Citywire North Retreat 2023

Welcome to our much-beloved Citywire North Retreat, bringing together the best and brightest in the region’s wealth management and financial advice communities.

We can now look forward to two educational and entertaining days ahead of us filled with fund manager presentations, plentiful networking opportunities as well as entertaining keynote speakers.

Kicking things off on Tuesday morning is Tim Marshall who, with thirty years’ experience in broadcasting, is well-placed to provide a sharp political commentary and analysis of global affairs. The former diplomatic editor and foreign correspondent for Sky News will employ his knack for boiling down big issues, to give us his up-to-the-minute perspective on geopolitics.

After lunch we will revisit one of our most highly rated sessions of 2022. In conversation with Steven Chatterton, Tom Fletcher, foreign policy advisor to three prime ministers, Blair, Brown and Cameron, will consider the 21st century survival skills we need as states, businesses and individuals. In this fully interactive session you will be able to question Tom on a number of subjects, including the nature of leadership and diplomacy in the digital age.

Following dinner, we will be joined by top stand-up comedian Aaron Simmonds.

Come Wednesday morning we will hear from experienced hostage negotiator Suzanne Williams QPM, who has worked on some of the highest profile and dangerous hostage situations across the world. She is a well-known expert in the global security community and her specialist security advice is highly sought after.

Learning Objectives:

- Develop the necessary skills to identify specific geopolitical risk factors.

- Investigate a variety of investment strategies from fund managers across multiple asset classes

- Learn how to achieve professional goals in a high-pressure, stressful environment.

