Citywire Scotland Retreat 2023

For over 10 years, Citywire Scotland has been firmly established as THE unmissable gathering for the region’s wealth management and financial advice professionals.

And so, it gives me great pleasure to invite you to join us on 8 - 9 June at Gleneagles, for a day and a half of invaluable insight offering cutting-edge investment strategy that is sure to be useful for your year ahead.

With available places in high demand, register today to ensure your participation.

There is no charge for attending (which is strictly by invitation only) and you will earn eight hours of structured CPD.

Once again, we will bring together the region’s key figures in wealth management for a full programme of keynote speakers, a huge selection of workshop sessions with leading fund managers, and of course, the opportunity to network with your peers.

Keynote speakers:

We kick things off on Thursday morning with Tim Marshall who, with thirty years’ experience in broadcasting, is well-placed to provide a sharp political commentary and analysis of global affairs. The former diplomatic editor and foreign correspondent for Sky News will employ his knack for boiling down big issues, to give us his up-to-the minute perspective on geopolitics.

After lunch we will revisit our most highly-rated session of 2022 in which I will be in conversation with Tom Fletcher, foreign policy advisor to three prime ministers, Blair, Brown and Cameron. In this fully interactive session you will also be able to question Tom on a number of subjects, including the nature of leadership and the 21st century survival skills we will need as states, businesses and individuals.

On Friday morning, Kimberley Wilson will be showing us How to Build a Healthy Brain, drawing on her professional experience of integrating evidence-based nutrition and lifestyle factors with psychological therapy. Kimberley believes the way we think about mental health is flawed, and throughout this session will provide useful takeaways for us all to improve our effectiveness and wellbeing.

Learning Objectives:- Investigate a variety of investment strategies from fund managers across multiple asset classes;

- Gain an understanding of the current geopolitical landscape and its effect on markets;

- Develop the necessary skills to identify specific geopolitical risk factors.

On behalf of the entire Citywire team, we do hope you can join us and I look forward to seeing you at Gleneagles.

All the best,

Steven

Agenda

08:00 - 09:20

Registration

09:20 - 09:30

Welcome with Steven Chatterton

09:30-10:30

Conference Session 1 - Tim Marshall

10:30 - 11:00

Fund Group Workshop 1

11:10 - 11:40

Fund Group Workshop 2

11:50 - 12:20

Fund Group Workshop 3

12:20 - 13:40

Lunch

13:40 - 14:30

Conference Session 2 - Tom Fletcher

14:30 - 15:00

Fund Group Workshop 4

15:10 - 15:40

Fund Group Workshop 5

15:50 - 16:20

Fund Group Workshop 6

16:30 - 17:00

Fund Group Workshop 7

19:30 - 20:00

Drinks Reception

20:00 - 23:00

Informal Dinner and After Dinner speaker Aaron Simmonds

09:30 - 10:30

Conference session 3 - Kimberley Wilson

10:30 - 11:00

Fund Group Workshop 8

11:10 - 11:40

Fund Group Workshop 9

11:50 - 12:20

Fund Group Workshop 10

12:20 - 13:20

Buffet Lunch

14:00

Event close

Keynote Speakers

Speakers

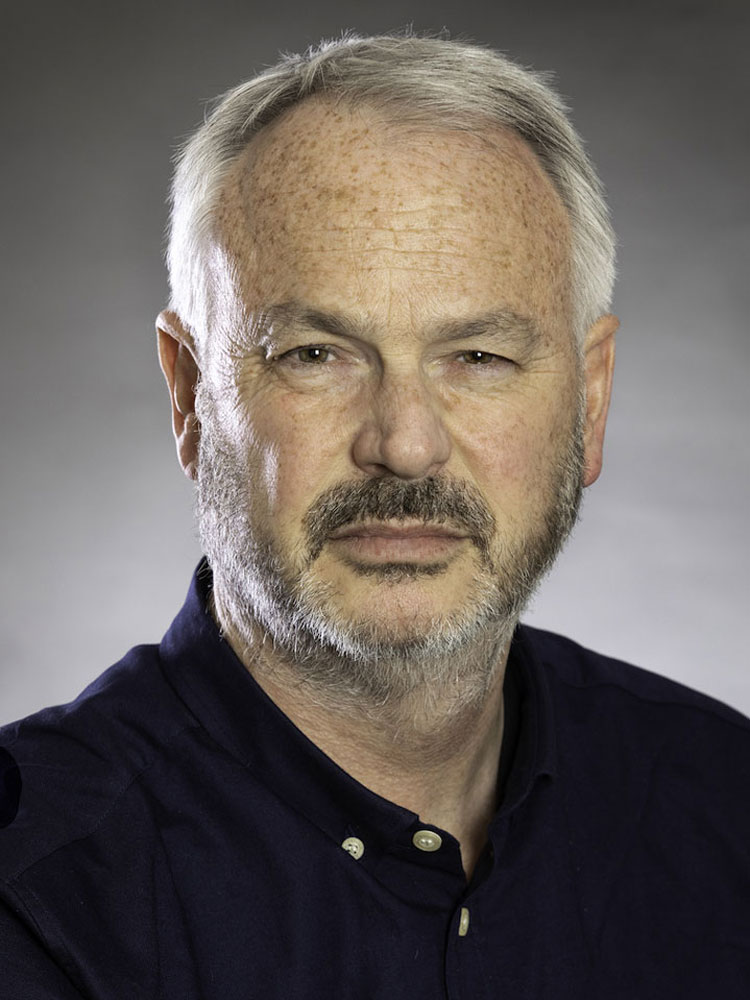

Tim Marshall

After thirty years’ experience in broadcasting, Tim Marshall is well-placed to provide a sharp political commentary and analysis of global affairs.

A generalist who is able to join the dots between specialisms in a wide field, the former Diplomatic Editor and foreign correspondent for Sky News has a knack for boiling down big issues, such as geopolitics and international diplomacy, to broad-brush terms.He has published several critically acclaimed books, including the 2015 New York Times best-seller Prisoner of Geography: Ten Maps That Tell You Everything You Need to Know About Global Politics.

Originally hailing from Leeds, Tim arrived at broadcasting from the road less travelled. He worked his way through newsroom nightshifts, and unpaid stints as a researcher and runner to the news producers. After three years as IRN's Paris correspondent and carrying out extensive work for BBC radio and TV, Tim joined Sky News. Reporting from Europe, the USA and Asia, he became the Middle East Correspondent based in Jerusalem, and his celebrated six-hour unbroken broadcasting stint as ground attack went in during the Gulf War made news reporting history.

Tim reported from the field in Bosnia, Croatia, and Serbia during the Balkan wars of the 1990s. He spent the majority of the 1999 Kosovo crisis in Belgrade, where he was one of the few western journalists who stayed on to report from one of the main targets of NATO bombing raids, and he greeted the NATO troops in Kosovo itself on the day that they advanced into Pristina.

Tom Fletcher

Tom Fletcher was the UK’s youngest ever senior ambassador when he was appointed the country’s representative in Lebanon. Prior to his posting he worked as a foreign policy advisor in Downing Street under three Prime Ministers. As well as lessons from dealing with actors in the uniquely combustible region, he considers the nature of leadership and negotiation, the power of social media, and the future of engagement and education.

