSEC Business School and is a CFA® charterholder.

Representatives

Gabriella Berglund

Investor Relations Southern Europe

Gabriella joined Comgest in 2010 to develop client relations with European-based investors. She previously worked for Société Générale Asset Management in Paris for 5 years, where she was co-head of European distribution before moving to lead the Nordic countries team. Prior to this, Gabriella gained 10 years’ experience working in international business development for asset management firms such as Edmond de Rothschild and the Natixis group, after having started her career in capital markets at JP Morgan Milan and Indosuez Stockholm. Gabriella holds a Master’s degree from Bocconi University Milan.

Gabriella joined Comgest in 2010 to develop client relations with European-based investors. She previously worked for Société Générale Asset Management in Paris for 5 years, where she was co-head of European distribution before moving to lead the Nordic countries team. Prior to this, Gabriella gained 10 years’ experience working in international business development for asset management firms such as Edmond de Rothschild and the Natixis group, after having started her career in capital markets at JP Morgan Milan and Indosuez Stockholm. Gabriella holds a Master’s degree from Bocconi University Milan.

US Value Stocks: An essential component of portfolio diversification

In the context of the unprecedented level of market concentration in US equities this year, Christophe Foliot, the Lead Portfolio Manager of the Edmond de Rothschild Fund US Value, will highlight the diversification benefits of a Value based strategy. Over the last two decades, the EDR Fund US Value has maintained the same active stance, with a high level of style consistency, based on the ability to identify companies whose long term fundamental prospects and intrinsic value are not fully reflected in their stock price. The Fund invests in a wide array of sectors and companies, and offers a very low overlap and uncorrelated returns with the majority of other US equity funds.

Workshop Objectives: To understand why the market concentrated leadership in tech names this year is creating several opportunities in many unloved companies/sectors, with a very low level of financial risks as these companies have on offer high quality assets and trade at low valuations.

Company Profile: As a conviction-driven investment house founded upon the belief that wealth should be used to build the world of tomorrow, Edmond de Rothschild specializes in Private Banking and Asset Management and serves an international clientele of families, entrepreneurs and institutional investors. The Group is also active in Corporate Finance, Private Equity, Real Estate and Fund Services. With a resolutely family-run nature, Edmond de Rothschild has the independence necessary to propose bold strategies and long-term investments, rooted in the real economy. Founded in 1953, the Group has CHF 160 billion of assets under management at the end of 2022, 2,500 employees, and 30 locations worldwide.

Speakers

Christophe Foliot

Portfolio Manager/Analyst

Christophe Foliot joined Edmond de Rothschild AM (France) in 2003 as US/International Equity portfolio manager.

He started his career in 1994 at Knight-Ridder Inc in the financial research department. In 1995, he became a buy-side financial analyst Banque Vernes. In 1999, he joined BNP Paribas Asset Management as buy-side analyst and then head of North American equity management.

Christophe holds an MBA from the City University of New York and a CFA.

Representatives

Sébastien Senegas

Head of Spain, Portugal and Latin America

He started his career in 1999 at BNP Paribas in Venezuela. He worked then at Société Générale in France from 2001 to 2006.

Sébastien is graduated from the Neoma Business School and the University of Salamanca

María García Fernández

Head of Sales Spain

Contrarian investment in Asia

Asia ex Japan is one of the fastest growing regions, but given its unique characteristics, one that has been challenging for investors to capture its successes through stock investments. The Federated Hermes Asia ex Japan Strategy has a track record of over 13 years and it is one of the top performing strategies versus peers since inception despite more than a decade of stylistic headwinds resulting from its distinctive contrarian investment approach. We like unloved companies in unloved markets and will discuss the opportunities we are seeing through our contrarian lens.

Workshop Objective: Update for existing clients and general introduction for potential clients.