Agenda

08:00 - 09:20

Registration

09:20 - 09:30

Welcome with Katie Gilfillan

09:30-10:30

Conference Session 1 - Tim Marshall

10:30 - 11:00

Fund Group Workshop 1

11:10 - 11:40

Fund Group Workshop 2

11:50 - 12:20

Fund Group Workshop 3

12:20 - 13:40

Lunch

13:40 - 14:40

Conference Session 2 - Tom Fletcher

14:400 - 15:10

Fund Group Workshop 4

15:20 - 15:50

Fund Group Workshop 5

16:00 - 16:30

Fund Group Workshop 6

16:40 - 17:10

Fund Group Workshop 7

19:30 - 20:00

Drinks Reception

20:00 - 23:00

Table Planned Dinner and After Dinner speaker - Aaron Simmonds

09:15 - 10:15

Conference session 3 - Suzanne Williams QPM

10:15 - 10:45

Fund Group Workshop 8

10:55 - 11:25

Fund Group Workshop 9

11:35 - 12:05

Fund Group Workshop 10

12:05 - 13:30

Buffet Lunch

14:00

Event close

Keynote Speakers

Speakers

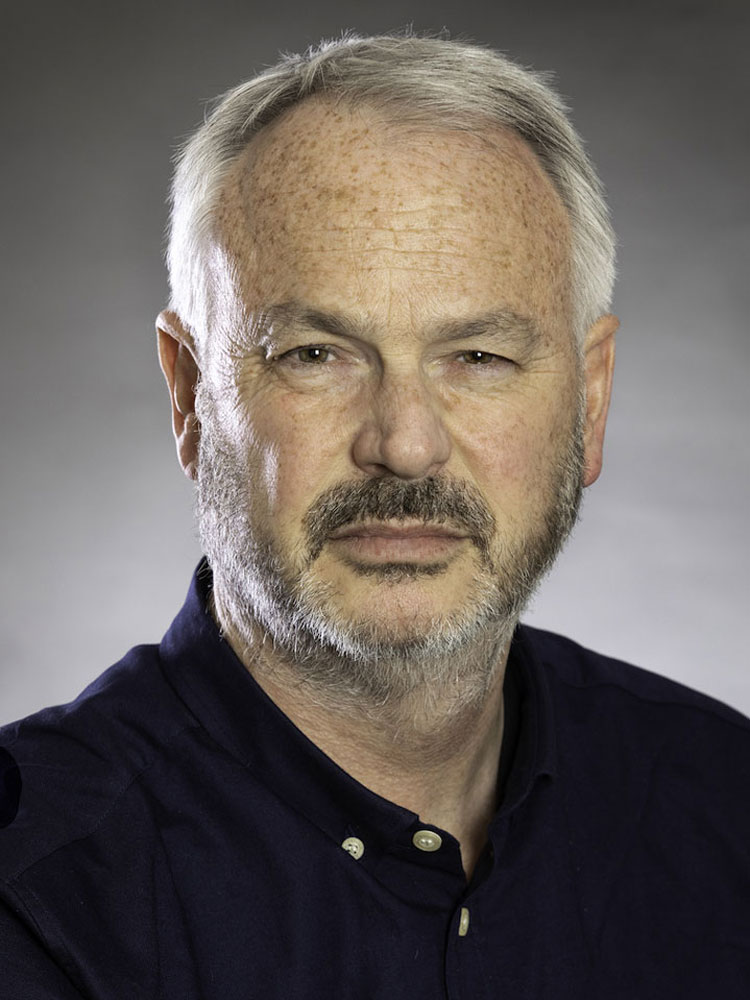

Tim Marshall

After thirty years’ experience in broadcasting, Tim Marshall is well-placed to provide a sharp political commentary and analysis of global affairs.

A generalist who is able to join the dots between specialisms in a wide field, the former Diplomatic Editor and foreign correspondent for Sky News has a knack for boiling down big issues, such as geopolitics and international diplomacy, to broad-brush terms.He has published several critically acclaimed books, including the 2015 New York Times best-seller Prisoner of Geography: Ten Maps That Tell You Everything You Need to Know About Global Politics.

Originally hailing from Leeds, Tim arrived at broadcasting from the road less travelled. He worked his way through newsroom nightshifts, and unpaid stints as a researcher and runner to the news producers. After three years as IRN's Paris correspondent and carrying out extensive work for BBC radio and TV, Tim joined Sky News. Reporting from Europe, the USA and Asia, he became the Middle East Correspondent based in Jerusalem, and his celebrated six-hour unbroken broadcasting stint as ground attack went in during the Gulf War made news reporting history.

Tim reported from the field in Bosnia, Croatia, and Serbia during the Balkan wars of the 1990s. He spent the majority of the 1999 Kosovo crisis in Belgrade, where he was one of the few western journalists who stayed on to report from one of the main targets of NATO bombing raids, and he greeted the NATO troops in Kosovo itself on the day that they advanced into Pristina.

Tom Fletcher

Tom Fletcher was the UK’s youngest ever senior ambassador when he was appointed the country’s representative in Lebanon. Prior to his posting he worked as a foreign policy advisor in Downing Street under three Prime Ministers. As well as lessons from dealing with actors in the uniquely combustible region, he considers the nature of leadership and negotiation, the power of social media, and the future of engagement and education.

Tom’s work has taken him from leading reviews into modernising the UN and the UK Foreign Office to advising the Global Business Coalition for Education (which uses the private sector to help 59 million children into school) and teaching as a Visiting Professor of International Relations in New York University and the Emirates Diplomatic Academy. He has also debated with Hezbollah on Twitter, and job-swapped for a day with a teenage Ethiopian housekeeper to highlight the abuse domestic staff often suffer (she, on the other hand, grilled a senior politician and held a press conference).

Believing more of the world wish to co-operate than build walls, Tom looks at the big picture issues of global power structures. With examples (and anecdotes) from meetings with the likes of Merkel and Obama, Tom considers the importance of three elements of leadership – inspiration and vision, engagement, and implementation. His bestseller Naked Diplomacy: Power & Statecraft in the Digital Age looks at the opportunities and challenges a connected world presents to policy makers, asks whether companies like Google should be treated more like a nation than a business and examines the need to revolutionise education to reflect the advances of a digital world. He considers the effects of new technologies on everything from the Sustainable Development Goals to the threat of lethal autonomous weapons to building a stronger international community.