Tom’s work has taken him from leading reviews into modernising the UN and the UK Foreign Office to advising the Global Business Coalition for Education (which uses the private sector to help 59 million children into school) and teaching as a Visiting Professor of International Relations in New York University and the Emirates Diplomatic Academy. He has also debated with Hezbollah on Twitter, and job-swapped for a day with a teenage Ethiopian housekeeper to highlight the abuse domestic staff often suffer (she, on the other hand, grilled a senior politician and held a press conference).

Believing more of the world wish to co-operate than build walls, Tom looks at the big picture issues of global power structures. With examples (and anecdotes) from meetings with the likes of Merkel and Obama, Tom considers the importance of three elements of leadership – inspiration and vision, engagement, and implementation. His bestseller Naked Diplomacy: Power & Statecraft in the Digital Age looks at the opportunities and challenges a connected world presents to policy makers, asks whether companies like Google should be treated more like a nation than a business and examines the need to revolutionise education to reflect the advances of a digital world. He considers the effects of new technologies on everything from the Sustainable Development Goals to the threat of lethal autonomous weapons to building a stronger international community.

His book Ten Survival Skills for a World in Flux focuses on how ESG has become essential to how we make sense of human endeavours. Tom details what his experience advising the Prime Minister at G20 meetings and climate conferences taught him about the gap between geopolitics and sustainability, outlining a roadmap to more sustainable living in a post-lockdown world.

Aaron Simmonds

Aaron Simmonds has been failing to stand up for 32 years; luckily he is far better at comedy than standing up. Aaron has appeared on A-Z Horror Stories (Sky Studios), Russell Howard Hour (Sky), Undeniable (Comedy Central) and Guessable (Comedy Central) and has been heard on BBC Radio 4, BBC Radio 1 and BBC Radio Scotland. Aaron offers sharply-observed comedy which is grounded in his disability, but is by no means limited by it.

Aaron performed his critically-acclaimed debut shows, Disabled Coconut and Hot Wheels, at the Edinburgh Fringe in 2019 and 2022. He was an Amused Moose Comedy Award Best Show finalist and was nominated for Best Comedy Show in the Broadway World UK Edinburgh Fringe Awards in 2019. He also performed a work-in-progress show, Aaron Simmonds And The Person That He Loves, at the 2018 Edinburgh Fringe.

To his core, Aaron is a circuit comedian and performs at Comedy Clubs across the country, performing at the UK’s top nights such as The Comedy Store,Just The Tonic, Screaming Blue Murder, Glee and many more.

Kimberley Wilson

Chartered psychologist Kimberley Wilson is a governor of the Tavistock and Portman NHS Mental Health Trust and a former chair of the British Psychological Society Training Committee in Counselling. She authored How to Build a Healthy Brain, named by critics a practical manual for the brain and something to help understand mental health on a deeper level. Kimberley also led the therapy service at HMP & YOI Holloway.Kimberley believes the way we think about mental health – as separate from physical health – is flawed. Her philosophy of Whole Body Mental Health is a comprehensive approach to mental health care; integrating evidence-based nutrition and lifestyle factors with psychological therapy. Her degree in nutrition informs her approach of looking at the roles food and lifestyle play in our mental health, including disordered eating and the gut-brain axis and our emotional relationship with food.Passionate about the power of psychology to transform lives, Kimberley is committed to demystifying the theories and putting the information into the hands of the people who need it through social media, podcasts, television appearances, live events and regular appearances on expert panels.Kimberley hosts the podcast Made of Stronger Stuff alongside Dr Xand van Tulleken on BBC Radio 4. Its unique approach takes the pair on a journey around the human body exploring a different body part in-depth in each episode, asking what it can tell us about our innate capacity for change.

Workshop hosts

.jpg)

Workshops

Workshops

Investing for income in an inflationary world

Against a changing macro backdrop that has seen interest rates and inflation rise significantly, we see the dividend landscape in Europe as an attractive hunting ground for returns going forward. The abrdn Europe ex UK Income Equity Fund is well positioned to navigate multiple economic scenarios through its balanced approach.

Workshop Objectives:

1) Show that European equity income can help clients in an inflationary environment.

2) Provide insight into the long-term attractions of European Equities.

3) Overview of abrdn’s successful approach to European Equity income investing

Company Profile: We invest to help our clients create more. More opportunity. More potential. More impact. We offer investment expertise across all key asset classes, regions, and markets so that our clients can capture investment potential wherever it arises. By combining market and economic insight with technology and diverse perspectives, we look for optimal ways to help investors navigate the future and reach their financial goals. And by putting environmental, social and governance (ESG) considerations at the heart of our process, we seek to find the most sustainable investment opportunities globally.

Speakers

Tom Dorner

Investment Director

Tom Dorner joined abrdn in 2014 as an Investment Director in the European Equity team. He manages the abrdn Europe ex UK Equity Income fund and has previously managed a number of other equity strategies. He is the European Research Lead responsible for maintaining excellence in the team's research. Previously he was an analyst specialising in the European Insurance sector at Citi and Lehman Brothers. He qualified as a Chartered Accountant with Ernst & Young and graduated with a MA Philosophy from the University of Nottingham.

Stuart Brown

Investment Director

Stuart joined abrdn in 2013 and is an Investment Director on the European Equity team. He manages the abrdn Europe ex UK Income Equity fund and has managed a number of other European equity strategies. Stuart has broad experience as a European equity analyst, with expertise covering Utilities and Energy, having also covered Industrials and Consumer sectors.

Representatives

Fergus McCarthy

Head of UK Investments Wholesale

Fergus is the Head of UK Wholesale Distribution, Investments for abrdn. In this role Fergus is responsible for the design and execution of the UK Wholesale Investments strategy. Fergus and his teamwork with Wealth Managers, Advisers, Ratings Agencies, Banks, and our external and internal strategic business partners in the UK. Fergus joined abrdn in 2019 from BNY Mellon Investment Management where he was Head of UK & Ireland Intermediary Sales.

Gary Anderson

Director of Business Development

Gary Anderson is a Director of Business Development at abrdn. Gary is responsible for client relationship management as well as building new business development in both the advisory and discretionary market in Scotland, Northern Ireland and north of England. Gary joined the company in 2015 from Barclays Wealth Management where he worked and Investment Services Manager.

UK Equities – investment opportunities in a new interest rate paradigm.UK Equities – investment opportunities in a new interest rate paradigm.

With interest rates set to be at a higher level than UK investors have been use to for the last 15 years, what opportunities that does this create? Set against a backdrop of higher inflation and less ‘cheap money’ from central banks it’s a new paradigm which offers great potential for active, experienced stock pickers.

Workshop Objectives:

• Gain an understanding of Ed’s outlook

• Understand how interest rates could impact returns from UK equities

Company Profile: Artemis is a leading UK-based fund manager, investing in the UK, Europe, the US and around the world. The firm opened for business in 1997 and manages some £25.8 billion* across a range of funds, two investment trusts and both pooled and segregated institutional portfolios. A number of these are now available to investors in continental Europe and Singapore. Independent and owner-managed, Artemis’ aim has always been to offer exemplary performance and client service. All Artemis’ staff share these two precepts – and the same flair and enthusiasm for fund management. *Source: Artemis as at 31 January 2023

Speakers

Ed Legget

Fund manager

Ed joined Artemis in December 2015 to manage Artemis‘ ‘UK Select‘ strategy and also co-manages Artemis‘ ‘high income‘ strategy. He graduated in manufacturing engineering from Cambridge and began his career in asset management at Standard Life Investments (SLI) in 2002. There he managed several UK equity funds, including the SLI UK Equity Unconstrained Fund. Ed is a CFA charterholder.