Company Profile: Federated Hermes is guided by the conviction that responsible investing is the best way to create long-term wealth. We provide specialised capabilities across equity, fixed income and private markets, in addition to multi-asset strategies and liquidity-management solutions. Through pioneering stewardship services, we engage companies on strategic and sustainability concerns to promote investors’ long-term performance and fiduciary interests. Our goals are to help people invest and retire better, to help clients achieve better risk-adjusted returns and, where possible, to contribute to positive outcomes that benefit the wider world.

Speakers

James Cook

Investment Director, Global Emerging Markets

James joined Federated Hermes in November 2011 and is Head of Investment Specialists. Within his role, he oversees the team of investment specialists supporting all equity, fixed income and multi-asset products and is also investment director for emerging markets strategies. He joined from Fidelity Worldwide Investments, where he was product director for emerging markets equities from October 2005 until May 2011. He previously worked at Threadneedle Investments in investment communications. James has a degree in Economics from Royal Holloway, University of London, and holds the Investment Management Certificate.

Representatives

Melanie Lange

Associate Director - Distribution, Iberia, Federated Hermes Limited

Melanie Lange joined Federated Hermes in July 2021. Melanie was previously at Caixabank where she was in charge for the alternative assets within the private banking product development team, and private banking since 2007. Melanie has been working in product and private banking during more than 15 years in entities as Morgan Stanley and Deutsche Bank. She holds a BA(Hons) in International Business from Southampton University and Business Studies form University of Valladolid.

Melanie Lange joined Federated Hermes in July 2021. Melanie was previously at Caixabank where she was in charge for the alternative assets within the private banking product development team, and private banking since 2007. Melanie has been working in product and private banking during more than 15 years in entities as Morgan Stanley and Deutsche Bank. She holds a BA(Hons) in International Business from Southampton University and Business Studies form University of Valladolid.

A World of Opportunity in Emerging Market Debt

Why invest now in EM debt? Alejandro Arevalo, Investment Manager, will explain the benefits of the asset class – with a focus on short duration and corporate bond strategies. The benefits for investors include attractive yields relative to history and solid fundamentals in many emerging markets. Alejandro will explain why he is positive about the outlook for the asset class, his experienced team and its investment process and where they are finding the best investment opportunities, as well as areas they are avoiding.

Workshop Objective: To understand the factors that could support emerging market debt this year, as well as the risks that should be considered.

Company Profile: Jupiter is a specialist, high conviction, active asset manager. We exist to help our clients achieve their long-term investment objectives. From our origins in 1985, Jupiter now offers a range of actively managed strategies available to UK and international clients including equities, fixed income, multi-asset and alternatives. Jupiter is a constituent member of the FTSE 250 Index and has assets under management of £50.8bn /$62.7bn /€57.8bn as at 31/03/2023.

Independence of thought and individual accountability define us. Our fund managers follow their convictions and seek those investment opportunities that they believe will ensure the best outcome for our clients. They do this through fundamental analysis and research, a clear investment process and risk management framework, with a focus on good stewardship.

Speakers

Alejandro Arevalo

Investment Manager, Fixed Income – EMD

.jpg)

Alejandro is an Investment Manager in the Fixed Income - EMD team.

Before joining Jupiter, Alejandro worked at Pioneer Investments as an emerging markets corporate debt portfolio manager. Prior to this, he worked on emerging market debt strategies at Standard Bank Asset Management, Gibraltar Bank and the International Bank of Miami. He began his investment career in 1998.

Alejandro has an MBA in finance.

Valerio Angioni

Investment Director, Fixed Income

Valerio joined Jupiter in 2022 and is an Investment Director in the Fixed Income team.

Before joining Jupiter, Valerio worked for PIMCO, in the EMEA Global Wealth Management Sales team looking after distribution, wholesale and sub-advisory clients, predominantly invested in fixed income and multi-asset strategies. He has 5 years of investment experience and previously worked at Commerzbank in Cross -Asset Structured Products Sales and completed internships at JP Morgan and GAM.