His book Ten Survival Skills for a World in Flux focuses on how ESG has become essential to how we make sense of human endeavours. Tom details what his experience advising the Prime Minister at G20 meetings and climate conferences taught him about the gap between geopolitics and sustainability, outlining a roadmap to more sustainable living in a post-lockdown world.

Aaron Simmonds

Aaron Simmonds has been failing to stand up for 32 years; luckily he is far better at comedy than standing up. Aaron has appeared on A-Z Horror Stories (Sky Studios), Russell Howard Hour (Sky), Undeniable (Comedy Central) and Guessable (Comedy Central) and has been heard on BBC Radio 4, BBC Radio 1 and BBC Radio Scotland. Aaron offers sharply-observed comedy which is grounded in his disability, but is by no means limited by it.

Aaron performed his critically-acclaimed debut shows, Disabled Coconut and Hot Wheels, at the Edinburgh Fringe in 2019 and 2022. He was an Amused Moose Comedy Award Best Show finalist and was nominated for Best Comedy Show in the Broadway World UK Edinburgh Fringe Awards in 2019. He also performed a work-in-progress show, Aaron Simmonds And The Person That He Loves, at the 2018 Edinburgh Fringe.

To his core, Aaron is a circuit comedian and performs at Comedy Clubs across the country, performing at the UK’s top nights such as The Comedy Store,Just The Tonic, Screaming Blue Murder, Glee and many more.

Suzanne Williams QPM

Suzanne Williams QPM is an experienced hostage negotiator who has worked on some of the most high profile and dangerous hostage situations across the world. This has required negotiating in war zones, on the high-seas with modern pirates, and on behalf of well-known families. She is a visiting lecturer at Harvard University and an Associate Fellow at the University of Oxford’s Said Business School.

Whilst seconded to the FBI Sue became an accredited Hostage Negotiator in the USA, and has contributed to the successful resolution of hundreds of kidnaps and hostage situations on land and the high seas. This has included working on sea hijackings with modern pirates, as well as being deployed in war zones at crucial points to negotiate in very delicate high-risk situations. She has recently undertaken negotiations as a tactic for combating cyber extortion.

Due to her extensive expertise in these areas she is currently called upon to assist and advise many foreign governments, high profile families, organisations and companies experiencing crimes in action and critical incidents involving hostage-taking or extortion.

She is a well-known expert in the global security community and her specialist security advice is highly sought after. She is a visiting lecturer at Harvard University, working with the international aid sector developing crisis plans required for a proportionate and successful response.

Workshop hosts

.jpg)

Workshops

Workshops

Is the future of income emerging?

What comes to mind when you think of income investing? Probably mature companies, legacy industries, developed markets, and low growth. Join us to hear from Matthew Williams, Senior Investment Director as he discusses why investors should consider diversifying into emerging markets.

Workshop Objectives:

1. Learn about why investors should consider diversifying into emerging markets.

2. Overview of abrdn's successful approach to income investing.

Company Profile: We invest to help our clients create more. More opportunity. More potential. More impact. We offer investment expertise across all key asset classes, regions, and markets so that our clients can capture investment potential wherever it arises. By combining market and economic insight with technology and diverse perspectives, we look for optimal ways to help investors navigate the future and reach their financial goals. And by putting environmental, social and governance (ESG) considerations at the heart of our process, we seek to find the most sustainable investment opportunities globally.

Speakers

Matthew Williams

Senior Investment Director

Matthew is a Senior Investment Director on the Global Emerging Markets (GEM) desk at abrdn, where he is responsible for the abrdn Emerging Markets Income Equity Fund. Matthew joined the company in 1998. He has successfully managed Japan, Asia Pacific and Emerging Market mandates. Matthew holds a BA in Economics from Durham University. He is a CFA charter holder.