Representatives

Jonny Braithwaite

Sales Director, North England, Scotland

Jonny joined Artemis in September 2021 as a Sales Director, responsible for intermediary sales and relationships in the North of England, Scotland, Northern Ireland and the Isle of Man. He was previously with LGIM for two years focused on advisory and discretionary clients across the North of England. Before LGIM, Jonny spent five years as Business Development Director at Aviva Investors and eight years at Aviva. Jonny holds the Investment Management Certificate.

Adam Gent

Head of Intermediated Business

Adam joined Artemis in August 2020 as Head of Intermediated Business with responsibility for wholesale sales channels across the UK and European markets. Adam began his career in asset management in 2000 at Thesis Asset Management as a discretionary wealth manager. In 2005 he moved to Henderson Global Investors as Southern Sales Manager before joining Legg Mason Global Asset Management in 2007, heading the UK Sales business from 2010. Next Adam joined Allianz Global Investors, where from 2017 he was Managing Director and Head of Northern European Retail/Wholesale Distribution.

Adam joined Artemis in August 2020 as Head of Intermediated Business with responsibility for wholesale sales channels across the UK and European markets. Adam began his career in asset management in 2000 at Thesis Asset Management as a discretionary wealth manager. In 2005 he moved to Henderson Global Investors as Southern Sales Manager before joining Legg Mason Global Asset Management in 2007, heading the UK Sales business from 2010. Next Adam joined Allianz Global Investors, where from 2017 he was Managing Director and Head of Northern European Retail/Wholesale Distribution.

Home of the Brave

Since 2020, we have experienced two distinct periods of dislocation, one up and one down. The market is noisy, but the fundamental opportunities for public and private companies remain significant. Join us to discuss how we sift through the noise and why we believe it pays to be brave when investing in US markets.

Workshop Objectives:

- Why should you still be excited about the growth opportunities in the US?

- How are companies adapting to a changed investment environment?

- How we value our private holdings.

Company Profile: Baillie Gifford & Co is a leading, UK based investment management firm, established in 1908. We are an independent partnership, with a culture underpinned by an enviable record of stability. Our investment teams manage specialist, concentrated global and regional equities, fixed income and multi-asset portfolios. We have a growth bias, and use fundamental analysis and proprietary research to construct portfolios from the bottom up. We manage US$280bn (as at 30 June 2022) / €268bn (as at 30 June 2022) in assets on behalf of a worldwide client base. We have an established institutional client base across Europe in specialist global and regional equity strategies, and fixed income.

Speakers

Kirsty Gibson

Investment Manager

Kirsty joined Baillie Gifford in 2012 and is an Investment Manager in the US Equity Growth Team and is involved in running the North American portfolio of the Managed Fund and Global Core Fund since 2021. Prior to joining the US Equity Growth Team, Kirsty also spent several years in the small and large cap global equities departments. Kirsty graduated MA (Hons) in Economics in 2011 and MSc in Carbon Management in 2012, both from the University of Edinburgh.

Representatives

Chris Whittingslow

Director

.jpg) Chris joined Baillie Gifford in 2013 and is Director in the Clients Department, with responsibility for intermediary client relationships in South West England, South Wales and the Channel Islands. He has been involved with collective investment vehicles for many years on both the buy and the sell side, focusing on Investment Trusts whilst at Canaccord and latterly Cantor Fitzgerald where he was Managing Director, Investment Company Sales. Chris is an Economics graduate and a Fellow of the Chartered Institute of Securities and Investment.

Chris joined Baillie Gifford in 2013 and is Director in the Clients Department, with responsibility for intermediary client relationships in South West England, South Wales and the Channel Islands. He has been involved with collective investment vehicles for many years on both the buy and the sell side, focusing on Investment Trusts whilst at Canaccord and latterly Cantor Fitzgerald where he was Managing Director, Investment Company Sales. Chris is an Economics graduate and a Fellow of the Chartered Institute of Securities and Investment.

Harry Driscoll

Client Service Manager

.jpg) Harry is a client service manager and a member of the UK intermediary sales team. He joined Baillie Gifford in 2020. Prior to joining Baillie Gifford, Harry spent nine years as a fund research analyst. Harry is a CFA charter holder.

Harry is a client service manager and a member of the UK intermediary sales team. He joined Baillie Gifford in 2020. Prior to joining Baillie Gifford, Harry spent nine years as a fund research analyst. Harry is a CFA charter holder.

It’s quality o'clock for equity investors

In light of the sharp rise in interest rates, many investors had a challenging year in 2022. Looking ahead for the rest of this year and into 2024, are there better prospects? According to FP Carmignac Global Equity Compounders, the key to successful equity investments is to identify companies that can compound their earnings over a long period. However, navigating the changing economic landscape requires a focus on selecting quality companies, along with adjusting the portfolio's cyclicality throughout the economic cycle.

Workshop Objectives: Obe Ejikeme will emphasise the importance of robust fundamentals, while also being aware of the business & economic cycle . He will clarify the concept of compounder and discuss how he modify the portfolio's cyclicality to manage risks and seize long-term opportunities in a global portfolio.

Company Profile: Carmignac is an independent asset management firm established in 1989 on three core principles that still stand true today: entrepreneurial spirit, human-driven insight and active commitment.

With a capital entirely held by the family and staff, Carmignac is now one of Europe’s leading asset managers, operating from 7 different offices. Today, as throughout our history, we are committed to try harder and better to actively manage our clients’ savings over the long-term.

Speakers

Obe Ejikeme

Fund Manager

Obe Ejikeme is a Fund Manager within the Cross Asset team. Obe joined Carmignac in 2014 as Quantitative Equity Analyst . He started his career in 2003 at FactSet Research Systems as a Senior Consultant. Then, he worked for seven years at Bank of America Merrill Lynch where he was Head of European Equity and Quantitative Strategy. Obe holds a Bachelor degree in Computer Science from the University of Hull.

Representatives

Edward Aram-Dixon

%20(1)%20(1).jpg)

Ed joined Carmignac in 2019 to help build client relationships in the intermediary and wholesale space. Prior to Carmignac, Ed worked at Schroders managing relationships with life companies, platforms, networks and rating agencies. Before that, he worked at Citywire where he was Head of Ratings and Research Sales. Ed graduated from UCL in 2009 and holds the IMC (Level 3), IAD (Level 4) and CFA Certificate in ESG Investing.

Sophia Sednaoui

Business Development Director

%20(1).jpg)

Sophia joined Carmignac in March 2018 and works closely with intermediary accounts, including private banks, family offices and wealth managers. She previously worked for J O Hambro Capital Management where she was on the European Business Development Team. Prior to that, Sophia worked for Korn Ferry in Hong Kong where she was responsible for Private Banking and Asset Management clients. She graduated from Bristol University with a BA(Hons) in French and German, and holds the IMC.