Valerio is a CFA charter holder and holds a degree in Business Economics from the University of Cagliari and a Master of Science in Finance from Bocconi University

Representatives

Félix de Gregorio

Head of Iberia

Félix de Gregorio joined Jupiter in 2019 and was appointed Head of Iberia in March 2021. Previously he spent 14 years at JPMorgan, where he was an Executive Director in Institutional Equity Sales. Before that, he worked in other international banks like BNP Paribas or Morgan Stanley. He holds a degree in Business Administration from CUNEF.

Félix de Gregorio joined Jupiter in 2019 and was appointed Head of Iberia in March 2021. Previously he spent 14 years at JPMorgan, where he was an Executive Director in Institutional Equity Sales. Before that, he worked in other international banks like BNP Paribas or Morgan Stanley. He holds a degree in Business Administration from CUNEF.Francisco Amorim

Sales Director Iberia

Francisco Amorim joined Jupiter in 2019 as a Sales Manager. Before joining Jupiter, he spent three years at Millennium BCP as a Fixed Income Fund Selector for the group’s DPM, Private Banking and Retail investment offer. Prior to this, he spent six years in Switzerland as an Investment Advisor to Iberian and LatAm HNWI at Banque Privée Espirito Santo.

Francisco Amorim joined Jupiter in 2019 as a Sales Manager. Before joining Jupiter, he spent three years at Millennium BCP as a Fixed Income Fund Selector for the group’s DPM, Private Banking and Retail investment offer. Prior to this, he spent six years in Switzerland as an Investment Advisor to Iberian and LatAm HNWI at Banque Privée Espirito Santo.

GF Sustainable Future Global Growth Fund

The GF Sustainable Future Global Growth Fund uses the Sustainable Future investment process to invest in a broad range of companies from around the world based on the fund manager’s view of their long term return prospects and exposure to our growth themes.

Workshop Objectives: To explain how the Fund’s investment process uses a thematic approach to identify the key structural growth trends that will shape the global economy of the future.

Company Profile: Liontrust is a specialist asset manager that takes pride in having a distinct culture and approach to running money. The company launched in 1995 and listed on the London Stock Exchange in 1999. We are an independent business with no corporate parent. Our purpose is to have a positive impact on our investors, stakeholders and society.

We believe investment processes are key to long-term performance and effective risk control. Our fund managers are truly active in applying their investment processes. There is no house view - our fund managers have the freedom to manage their portfolios according to their own investment processes and market views.

Speakers

Chris Foster

Fund Manager

Chris Foster is Lead manager of the GF SF US Growth Fund and Co-manager of the Liontrust SF Global Growth Fund, GF SF Global Growth Fund and SF Managed Growth Fund. Chris joined Liontrust in April 2017 following the acquisition of Alliance Trust Investments. Prior to this, Chris joined ATI through the management training programme after graduating from the University of Edinburgh. Chris is a CFA Charterholder.

Representatives

Gonzalo Thomé

International Sales Director – Spain, Portugal & Andorra

Gonzalo joined Liontrust in December 2019 and is International Sales Director for Spain, Portugal, Andorra and Latam. Prior to Liontrust Gonzalo was Senior Fund Analyst & Deputy Sales Director at Banco Inversis. Previously, he was a fund selector and fund of funds manager at Banco Sabadell and Altex Partners. Gonzalo holds a Finance MBA from IE Business School, is CAd qualified and Agricultural Engineer.

Gonzalo joined Liontrust in December 2019 and is International Sales Director for Spain, Portugal, Andorra and Latam. Prior to Liontrust Gonzalo was Senior Fund Analyst & Deputy Sales Director at Banco Inversis. Previously, he was a fund selector and fund of funds manager at Banco Sabadell and Altex Partners. Gonzalo holds a Finance MBA from IE Business School, is CAd qualified and Agricultural Engineer.

James Beddell

Head of International Sales

James joined Liontrust in September 2014 and is Head of International Sales. He has worked in asset management distribution for 18 years and was previously Head of International Wholesale Sales at Thames River Capital/F&C Investments. Prior to this James was Head of Distribution for Europe (ex. Switzerland, Germany and Italy) at Credit Suisse Asset Management. He started his career at Fleming Asset Management.