Representatives

Fergus McCarthy

Head of UK Wholesale Distribution

Fergus is the Head of UK Wholesale Distribution, Investments for abrdn. In this role Fergus is responsible for the design and execution of the UK Wholesale Investments strategy. Fergus and his teamwork with Wealth Managers, Advisers, Ratings Agencies, Banks, and our external and internal strategic business partners in the UK. Fergus joined abrdn in 2019 from BNY Mellon Investment Management where he was Head of UK & Ireland Intermediary Sales.

Sean Walter

Sales Director

Sean is a Sales Director within abrdn’s UK wholesale distribution team. For the last 5 years, Sean has covered the London discretionary channel, but now covers the North and Midlands regions, working with top IFAs, wealth managers and DFMs. He’s sitting his CAIA level 1 exam next week! Sean joined abrdn as a graduate in 2016.

Looking East

Asia is the fastest growing region in the world, and a crucial one for investors to consider. However, it is both underrepresented in global benchmarks and difficult to understand. How do we grasp the opportunity?

Workshop Objectives:

- Why Asia matters more than ever

- What’s changing, what’s not: separating signal from the noise over the past few years

- Baillie Gifford’s approach to investing in Asia

Company Profile: Baillie Gifford’s sole business is investment management. Since the company was founded in 1908 it has been a partnership. Today it is owned by 57 partners all of whom work in the business.

We currently manage or advise some £234.2bn on behalf of clients worldwide.

Speakers

Ben Durrant

Investment Manager

Ben is an Investment Manager in the Emerging Markets Equity Team. He has managed the Baillie Gifford Pacific Fund since 2021, and became Deputy Manager of the Pacific Horizon Investment Trust in January 2023. He joined Baillie Gifford in 2017, and prior to re-joining the team in 2021, he has also spent time in our UK, Global Discovery and Private Companies teams. Prior to joining Baillie Gifford, he previously worked for RBS in their Group Strategy and Corporate Finance Team. Ben is a Chartered Accountant and a CFA Charterholder, and graduated with a BSc (Hons) in Mathematics from the University of Edinburgh in 2012

Representatives

Laura Ingleby

CEO, Barclays

.jpg)

Laura joined Baillie Gifford in 2010 and is a Director, Intermediary Clients responsible for the North and Midlands. Prior to Baillie Gifford she worked at Norwich Union in Leeds as a Business Development Manager before moving to Close Fund Management as a Regional Sales Manager for the North and Scotland. Laura graduated in German from the University of St Andrews in 1998.

Kevin Mitchell

Director

Kevin is a Director with a focus on intermediaries in Scotland, Ireland and North East England. He initially joined Baillie Gifford in 2006 to support the Intermediary Client Team. After achieving the IMC in 2010, Kevin took up his current role at the beginning of 2011. Before joining Baillie Gifford, he worked in a marketing role for the Edinburgh-based pensions provider, Scottish Equitable, for six years.

Are bonds in the sweet spot?

Aggressive tightening of monetary policy over the past 18 months has created a potential once-in-a-generation opportunity to access this asset class. Either central banks pause their hiking cycle and rates stay higher for longer, in which case investment grade investors continue to earn the current high level of carry, or they pivot and start easing policy. In that situation, IG bonds earn both the current carry and benefit from the duration tailwind from falling rates.

This session covers the outlook for investment grade over the rest of 2023 and beyond and outlines the benefits of maintaining a high-quality and global focus

Workshop Objectives:

• Why get out of cash and into investment grade bonds now

• How diversifying through global exposure is a cut above a UK-only approach

• The strengths of active management / security selection

Company Profile: Capital Group is one of the oldest and largest asset management companies in the world, managing multi-asset, equity and fixed income investment strategies for different types of investors.

Since 1931, Capital Group has been singularly focused on delivering superior, consistent results for long-term investors using high-conviction portfolios, rigorous research and individual accountability. We build our investment strategies with durability in mind, backed by our experience in varying market conditions. Fundamental proprietary research forms the backbone of our approach, provided by our integrated global network of more than 450 experienced investment professionals, with an average portfolio manager investment experience of 27 years.

Today Capital Group works with financial intermediaries and institutions to manage more than US$2.31 trillion in long-term assets for investors around the world.