Active stock selection in US Small Caps: aiming for predictable and consistent returns in turbulent times

The US equity market is having to contend with the twin issues of high inflation and slowing growth. To deal with the inflation problem the Fed is rapidly tightening financial conditions by aggressively raising interest rates and unwinding its vast balance sheet. In order to navigate these difficult conditions, a truly active approach that can discern between the winners and losers in this environment is as important as ever.

Hear how our team adds value through the cycle using a process that opens up the entire small cap investment universe and that aims to deliver predictable and consistent returns for investors. We will explain how the fund has historically navigated different market environments using a concentrated, fundamental bottom-up approach which predominantly derives alpha from stock selection and how we view the outlook for US small caps.

Workshop Objectives

- Understand the macroeconomic backdrop for US small cap stocks

- Understand what sectors make up the small cap market

- How is ESG factored in when managing US small caps

Company Profile

Investing smarter for the world you want

At Columbia Threadneedle Investments, we invest to make a difference in your world, and the wider world. Millions of people rely on us to manage their money and invest for their future; together they entrust us with £485 billion. Whatever world you want, our purpose is to help you achieve it. We do this by being globally connected, intense about research, having a responsible ethos and a focus on continuous improvement.

Source: Columbia Threadneedle Investments as of 31 December 2022.

Speakers

Nicolas Janvier

Head of US Equities EMEA

Nicolas leads the London-based team that manages a significant US equities franchise as well as managing several US equity strategies. He has been with the company for 20 years, working as a US equities portfolio manager in both our US and London offices. This included working as a portfolio manager with the Private Bank at Bank of America before moving within the business to Columbia Management in 2006, where he spent eight years in our New York office as a portfolio manager focusing on US mid and small cap companies. Nicolas moved to the London office in 2014.

Louis Ubaka

Deputy Portfolio Manager

Louis focuses on the EMEA US Small-Mid Cap strategy. He joined the London-based US Equities team in July 2021. Prior to joining Columbia Threadneedle, Louis was employed as a Fund Manager’s Assistant on the European Equities team at Schroders in London. Prior to Schroders, he was a Fund Manager’s Assistant on the Multi-Asset Fund of Funds team at Sarasin & Partners. Louis has a BA in Business Management from Middlesex University, holds the Investment Management Certificate and has obtained the Chartered Financial Analyst designation.

Representatives

Richard Borthwick

Head of UK Regional Sales

Richard joined the company in 2014 as a Regional Sales Manager in the UK Sales team, becoming Head of UK Regional Sales in 2023.

Richard has over 15 years’ experience in the asset management industry having previously been a Regional Sales Manager at AEGON Asset Management (then Kames Capital).

Richard graduated from the University of Edinburgh with an MA Hons degree in English and History. He also holds the Investment Management Certificate and the CFA Certificate in ESG Investing.

Jonathan Feely

Regional Sales Manager

Jonathan Feely joined the company in 2007 as a Regional Sales Manager in the UK Sales team. He is currently responsible for relationships with discretionary wealth managers, IFAs and fund of fund managers in Scotland, Northern Ireland, Republic of Ireland and the North of England.

Jonathan has over 20 years’ experience in the financial services industry having previously been a Regional Sales Manager at Friends Provident and Scottish Widows in London. In these roles he engaged with key advisory firms as well a strategic partners.

Jonathan has the CII Level 4 Diploma in Financial Planning (DipPFS) and is a PFS member, he also holds the Investment Management Certificate and CII Level 4 Certificate in Discretionary Investment Management. He is currently studying for the CFA Certificate in ESG Investing.

Federated Hermes: Seeking contrarian opportunities in Asia ex-Japan and Chinese equities

Interest rate and inflation expectations have taken a downward turn following a prolonged ‘goldilocks’ period. Asian economies are facing pressure from the global slowdown, however China is in a different economic and policy cycle compared to other major economies. Rising market volatility and the shift from a ‘narrative-based’ investment approach presents opportunities to stock pickers and long-term investors navigating this new environment. Against this backdrop, investors need to adopt a balanced and clear-eyed assessment of any potential risks. Join Sandy Pei, Deputy Portfolio Manager to discuss the opportunities she sees as a contrarian investor in both Asia Ex- Japan and Chinese Equities.

Workshop Objectives:

- Since the lifting of zero covid policy in China, what has been happening on the ground and what are the implication of resurfacing geopolitical tensions ?

- Is it worth taking the risk of investing in china?

- Why it makes sense to invest in Korea, a cyclical market with poor track record of corporate governance when global economy is slowing down ?

- What are the cheapest and most expensive parts of Asia ex Japan?

- What are the biggest long term growth opportunities across the regions?

Company Profile: Federated Hermes is guided by the conviction that responsible

investing is the best way to create long-term wealth. We provide specialised capabilities across equity, fixed income and private markets, in addition to multi-asset strategies and liquidity-management solutions. Through pioneering stewardship services, we engage companies on strategic and sustainability concerns to promote investors’ long-term performance and fiduciary interests. Our goals are to help individuals invest and retire better, help clients achieve better risk-adjusted returns, and to contribute to positive outcomes in the wider world.

Speakers

Sandy Pei, CFA

Deputy Portfolio Manager, Asia ex-Japan and China Equity Fund

Sandy re-joined Federated Hermes Limited in July 2013 as a senior analyst responsible for idea generation for the Asia ex-Japan strategy; she became deputy portfolio manager of the strategy in July 2014. She joined from Ninety One, where she was part of a two-person team dedicated to managing the Ninety One Asia ex-Japan Equity Strategy. Sandy was previously an analyst at Federated Hermes Limited for the

Federated Hermes Global Emerging Markets team between 2009 and 2011. She holds an MSc in Quantitative Finance from the Cass Business School and a BSc in Economics from University College London. Sandy is a CFA charterholder and is a native Mandarin speaker.

Representatives

Neil McHaffie

Director, Distribution, UK & Ireland

Neil joined in March 2019 to focus on the development of UK regional clients, mainly in the north of the UK. He brings with him a wealth of experience having been in financial services for more than 20 years. Most recently, Neil was working with Carmignac in the development of their regional business, working with Discretionary Wealth Managers and Financial Advisers. Neil holds the Chartered Financial Planner and Investment Management Certificate qualifications.

Shanta Nathan

Director, Distribution, UK & Ireland

Shanta joined in September 2022 and is responsible for the distribution of the fund range to the UK Wholesale market in the of South of England. Prior to joining, Shanta spent 10 years at Polar Capital, where he was responsible for building out the Wholesale channel in South England, South Wales & Ireland, for both closed and open-ended funds. He joined Polar Capital in 2012 where he worked in the Investor Relations & Client Services Teams before moving to Sales in 2018. Shanta holds a BSc in Marketing from University of Newcastle and also holds the CFA UK Level 4 Diploma in Investment Management (ESG).

Global Value and the Global Grid: Opportunities in Factors and Themes

First Trust is committed to exploring investment opportunities in this ever-changing global market. The presentation will dive into the factor (Global Value) and theme (Global Smart Grid) that we believe have attractive long-term growth expectations.

First Trust will explain the concept of factors and themes and how they help identify investment opportunities. We will define the multi-decade investment opportunity presented by cheap dividend stocks and how the Smart Grid offers a ‘value’ opportunity to access the megatrend of the energy transition.