James joined Liontrust in September 2014 and is Head of International Sales. He has worked in asset management distribution for 18 years and was previously Head of International Wholesale Sales at Thames River Capital/F&C Investments. Prior to this James was Head of Distribution for Europe (ex. Switzerland, Germany and Italy) at Credit Suisse Asset Management. He started his career at Fleming Asset Management.

Convertibles, a strategic solution for all times

Join Nicolas Crémieux for a deep dive into the convertible bond asset class including latest macro views, addressing misconceptions and the role they can play in your overall portfolio. Nicolas will introduce our high conviction Sustainable Convertibles Global strategy. A pure-play convertibles fund with a sustainable focus, the team actively manage portfolio delta to deliver equity participation in rising markets and limit the downside in falling equity markets.

Workshop Objectives: The objective of this workshop is to help multi-asset investors deepen their understanding of the convertibles asset class, explaining to them why they should invest and how to get exposure successfully, as this asset class remains strong on a risk-adjusted basis and has the ability to generate strong returns.

Company Profile: Mirabaud Asset Management is part of a private owned partnership, originally founded in 1819. We provide a range of investment solutions across Fixed Income, Equities and Alternatives, to Institutional and Wholesale investors in Switzerland and Europe. A common philosophy applies across each of these areas of expertise, which is an active, high conviction approach to generating long term risk adjusted returns. A focus on managing risk and a commitment towards environmental, social and corporate governance principles are important constituents of our heritage.

We operate in Europe’s key financial centres: Geneva, Zurich, London, Paris, Madrid, Milan and Luxembourg.

Speakers

Nicolas Crémieux

Head of Convertible Bonds

Nicolas Crémieux, Head of Convertible Bonds at Mirabaud Asset Management, has over 20 years’ experience in the portfolio management industry. Prior to joining Mirabaud Asset Management in August 2013, Nicolas was Head of Convertible Bond Management at Candriam between 2000 and 2013, where he managed two funds, as well as being Head of Technical Analysis. He is a Certified European Financial Analyst Charterholder (EFFAS) and holds a Master's Degree in Finance and a Master's degree in Insurance and Risk Management from the University of Paris Dauphine.

Representatives

David Basola

Head of Consultants, GFI & Southern Europe

Elena Villalba

Managing Director Iberia and Latinoamerica

Elena Villalba has over 25 years of experience in the financial sector in the areas of business development and portfolio management. She has developed her professional career as part of firms, such as Credit Suisse and American Express, as well as more specialized, boutique-level companies, such as Focus Capital Ltd, where she was a founding partner and Investment Co-Director. She holds a bachelors degree in Finance from Bentley College (Boston) and Master in Portfolio Management from the IEB and has certificates in various modules related to asset management taught by the Harvard Business School and the Massachusetts Institute of Technology.

Elena Villalba has over 25 years of experience in the financial sector in the areas of business development and portfolio management. She has developed her professional career as part of firms, such as Credit Suisse and American Express, as well as more specialized, boutique-level companies, such as Focus Capital Ltd, where she was a founding partner and Investment Co-Director. She holds a bachelors degree in Finance from Bentley College (Boston) and Master in Portfolio Management from the IEB and has certificates in various modules related to asset management taught by the Harvard Business School and the Massachusetts Institute of Technology.

Ride the structural growth opportunity of a generation: decarbonisation

Most investors have very little exposure to the climate-solutions investment universe – a select but diverse group of companies that are enabling the multi-decade shift to a low-carbon economy. These companies make up only a small fraction of broad global stock indices. Beyond the positive environmental impact, there are two key investment reasons to consider allocating to climate-solutions companies, says Ninety One’s Jennifer Moynihan. First, given the vast investment that will go into decarbonisation in the years ahead, these companies have significant long-term return potential as well as benefitting already from the growth in this industry. Second, because decarbonisation companies are exposed to such a powerful structural growth opportunity, they have different long-term drivers of success than other companies which means they can add diversification to an equity portfolio.