1All data as at 31 Mar 2023 and attributed to Capital Group, unless otherwise stated.

Speakers

Edward Harrold

Investment Director

Edward Harrold is an investment director at Capital Group. He has 16 years of industry experience and has been with Capital Group for nine years. Prior to joining Capital, Edward worked as an associate in RBS Global Banking & Markets at the Royal Bank of Scotland. He holds a bachelor’s degree with honours in international relations from the London School of Economics. He also holds the Chartered Financial Analyst® designation. Edward is based in London.

Representatives

Adam Price

Business Development Manager

2_Small%20(1).jpg)

Adam Price is a business development manager at Capital Group. He has 11 years of industry experience and has been with Capital Group for seven years. Prior to joining Capital, Adam worked in structured products at UBS Investment Bank. He holds a bachelor's degree in business management with honors from University of Leeds. Adam also holds an Investment Management Certificate. Adam is based in London.

Tri Huynh

Business Development Manager

Tri Huynh is Managing Director, Financial Intermediaries at Capital Group. He has over 16 years of industry experience. Prior to joining Capital, Tri was Head of Strategic Partnerships at Artemis Investment Management. He holds a bachelor’s degree in Biochemistry and Molecular Medicine from Essex University and has completed the Business Sustainability Management program from the University of Cambridge, Institute for Sustainable Leadership. He also holds the Investment Management Certificate.

The enduring case for European equities

Portfolio manager Marcel Stötzel will examine the outlook for European companies in the current environment and highlight the key factors and themes shaping his latest investment thinking. Against an uncertain macro backdrop, he will outline why a focus on robust dividend-payers is well placed to continue to deliver attractive long-term outcomes for investors.

He will also discuss how the investment philosophy and process underpinning the Fidelity European Fund and Fidelity European Trust PLC are constructed to capture this potential, aimed at finding attractively valued companies with strong balance sheets that are resilient, and able to grow dividends, even in a more challenging economic environment

Workshop Objectives:

• Gain an insight into the global nature of European companies and their correspondingly low impact from the European macro environment.

• Understand the current environment for investors and the outlook for continental European companies.

• Discover the investment implications of higher inflation and the benefit of favouring companies with pricing power in this environment.

Company Profile: Fidelity International offers investment solutions and services and retirement expertise to more than 2.87 million customers globally. As a privately held, purpose-driven company with a 50-year heritage, we think generationally and invest for the long term. Operating in more than 25 countries and with $663.1 billion in total assets, our clients range from central banks, sovereign wealth funds, large corporates, financial institutions, insurers and wealth managers, to private individuals.

Our Workplace & Personal Financial Health business provides individuals, advisers and employers with access to world-class investment choices, third-party solutions, administration services and pension guidance. Together with our Investment Solutions & Services business, we invest $493.5 billion on behalf of our clients. By combining our asset management expertise with our solutions for workplace and personal investing, we work together to build better financial futures.

Data as of 31 December 2022.

Speakers

Marcel Stötzel

Portfolio Manager, Equities

Marcel Stötzel joined Fidelity as an analyst in 2014 and has consistently been one of Fidelity’s top global analysts in terms of both internal metrics and client value add. In addition to his analyst responsibilities Marcel was also promoted to head the cyclicals segment of the European analysts ‘best ideas’ fund in 2018.

He first joined the Fidelity equities team as an MBA intern (covering US tech) before being hired fulltime to cover European Software and IT services and thereafter European Aerospace, Defence and Airlines. Prior to joining Fidelity, Marcel worked as an investment banker at Barclays.

Marcel holds an MBA (INSEAD), is a CFA charter holder and graduated with a Business Science (Hons) in Finance from the University of Cape Town.