Join us for an engaging and informative presentation designed to help you navigate the ever-evolving global market with ease.

Workshop Objectives: Highlight the significance of diversification in an investment portfolio and how factors and themes can be used to achieve this goal.

Discover how two ETFs have the potential to add hundreds of attractive companies, underrepresented in the average portfolio.

Company Profile: First Trust is a privately owned U.S. based financial services firm established in 1991. Our mission and approach are simple. We aim to offer investors a better way to invest by providing transparent and innovative solutions - through knowing what we own, investing for the long term, employing discipline and rebalancing our portfolios. Today First Trust is one of the fastest growing global ETF providers and as at the end of December 2022 has $190.452 Billion global assets under management and supervision.

Speakers

Gregg Guerin

Senior Product Specialist

Prior to working in London, Gregg was a member of the First Trust Institutional Team. Gregg is a graduate of the Booth School of Business where he received an MBA from the University of Chicago with concentrations in Finance, Economics, and International Business. While there he studied the Efficient Market Hypothesis, its known anomalies and Behavioural Finance. Thus, he is especially equipped to discuss, present and educate the market regarding a plethora of related topics, including the currently popular and confusing term “Smart Beta.” In fact, Gregg taught a course at his alma mater, Wheaton College, entitled The History and Relevance of the Stock Market. He has been immersed in the ETF industry for over 10 years and sees tremendous growth potential for the ETF market here in the UK and European markets. Gregg is passionate about Innovation and Exponential Technologies and the benefits of Thematic Investing.

Representatives

James Wright

Vice President

James is a Senior Sales Associate at First Trust and has been with the company for 5 years handling ETF distribution in the UK and Northern Europe. Previously he worked at an investment brokerage in the city of London working specifically within structured tax products and private bond markets. James holds a BA Hons in Classics & Ancient History from King’s College London.

Charlie Collins

Sales Associate

Investing in infrastructure for a better future

Infrastructure is the backbone of society, providing essential services for economic growth and supported by the multi-decade secular trends of energy transition and digitalisation. Operating in industries with high barriers to entry and supported by regulation and/or take-or-pay contracts, infrastructure exhibits resilient and inflation-hedged earnings growth, defensive cash flow characteristics, and above average yields making it an attractive proposition for investors.

We believe the long-term nature of infrastructure assets and cash flows are best suited to bottom-up, fundamental analysis. Our philosophy recognizes that not all infrastructure assets are the same. As such, we focus on core infrastructure assets; that is, assets with lower volatility of cash flows and higher expected risk adjusted long term returns. We implement an analysis framework that combines a comprehensive quality assessment and a long-term value-based investment approach.

Workshop objective:

• Outline the growth of global listed infrastructure (GLI)

• Identify the benefits of investing in GLI

• Highlight HSBC AM’s Listed Infrastructure Equity team’s focus on core infrastructure and their robust investment process to deliver strong long-term outcomes for investors

Speakers

Giuseppe Corona

Head of Listed Infrastructure Equity

Giuseppe Corona is the Head of Listed Infrastructure Equity at HSBC Asset Management, based in the London office. He joined the financial industry in 1999 and began portfolio management across long only and long/short products in 2008. Prior to joining HSBC Asset Management, Mr Corona spent ten years in AMP Capital’s Global Listed Infrastructure Team where he was appointed Head of Global Listed Infrastructure in 2016. Mr Corona moved to HSBC Asset Management in March 2022, alongside the rest of the AMP Capital Global Listed Infrastructure team, to launch its Listed Infrastructure Equity capability. Previously, he spent two years at Exane-BNP Paribas as a senior equity analyst covering multi-utilities and infrastructure companies, one year in Switzerland, managing a long/short market neutral portfolio at Swan, a small investment boutique, and nine years at Bear Stearns Asset Management in the US where he was appointed Managing Director in 2006. While at Bear Stearns he played an integral part in managing a US large cap value fund and a European long/short hedge fund. Mr Corona holds a Bachelor of Economics and Business Administration from the University of Palermo in Italy and a Master of Business Administration in International Finance from St. John's University in Italy. He is also a CFA Charterholder.

Representatives

Simon Page

Director, Business Development

Simon Page, Director, Business Development has worked at HSBC Global Asset Management since 2011 and covers the North and Scotland, looking after Wealth Managers and Discretionary Fund Managers. He holds the Diploma in Financial Planning, the Certificate in Discretionary Investment Management and the Certificate in Investment Operations.

.png)

Europe: Meaningfully misunderstood?

After a very difficult few years with Brexit followed by the Covid pandemic, the negative headlines for Europe continued with Russia’s invasion of Ukraine. As a result, many European companies are trading on attractive valuations and at significant discounts to their counterparts in the US.

Blake Crawford will outline why he feels that the European equity market deserves investor focus, where there are attractive opportunities and how active management will be key to navigating whatever macro challenges may present themselves in the future.

Workshop Objective: To provide participants with the key reasons as to why we believe that European equities should be considered as an asset class which offers attractive opportunities for the long term investor.

Speakers

Blake Crawford

Executive Director, Porfolio Manager

Blake Crawford, Executive Director, is a portfolio manager within the J.P. Morgan Asset Management International Equity Group, based in London. An employee since 2008, Blake joined the firm as a graduate trainee. Blake obtained a BSc in Economics from the University of Bath and is a CFA charterholder.

Representatives

Michael Dinwoodie

Executive Director

Michael Dinwoodie, Executive Director, is a Client Advisor for Scotland, Northern Ireland & N.E. England. He has over 18 years' experience in asset management holding a number of roles across distribution at Standard Life Investments/Aberdeen Standard Investments. He joined J.P. Morgan in August 2019. Michael lives in Edinburgh, is a keen follower of most sports, in particular Rugby, and has a passion for gastronomy.

Are you running too much of a home bias in your fixed income allocations?!

Many investors have accepted that it makes sense for the home bias to be reduced within their equity buckets, with the trend from UK equities towards global equities being played out for many years, the implication here being investors have accepted there are better opportunities outside the UK. But that trend hasn’t played out in fixed income markets, with investors still preferring from a strategic perspective a big overweight to the home market: we will be exploring – perhaps unintended – risks to holding UK assets at the moment, as well as dealing with some of the myths with going beyond the UK. We believe you can get a similar total return profile, but with more diversification, by thinking with a truly global lens and will hence give our views on opportunities and outlook for fixed income markets as a whole.

Workshop Objectives: Learn about (i) unintended risk creeping in by maintaining a large home bias within fixed income (ii) currency hedging costs and implications (iii) diversification benefit (iv) opportunities beyond UK.

Company Profile: Mirabaud Asset Management is part of a private owned partnership, originally founded in 1819. We provide a range of investment solutions to Institutional and Wholesale investors in the UK and Europe. Our investment capabilities cover domestic equities in Europe, including the UK, alternatives and fixed income, encompassing multi-asset credit, high yield and emerging market debt. A common philosophy applies across each of these areas of expertise, which is an active, high conviction approach to generating long term risk adjusted returns. A focus on managing risk and a commitment towards environmental, social and corporate governance principles are important constituents of our heritage.