Workshop Objective: For investors to understand the significant long-term return opportunity in investing in climate-solutions companies and the powerful structural growth opportunity they are exposed that can add diversification to an equity portfolio.

Company Profile: Investing for a world of change

Ninety One is an active, global investment manager managing €147.1 billion in assets (as at 31.03.23). Our goal is to provide long-term investment returns for our clients while making a positive difference to people and the planet.

Established in South Africa in 1991, as Investec Asset Management, the firm began as a small start-up offering domestic investments in an emerging market. In 2020, as a global firm proud of our emerging market roots, we demerged to become Ninety One.

We are committed to developing specialist investment teams organically. Our heritage and approach let us bring a different perspective to active and sustainable investing across equities, fixed income, multi-asset and alternatives to our clients - institutions, advisors and individual investors around the world.

Speakers

Graeme Baker

Portfolio Manager

Graeme is a portfolio manager in the Sustainable Equity team within the Multi-Asset team at Ninety One. Graeme is co-portfolio manager for the Global Environment strategy.

He joined the team in 2010. During this time, he has been instrumental in driving the team’s work on the Energy Transition and co-authored the 2016 paper on the subject; “Our energy future: creating a sustainable global energy system”. This work has provided the base for the team’s investment process and philosophy around the process of Sustainable Decarbonisation.

Prior to joining the firm, Graeme worked as an investment analyst at Hargreaves Lansdown Asset Management where he focused on Alternatives and Global Equities. Graeme received a BSc in Economics from the University of Bristol and is a CFA® Charterholder, a member of the CFA® Society of the UK and holds the Investment Management Certificate (IMC).

Representatives

Paloma Vega

Relationship Manager

Tatiana Monteiro

Relationship Manager

.png)

Using market dispersion through a value based sector rotation approach

Based on the work of Professor Shiller, the Barclays range of CAPE indices, accessible though Ossiam UCITS ETFs, offers a good risk-return profile on US, Europe & Global large cap equity universes. Experts from Barclays and Ossiam will walk you through the investment process, both in terms of sector selection and ESG features.

Workshop Objectives: Present the meaning and usefulness of the Shiller Cape ratio for equity sectors - Explain the construction methodology of the Barclays Shiller Cape indices - Demonstrate the added value of ESG integration with such an approach

Company Profile:

Company profile - 120 words Ossiam is a specialist asset management company that develops and manages investment funds, including exchange-traded funds (ETFs), based on systematic investment processes. Ossiam is headquartered in Paris, France and is a subsidiary of Natixis Investment Managers. Ossiam's total assets under management amounted to €7.8 billion at the end of 2022.

Barclays is a consumer and wholesale bank, supporting individuals and small businesses through our consumer banking services, and larger businesses and institutions through our corporate and investment banking services. Our Corporate and Investment Bank is comprised of the Investment Banking, International Corporate Banking, Global Markets and Research businesses; it provides money managers, financial institutions, governments, supranational organisations and corporate clients with services and advice for their funding, financing, strategic and risk management needs.

Speakers

David Haefliger

Director in the Barclays Quantitative Investment Strategies (QIS)

David joined Barclays in 2009 as a credit derivatives structurer focusing on Credit Linked Notes and systematic credit strategies. In 2012, he moved to the QIS team, which specializes in the design and implementation of systematic strategies across a wide range of investments. He is responsible for the Equity, Rates and Credit QIS development at Barclays. David holds a Bachelor's degree in Business Administration and a Master's degree in Banking and Finance from the University of St. Gallen

Representatives

Paul Lacroix

Head of Structuring Ossiam

Paul joined Ossiam in 2016. In the beginning of 2019, he joined the portfolio management & research team as a product specialist. He had previously held sales positions at Sanso IS (2015) and Ossiam (between 2016 and 2019). He has a finance master's degree from Kedge Business School.