Speakers

Al Cattermole

Portfolio Manager & Global Credit Analyst

Al joined Mirabaud in November 2013 from Goldbridge Capital Partners where he was responsible for corporate credit research. Al has previously covered global corporates at JP Morgan Asset Management and ECM, having started his career at the Bank of England in 2004.

Al is a CFA Charterholder and has a BA in Economics from the University of Durham.

Representatives

Benjamin Carter, PhD

Head of UK Wholesale

Benjamin Carter, Head of UK Wholesale, joined Mirabaud Asset Management in 2021. Benjamin, who has a decade of experience within the financial services industry, joined from Aviva Investors where he was a Senior Business Development Director and responsible for setting the discretionary strategy, as well as lead of the London team. He started his investment career as a product specialist for the Aviva Investors global convertibles capability in 2012.

Elliot Fowles

UK Wholesale Sales

Elliot Fowles, UK Wholesale Sales, joined Mirabaud Asset Management in 2022. Elliot, who has nearly thirty years of experience in

the industry, joined from Aviva Investors where he spent the last ten years as Senior Business Development Director. Prior to this, he held sales positions at HSBC Global Asset Management and DWS Investments, among others.

Why Resilience Matters

Managed by MSIM’s International Equity Team with a 25 year+ track record in running quality equity portfolios, we are delighted to present American Resilience, our latest fund launch.

American Resilience is a concentrated portfolio of 20-50 high quality North American stocks. The combination of the portfolio companies’ good visibility of earnings, pricing power and recurring revenues, aims to provide clients with resilience when it is needed most. By seeking out companies with strong market positions underpinned by powerful, hard to replicate intangible assets, the Fund aims to compound shareholder wealth over the long term. Given concerns about the market’s earnings as well as persistent inflation, the case for enduring quality and resilience is more compelling than ever.

Workshop Objectives:

To understand the following:

Why does resilience matter?

Why American Resilience?

Why invest with the Morgan Stanley International Equity team?

Company Profile: Morgan Stanley Investment Management (the Firm) brings innovative, highly relevant solutions to investors across the globe. Our unwavering commitment to investment excellence, diversity of perspective, and differentiated values help us to deliver innovative solutions and a suite of value-added services to our clients.

Established in 1975, the Firm has provided client-centric investment and risk-management solutions to a wide range of investors and institutions for more than 40 years. Our investment teams strive to provide strong investment performance, excellent client service and a comprehensive suite of investment management solutions to a diverse client base, including governments, institutions, corporations and individuals worldwide.

In March 2021, Morgan Stanley completed the acquisition of Eaton Vance, including its market-leading affiliates Calvert Research and Management and Parametric Portfolio Associates LLC, allowing the Firm to bring even more value to clients through an expanded array of diverse and complementary investment offerings across public and private markets.

Speakers

Richard Perrott

Richard is a portfolio manager for the London-based International Equity team. He joined Morgan Stanley in 2015 and has 17 years of industry experience. Prior to joining the team, Richard was an equity research analyst at Autonomous Research covering specialty financials. Before that Richard covered financials at Berenberg Bank and financials and healthcare at Sanford Bernstein. Richard received an M.A in Mathematics and Philosophy from St Edmund Hall, Oxford.

Candida De Silva

Candida is a senior portfolio specialist and member of the International Equity team. She joined Morgan Stanley in August 2019 and has 19 years of investment industry experience. Candida spent 11 years at BlackRock most recently as Head of the UK Charities & Endowments business, having previously served as Head of EMEA Retail Marketing. Prior to BlackRock, Candida was Executive Director at Goldman Sachs Asset Management following four years at Mellon and its subsidiary Newton Investment Management.

Candida is a senior portfolio specialist and member of the International Equity team. She joined Morgan Stanley in August 2019 and has 19 years of investment industry experience. Candida spent 11 years at BlackRock most recently as Head of the UK Charities & Endowments business, having previously served as Head of EMEA Retail Marketing. Prior to BlackRock, Candida was Executive Director at Goldman Sachs Asset Management following four years at Mellon and its subsidiary Newton Investment Management.

Representatives

Harvey Lewis

Vice President, UK Sales

Harvey is a member of the UK Intermediary Distribution team at Morgan Stanley Investment Management. He joined Morgan Stanley full time in 2015, having interned in 2014, and has 8 years of industry related experience. Harvey received a B.A in Economics and Politics from the University of Nottingham and holds the Investment Management Certificate (Level 6).

Daniel Hawkes

Executive Director, UK Sales

Daniel is a member of the UK Intermediary Distribution team at Morgan Stanley Investment Management. He joined Morgan Stanley in 2015 and has 23 years of related industry experience. Prior to joining MSIM, Daniel worked at Columbia Threadneedle Investments for 11 years and both Cofunds and Fidelity before that. Daniel holds a degree in Criminology and Criminal Justice from the University of Wales, Bangor and holds the Investment Management Certificate (IMC) Level 6.

Diversified Commodities: More than just an inflation play?

Commodities are an offensive diversifier in the sense that, historically, when inflation became a threat, they have reliably outperformed all other major assets. With inflation concerns no longer at the forefront, what role can commodities play in portfolios? In this session we will explore the characteristics of different approaches of commodity investing and the potential offered by diversified commodities to benefit from the green transition of the global economy.

Workshop objective: To understand some of the core properties of direct commodities and the role they can play in portfolios, particularly in the green transition

Company Profile: Neuberger Berman, founded in 1939, is a private, independent, employee-owned investment manager. The firm manages a range of strategies—including equity, fixed income, quantitative and multi-asset class, private equity, real estate and hedge funds—on behalf of institutions, advisors and individual investors globally. With offices in 26 countries, Neuberger Berman’s diverse team has over 2,600 professionals. For eight consecutive years, the company has been named first or second in Pensions & Investments Best Places to Work in Money Management survey (among those with 1,000 employees or more). Neuberger Berman is a PRI Leader, a designation, since last assessed, that was awarded to fewer than 1% of investment firms for excellence in Environmental, Social and Governance (ESG) practices. In the 2021 PRI Assessment, the firm obtained the highest possible scoring for its overarching approach to ESG investment and stewardship, and integration across asset classes. The firm manages $427 billion in client assets as of December 31, 2022.

For more information, please visit our website at www.nb.com.

Speakers

Hakan Kaya, PhD

Managing Director

Hakan Kaya, PhD, Managing Director, joined the firm in 2008. Hakan is a Senior Portfolio Manager on the Quantitative and Multi-Asset Strategies team responsible for Global Risk Balanced Portfolios and Commodities. He contributes to asset allocation research with a focus on risk management and has a record of publishing research in both refereed journals and white papers on timely investment issues. Prior to joining the firm, he was a consultant with Mount Lucas Management Corporation where he developed weather risk and statistical relative value models for commodities investment. Dr. Kaya received BS degrees summa cum laude in Mathematics and Industrial Engineering from Koc University in Istanbul, Turkey and holds a PhD in Operations Research & Financial Engineering from Princeton University

Representatives

Ollie Meyer

Vice President, Relationship Manager

Ollie Meyer, Vice President, joined the firm in 2018. Ollie is a Relationship Manager with the EMEA Client Group, with specific focus on financial institutions and intermediary clients across the United Kingdom. Prior to this, Ollie worked as a relationship manager at Western Asset Management.