Paul joined Ossiam in 2016. In the beginning of 2019, he joined the portfolio management & research team as a product specialist. He had previously held sales positions at Sanso IS (2015) and Ossiam (between 2016 and 2019). He has a finance master's degree from Kedge Business School.

Maider Lasarte

Business Development non-french speaking countries

Maider Lasarte started her career at Natixis Investment Managers within the sales team based in Madrid in 2013, to contribute to the mutual fund distribution business development in the region. Four years later, she joined the US Offshore dedicated sales team at Natixis Investment Managers based in Miami. She joined Ossiam in 2021 as a business developer for the non-French speaking countries.

Maider Lasarte started her career at Natixis Investment Managers within the sales team based in Madrid in 2013, to contribute to the mutual fund distribution business development in the region. Four years later, she joined the US Offshore dedicated sales team at Natixis Investment Managers based in Miami. She joined Ossiam in 2021 as a business developer for the non-French speaking countries.

Pacific G10 Macro Rates

The Pacific G10 Macro Rates strategy is widely acknowledged to be differentiated from many traditional macro funds. This strategy focusses on G10 sovereign bonds and interest rates, meaning the Fund does not invest in equities, credit or emerging markets. The team have developed a relative value process which harnesses inefficiencies in the pricing of interest rate products rather than forecasting their direction. For example playing curve shapes, but also investing in cross currency interest rate strategies and spreads. This is particularly pertinent at times, such as now, when confusion takes hold of financial markets.

With increasing divergence in monetary policy across the G10 countries, coupled with continued volatility in the forward rates markets, the team’s opportunity-set looks greater than ever.

Workshop Objectives:

- G10 Macro Rates versus traditional Macro Investing

- Relative Value Investing: Pricing Anomalies & Mean Reversion

- Diversification & Uncorrelated Returns

- Discuss Market Environment

Company Profile: Pacific Asset Management (PAM) is an independent asset manager responsible for more than $4.8bn of assets. Fresh and progressive, PAM is rethinking the conventions of how asset management works. Its single manager business focuses on high-conviction investing in less efficient markets, where it believes active managers can outperform. Alongside the G10 Macro Rates strategy, it also offers Emerging Market Equity and Longevity & Social Change solutions. PAM’s technology-enabled model portfolio solutions are available on all major platforms.

Speakers

Shayne Dunlap

Portfolio Manager - G10 Macro Rates

Shayne Dunlap is a Founding Portfolio Manager of Pacific’s G10 Macro Rates team. Prior to joining, Shayne worked as the Lead Fund Manager at Standard Life Investments. He has worked in fund management and investment banking for 29 years and has actively managed portfolios since 1999 with an excellent track record in G10 government bonds, interest rates and FX.

Representatives

Jonno Ross

Associate Director

Jonno is an Associate Director at Pacific and joined the firm in September 2022. He is primarily focussed on distribution of PAM’s single manager range of strategies. Prior to arriving at Pacific, Jonno spent 7 years at Waverton Investment Management where he worked with institutional and wholesale investors across the UK, Europe and Offshore markets.

Jonno is an Associate Director at Pacific and joined the firm in September 2022. He is primarily focussed on distribution of PAM’s single manager range of strategies. Prior to arriving at Pacific, Jonno spent 7 years at Waverton Investment Management where he worked with institutional and wholesale investors across the UK, Europe and Offshore markets.

Lorenzo Parages

Country Head, Campion Capital

Exciting times for Japanese equities – is it finally Japan’s time to shine again?

For the last 30 years, Japan has been a perennial underperformer relative to global markets and been largely ignored by investors. Despite this, it is a market that has been fertile stock picking ground for Platinum Asset Management. There have been gradual changes in corporate governance since we established our dedicated Japan strategy in 1998, but these have been galvanised and accelerated by recent government driven structural reforms. Rarely have been more reasons to be excited about the investment opportunity in the region. Leon Rapp, a 30-year Japan veteran, will highlight why now is such an exciting time for Japanese equities and where Platinum is finding compelling investment opportunities.