Jonathan Geoghegan

Senior Vice President, Relationship Manager

Jonathan Geoghegan, Senior Vice President, Relationship Manager, joined the firm in 2015 as part of the UK Financial Institutions and Intermediaries client group. Jonathan contributes towards the continued growth of the Neuberger Berman intermediary business; specifically focusing on broadening and deepening relationships across UK and global private banks, asset managers, family offices, wealth managers and multi managers. Jonathan has over 20 years’ industry experience; he previously held a position at HSBC Global Asset Management for six years as Senior Relationship Manager, responsible for Financial Institution distribution relationships. Prior to this, Jonathan held similar positions at Architas Multi Managers, Invesco Perpetual and Schroders.

Introduction to the Nordea Global Climate & Social Impact Strategy

The strategy was launched in 2021 to enable the transitioning towards an Inclusive Green Economy. It selects companies that have the ability to generate positive Environmental and Social impacts via their solutions. It is managed by the same portfolio managers and a sister-product of the multibillion Global Climate and Environment strategy that has an outstanding 15-years track-record. Leveraging on the portfolio managers’ climate expertise and risk management experience, this relatively new strategy allows investors to participate in the opportunities arising from this transition, where it aims to deliver attractive returns by investing in businesses that provide meaningful solutions to meet the most pressing environmental and social needs ¬ – planting the seed for a greener, fairer and more efficient society.

Workshop Objectives: Introduction to the investment philosophy of the strategy. Highlights of the investment opportunity for Social in addition to Climate solutions. Understanding of investment process, universe, impact assessment and return potential.

Company Profile: Nordea Asset Management (NAM, AuM 274bn EUR*), is part of the Nordea Group, the largest financial services group in the Nordic region. NAM offers European and global investors’ exposure to a broad set of investment funds.

Nordea’s success is based on a sustainable and unique multi-boutique approach that combines the expertise of specialised internal boutiques with exclusive external competences allowing us to deliver alpha in a stable way for the benefit of our clients. NAM solutions cover all asset classes from fixed income and equity to multi asset solutions, and manage local and European as well as US, global and emerging market products.

Speakers

Henning Padberg

Portfolio Manager

Henning Padberg has been portfolio manager of the Nordea Global Climate and Environment fund since 2009, the Nordea Global Disruption fund since 2018 and the Nordea Global Climate & Social Impact fund since 2021. He began his career with Nordea Investment Management in 2008 and is part of the Sustainable Thematic team in Fundamental Equities. Henning has held several sector and portfolio management responsibilities over the years. Henning holds an MSc. in Business Management from the University of Münster, Germany.

Representatives

Scott Hardie

Director – UK Sales, Nordea Asset Management

https://www.linkedin.com/in/scott-hardie-7a91a847/

Scott joined the UK Sales team at Nordea AM in May 2016. Prior to joining Nordea he worked for a number of Life & Pension companies in their Fund analysis and selection teams. He holds a BA in Business Management and Economics from Edinburgh Napier University.

Credit Investing 2.0 – Back to the Future

Fixed Income investing has recently been characterised by low yields in the “cheap money” era of ultra-loose monetary policy. Times have changed; an unprecedented tightening cycle has seen carry return to the asset class. The “income“ in Fixed Income is well and truly back. But where we go from here is unclear. The next credit cycle will be marred by increased volatility and an uncertain macro and rates environment. We believe a contrarian and value-driven approach is vital to protecting and appreciating capital in this environment. Capital markets have evolved, and so must the way credit is managed.

Workshop Objectives: How to generate equity-like returns with bond-like volatility: demonstrating that a contrarian, value-driven and nimble approach to credit investing is needed for better risk-adjusted returns.

Company Profile: Pictet Asset Management is an independent asset manager offering investment services around the world. Our key investment capabilities include: Global Thematic Equities, Multi Asset, Emerging Markets Debt, Global Fixed Income (including Strategic Credit) and Alternative Investments. We manage GBP 202 billion in assets as at the end of March 2023. We are convinced that Environmental, Social and Governance considerations can help us make better long-term investment decisions for our clients. For decades, sustainability has been central to our way of thinking. Since the Pictet Group was founded in 1805, we have aimed to ensure the prosperity of our clients over the long term.

Speakers

Jon Mawby

Co-Head of Absolute and Total Return Credit

Jon Mawby joined Pictet Asset Management in 2018 and is Co-Head of Absolute & Total Return Credit. At the time of joining, he was Senior Investment Manager in the Developed Markets Credit team.

Before joining Pictet, he was a Senior Portfolio Manager at ManGLG where he was lead portfolio manager for the unconstrained bonds and investment grade strategies. Jon worked at GLG Partners for 6 years having joined to build out their capability in unconstrained bonds. In a career spanning 18 years Jon has also worked at ECM, Gartmore, Morley (Aviva Investors) and Goldman Sachs primarily managing credit portfolios across the full product spectrum from long only to long/short.

Jon holds a B.A. (Hons), Economics from Durham University and is a CFA Charterholder.

Representatives

Louis Richards

Sales Manager

Louis joined Pictet Asset Management in 2018 and leads business development across Scotland wholesale & advisory firms and Global Financial Institutions. He previously spent four years working in distribution at Janus Henderson Investors.

Louis has a degree in Law from the University of Leeds and holds the Investment Management Certificate (IMC).

Nimo Ibrahim

Sales Officer

Nimo joined Pictet Asset Management in 2021 and following the completion of her rotational graduate programme, joined the UK Intermediaries sales team focussing on UK Wholesale business development. Whilst at university she completed internships at Santander CIB and Natixis CIB.

Nimo holds a Bachelor of Arts in Politics and International Relations from the University of Nottingham and has been awarded the CFA ESG Certificate.

(Fixed) Income is back

2022 needs no introduction. It was one of the worse years on record for fixed income.

We believe 2023 is different. Through our 50 years of bond investing, this is one of the most exciting times we have experienced for the asset class. After years of being starved for income, today’s entry yield levels mean that investors in multi-sector bond strategies can once again aim for attractive income distributions and capital appreciation.

This is what PIMCO’s flagship strategy, the GIS Income fund, is all about. With a 10-year track record of delivering consistent income and strong risk-adjusted returns, the Income fund is that Strategic Bond allocation that takes you through any market environment and helps you go global.

Workshop Objectives: To explain the core considerations for investors looking to allocate to income-generating investment strategies, focusing on multi-sector fixed income.

To highlight PIMCO’s flagship strategy, the GIS Income Fund.

Company Profile: PIMCO is a global leader in active fixed income. With our launch in 1971 in Newport Beach, California, PIMCO introduced investors to a total return approach to fixed income investing. In the 50+ years since, we have worked relentlessly to help millions of investors pursue their objectives – regardless of shifting market conditions. As active investors, our goal is not just to find opportunities, but to create them. To this end, we remain firmly committed to the pursuit of our mission: delivering superior investment returns, solutions and service to our clients.

Speakers

Gordon Harding

Vice President, Fixed Income Strategist

%20(1)%20(1).jpg)

Mr. Harding is a vice president and fixed income strategist in the London office, focusing on multi-sector fixed income strategies. Prior to joining PIMCO in 2019, he was a fixed income specialist at UBS Asset Management. Prior to that, he spent 12 years on M&G Investments. He has 18 years of investment experience and holds an undergraduate degree in economics and public policy from Leeds Beckett University in the U.K.

Representatives

Joseph McCurdy

Vice President, Account Manager - EMEA GWM

Mr. McCurdy is a vice president in global wealth management based in the London office. He is responsible for overseeing the development of PIMCO's business across the U.K. and Ireland, focusing on wealth managers, multi-managers and financial advisers. Prior to joining PIMCO in 2018, he was an investment director at Standard Life Investments. He has 21 years of investment experience and holds an undergraduate degree from the University of Dundee.

Mr. McCurdy is a vice president in global wealth management based in the London office. He is responsible for overseeing the development of PIMCO's business across the U.K. and Ireland, focusing on wealth managers, multi-managers and financial advisers. Prior to joining PIMCO in 2018, he was an investment director at Standard Life Investments. He has 21 years of investment experience and holds an undergraduate degree from the University of Dundee.

Hannah Roberts

Vice President, Account Manager

Ms. Roberts is a vice president and account manager responsible for developing PIMCO’s business across U.K. wealth managers, multimanagers, banks, and financial advisers. She previously worked at PIMCO as part of the institutional account management team, and prior to this she was in the debt capital markets division at RBS in London and New York. She has eight years of investment and financial services experience and is a CFA charterholder.

Why a return to normal could be so painful.

For so long investors and corporates have enjoyed the abnormal period of QE and zero interest rates. That time is behind us and a return to normality, cycles and inflation will break many things. This is a minder that growing wealth slowly, compounding a growing dividend is the more appropriate way to navigate the return to normal.

Workshop Objectives:

- The macro landscape for equities returns post QE

- The importance of dividends as a component of total returns

- The effects of compounding on long term returns

Company Profile: Redwheel is a specialist, independent investment organisation. Our active investment heritage is built on a foundation of innovation, origination and high conviction.

Our business was established in 2000 with a simple ambition: to create an environment in which exceptional fund managers can operate in a manner that allows them to maximise the benefits of their skills over the long-term.

We have always remained true to that ambition. Today, we have more than 150 people aligned to that goal, including 56 dedicated investment professionals working across seven independent investment teams.

There are three key attributes that define who we are:

- Autonomy

- Independence

- Ownership

Speakers

Nick Clay

Portfolio Manager, Redwheel Global Equity Income Strategy

Nick joined Redwheel in 2020 and leads the Global Equity Income team. He has been managing the Global Income Equity strategy since 2012 while at Newton Investment Management where he spent 20 years and managed a variety of global multi asset strategies. He joined Redwheel along with his team from Newton.

Representatives

Mark Stirling

Mark joined Redwheel in April 2011 and is responsible for relationships with discretionary asset managers including banks, private banks, fund of funds, family offices, and private client managers in the UK, Ireland and Channel Islands. He has over 20 years investment sales experience, starting his career at Schroders as a Regional Sales Manager, before moving on to Henderson Global Investors as an Associate Sales Director and more recently as an Account Director at Gartmore.

The Outlook for Asian Markets

After a volatile period for Asian stocks, we will review the drivers of recent market performance and look at the investment outlook for the region following China’s move away from its “zero Covid” policy. We will also discuss our latest view on the IT cycle and the attractiveness of current valuations across the region.

Workshop Objective: At the end of the presentation you should have an appreciation of some of the key issues driving Asian markets, why we are cautious on China and have an understanding of the case for investing in Asian markets.

Speakers

Abbas Barkhordar

Fund Manager, Asia

Abbas is currently a Fund Manager, Pacific Equities having joined the Asian specialist team in July 2020. He joined Schroders in 2007 on the graduate scheme as an analyst on the Emerging Market Equities team.

Prior to this, he was a strategy Analyst for the Global Emerging Markets funds from 2007-2014. This involved specifying and back-testing quantitative models to guide the funds’ asset allocation, as well as producing written research into economic, sector, industry and thematic trends.

Abbas was a Senior Analyst for the Frontier Markets fund since its launch in 2010. Regional coverage included all of Frontier Asia. In addition to equity analysis, the role involved strategy, risk management and significant input into portfolio construction.

Qualifications: Master’s Degree in Physics (MPhys) from Oxford University. CFA Charterholder since 2011.

Representatives

Jamie Fowler

Head of Regional and Advisory Sales

Jamie Fowler is Head of Regional and Advisory at Schroders. He joined Schroders in 2002. Previous to that, Jamie was a Regional Sales Manager at HSBC Asset Management from 1999 to 2002.

Kim Nelson

Head of Scotland and Northern Ireland, Advisory Sales

.png)

Crisis, uncertainty and the era of secular change

Crisis compounded crisis in 2022, with war accentuating the inflationary impact of the pandemic in a way few could have imagined. As the end of the stimulus era becomes an economic reality, will 2023 be shaped by a year of ‘sideways’, or have equity bears finally found their ice age?

Join Laurence Taylor, Global Equity Portfolio Specialist, as he shares our experts’ latest global equity insights and how these are reflected in the T. Rowe Price Global Focused Growth Equity Fund, as well as answer your questions on the global economic environment

Workshop Objective: Understand the consequential implications of the 2022 crises on the current global economic environment

Company Profile: Founded in 1937 during the Great Depression, T. Rowe Price is built on the enduring philosophy of our founder; meeting clients’ individual needs. For over 80 years and through changing investment and economic environments, the core principles that guide our business have remained the same. Today, T. Rowe Price is one of the largest investment firms in the world, managing £1.1 trillion* for clients in 56 countries.

*As at 31 December 2022

Speakers

Laurence Taylor

Portfolio Specialist

Laurence Taylor is a portfolio specialist in the Equity Division. He represents the firm's global equity strategies to institutional clients, consultants, and prospects. Laurence is a vice president of T. Rowe Price Group, Inc., and T. Rowe Price International Ltd.

Laurence’s investment experience began in 1999, and he has been with T. Rowe Price since 2008, beginning in the Investment Specialist Group. Prior to this, Laurence was employed by AXA Rosenberg as a quantitative portfolio manager, with responsibility for global and European equity portfolios, and began his career at AonHewitt Associates in the UK investment practice. At AonHewitt, Laurence provided investment advice to European institutions as a client-facing consultant before specializing in the research and selection of global and regional equity managers in the manager research team

Laurence earned a B.A., with honors, from Greenwich University. He also has earned the Chartered Financial Analyst® designation.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

Representatives

Stephen McCall

Relationship Manager, Scotland, Ireland & North East

Stephen McCall is a relationship manager for Scotland, Northern Ireland and North East. He also is a vice president of T. Rowe Price International Ltd.

Stephen’s investment experience began in 1999 and he has been with T. Rowe Price since 2019. Prior to this, Stephen was employed by JP Morgan Asset Management. Stephen also worked in sales roles with BMO Global Asset Management and Ignis Asset Management.

Tom Johnson

Relationship Manager

Tom Johnson is a Relationship Manager for the UK Intermediary Business. He also is an Associate Vice President of T. Rowe Price International Ltd.

Tom’s Investment experience began in 2016 and he has been with T. Rowe Price since 2021. Prior to this, Tom was employed by AXA Investment Managers working within the Wholesale Distribution Team.