Workshop Objective: An overview of Platinum’s Japan strategy which follows a benchmark unconstrained, fundamental equity long-short approach. The strategy was established in 1998 and a UCITS vehicle was launched in 2015.

Company Profile: Founded in Sydney, Australia in 1994, Platinum has built a strong long-term track record as a fund manager specialising in global equities. Platinum is an active, equity (long/short) manager focused on delivering long-term absolute returns, offering global, regional and sector strategies. Platinum takes a disciplined approach: pursuing opportunities overlooked by the market, ignoring benchmarks, and seeking to protect capital. Platinum is staffed by over 100 professionals including an investment team of 35, encompassing five global sector teams and a specialist Asia coverage team.

Speakers

Leon Rapp

Co-Portfolio Manager

Representatives

Tim Maher

Managing Director (UK)

Charles Brooks

Institutional Investment Specialist

Charles began his career in finance at Morgan Grenfell Asset Management in London. After settling in Sydney he took up investment analyst and portfolio management roles at United Funds Management and later at MLC Investment Management.

Uncovering Opportunities in Japan

In 1H of 2023, large-cap dominated the Japanese market. Particularly after April, while financial policies in Europe and US continued to tighten, Japan maintained its monetary easing, leading to expectations of Japan's resilient economic sentiment compared to Europe and US. International investors' funds in-flowed, resulting in significant outperformance of large-cap stocks. We will be explaining why this rally will continue and what will be the drivers of growth in Japanese equities.

Workshop Objectives: To introduce the bottom-up opportunities in Japan that we believe can grow in the coming market environment.

Company Profile: At SPARX, we believe in fundamental, bottom-up investing to uncover long-term growth opportunities across Japan and Asia. Founded in 1989, SPARX Group is one of the largest independent, Asia-focused asset management boutiques headquartered in Tokyo. Since establishment, we have focused our efforts and expertise initially in Japan and then across Asia, investing through a variety of market environments. Conducting thousands of company research activities per year, we draw on this experience to identify companies that can consistently generate excess returns. Our unique and unconstrained investment style serves a diverse client base of long-term oriented investors around the globe.

Speakers

Masa Takeda

Portfolio Manager

Masakazu Takeda has over 22 years of portfolio management and financial analysis experience. Since 2006, he has been the lead portfolio manager of the Japan Focus All Cap Strategy. Since 2010, he has been part of the SPARX OneAsia investment strategy team. Mr. Takeda joined SPARX in 1999 as a research analyst and became a fund manager in 2004. Prior to joining SPARX, he started his career as a corporate loan officer at Long Term Credit Bank (currently Shinsei Bank) and then as an operations risk manager with LTCB Warburg (currently UBS Securities). He graduated from International Christian University in 1996 with a Bachelor’s degree in Liberal Arts.

Representatives

Philip Stoddart

Director of Business Development

Philip Stoddart graduated from the University of York with a BA in Economics, Econometrics and Finance and has worked across multiple functions in the finance world in his 17 years in the industry. Starting in hedge fund operations and product management then moving through to structured product brokerage. He then diversified his experience in the Vendor and consulting space: working with some of the largest names in global buy-side software, including Bloomberg, Charles River Developments and Broadridge: in London, Boston and Hong Kong. He recently joined SPARX as a Director of Business Development working with focusing on their long-only and alternative strategies.

Philip Stoddart graduated from the University of York with a BA in Economics, Econometrics and Finance and has worked across multiple functions in the finance world in his 17 years in the industry. Starting in hedge fund operations and product management then moving through to structured product brokerage. He then diversified his experience in the Vendor and consulting space: working with some of the largest names in global buy-side software, including Bloomberg, Charles River Developments and Broadridge: in London, Boston and Hong Kong. He recently joined SPARX as a Director of Business Development working with focusing on their long-only and alternative strategies.

Daigo Hisaoka

Daigo started his career at Mitsubishi UFJ Trust & Banking corporation, and belonged to the asset management division. His primary responsibility was the distribution of Japanese equity funds to overseas client, and client service of existing clients. After spending 3 years at the previous company, he joined SPARX. His primary responsibility is to serve as an account manager of several clients and the distribution of long-only strategies.

Daigo started his career at Mitsubishi UFJ Trust & Banking corporation, and belonged to the asset management division. His primary responsibility was the distribution of Japanese equity funds to overseas client, and client service of existing clients. After spending 3 years at the previous company, he joined SPARX. His primary responsibility is to serve as an account manager of several clients and the distribution of long-only strategies.

FIXED INCOME RISKS AND OPPORTUNITIES AT THE END OF THE HIKING CYCLE

Oliver Boulind, Head of Credit, HSBC Asset Management will take a deep dive into the fixed income markets, what this current environment means for investors and what solutions are available as they navigate this uncertain and volatile market turning point.

Workshop Objectives: Oliver Boulind, Head of Credit, HSBC Asset Management will go into depth looking at a short duration, multi-sector fixed income solution.

Company Profile: HSBC Asset Management, the investment management business of the HSBC Group, invests on behalf of HSBC’s worldwide customer base of retail and private clients, intermediaries, corporates and institutions through both segregated accounts and pooled funds. HSBC Asset Management connects HSBC’s clients with investment opportunities around the world through an international network of offices in more than 20 countries and territories, delivering global capabilities with local market insight. As at 31 of March 2023, HSBC Asset Management managed assets totaling US$41bn on behalf of its clients. Our vision is to become a core solutions and specialist Emerging Markets, Asia and Alternatives focused asset manager with client centricity, investment excellence and sustainable investing being the key proponents of our strategy. To help us achieve our strategy, we focus on eight strategic growth initiatives, as follows:

1. Private Loans & Credit

2. Direct investment capabilities in Alternatives – Private Equity and Infrastructure

3. Liquidity solutions

4. Sustainable and Impact investing

5. Solutions i.e Insurance companies

6. ETFs (particularly ESG, Fixed Income and Asia)

7. Building a competitive fund range for our Wealth distribution channels

8. China and India

Speakers

Oliver Boulind

Head of Global Credit

Oliver Boulind is Head of Global Credit and a portfolio manager in the Global Bond team within HSBC Global Asset Management in London and has been working in the financial industry since 1993. Within the team, Oliver is responsible for developing asset allocation strategies for global bond portfolios and for managing global aggregate and total return bond portfolios. Prior to his current position, Oliver was Head of Global Fixed Income strategies at Aberdeen Asset Management. Prior to this he worked at AllianceBernstein, Invesco, JP Morgan and Salomon Brothers. He holds a BSc in Economics from the Wharton School of the University of Pennsylvania and an MBA from the Tuck School at Dartmouth College. He is a CFA charterholder.

Representatives

Paul Mitchell

Fixed Income Investment Specialist

Shadia Fayad

Head of Wholesale Business Iberia and Managing Director of the Spanish branch

Agenda

08:30 - 09:30

Delegate registration

09:30 - 09:40

Welcome Session

09:40 - 10:40

Conference Session 1

10:40 - 11:10

Fund Group Workshop

11:20 - 11:50

Fund Group Workshop

12:00 - 12:30

Fund Group Workshop

12:30 - 13:50

Lunch

13:50 - 14:50

Panel Session

14:50 - 15:20

Fund Group Workshop

15:30 - 16:00

Fund Group Workshop

16:10 - 16:40

Fund Group Workshop

19:30 - 20:00

Drinks Reception

20:00 - 23:00

Dinner

07:00 - 09:30

Breakfast at leisure

09:30 - 10:30

Conference session 2

10:30 - 11:00

Fund Group Workshop

11:10 - 11:40

Fund Group Workshop

11:50 - 12:20

Fund Group Workshop

12:30 - 13:00

Fund Group Workshop

13:00

Buffet Lunch