Representatives

Dave Ross, CFA

Key Account Senior Manager - Retail Sales, Fidelity International

Dave is responsible for IFA relationships in the North of England and Scotland. He joined Fidelity in Sept 2014 from Aberdeen Asset Management where he was responsible for Adviser and Discretionary relationships in Scotland. Prior to that he held client focussed roles within Scottish Widows Investment Partnership, having joined in 2000 from the Scottish Widows pension department. He holds a BSc (Economics) from the University of Edinburgh and is a CFA Charterholder.

Andrew McNulty

Discretionary Sales Director - Wholesale Sales, Fidelity International

Andy is responsible for DFM relationships in the North of England, Scotland and Northern Ireland. He joined Fidelity in November 2019 after serving ten years at J.P. Morgan Asset Management, where he headed up the Wealth Manager sales team. Prior to that Andy had been Head of UK Sales at Legg Mason. Andy started his career in 1989 as a graduate trainee at Save and Prosper before a 5 year stint at Invesco Perpetual. He holds a BA Honours in History from Sheffield University and has the IMC.

.png)

Why dividends should stop you giving up on Emerging Markets.

Workshop objectives:

• Understand the current backdrop for emerging markets

• Learn how a quality, value approach has delivered a compelling performance profile over the last decade

• In-depth analysis of improving dividend culture in Korea, historically a structural underweight.

Speakers

Omar Negyal

Managing Director

Omar Negyal, Managing Director, is a portfolio manager for the Emerging Markets and Asia Pacific (EMAP) Income and Total Emerging Markets strategies within the EMAP Equities team, based in London. An employee since 2012, Omar previously worked at HSBC Global Asset Management (2009-2012), Lansdowne Partners (2006-2009) and F&C Asset Management (1998-2005). Omar has an M.A. and an M.Eng. in Chemical Engineering from the University of Cambridge and is a CFA Charterholder.

Representatives

A new dawn? Fixed income investing in a high yield environment

Over the last 18 months, the radical repricing in fixed income yields has forced investors to reckon with a new and uncertain environment. The conventional response to the widely anticipated recession would be to turn to lower-risk assets and increase duration, but there are more options available thanks to persistent inflation and conflicting data on when we can expect the downturn to arrive. How can investors position themselves to capture the potential opportunities others may overlook?

Join LGIM’s Head of Global Bond Strategies Matthew Rees and Fund Manager Alex Mack as they explain how they believe the L&G Strategic Bond Fund has benefited from a nimble, diversified and team-based approach and how it is positioned for a challenging economic environment in 2024 and beyond.

Workshop Objectives:

• Outline the key macro dynamics driving investments in 2023

• Describe the fund’s positioning to manage these challenges

• Outline LGIM’s Fixed Income outlook for 2024 and beyond

Company Profile: We are Legal & General Investment Management (LGIM), the asset management business of Legal & General Group. Our purpose is to create a better future through responsible investing. We strive to achieve this through a strong sense of partnership with our clients, working together to achieve positive long-term outcomes.

We draw on industry-leading expertise to innovate constantly across public and private assets, index and active strategies. And we are a responsible investor, rising to the challenges of a rapidly changing world. On behalf of savers, retirees and institutions worldwide, we manage £1.2 trillion in assets.*

*Source: LGIM internal data as at 31 December 2022. The AUM disclosed aggregates the assets managed by LGIM in the UK, LGIMA in the US and LGIM Asia in Hong Kong (2018-2019 only). The AUM includes the value of securities and derivatives positions.

Speakers

Matthew Rees

Head of Global Bond Strategies

.jpg)

Matthew was appointed Head of Global Bond Strategies in September 2019. He was previously co-head of the Euro credit portfolio management team, and joined LGIM in March 2009. Prior to this Matthew spent three years as a Partner at Banquo Credit Management and has worked at UBS, Merrill Lynch and the rating agency Fitch IBCA. Matthew has more than 25 years’ experience in financial services and qualified as a chartered accountant with Coopers & Lybrand in 1996.

Alex Mack

Fund Manager

Alex is a Fund Manager in Global Bond Strategies. He is responsible for managing interest rate exposure in Fixed Income and Multi Asset portfolios. Alex joined LGIM in 2013. Alex holds an MPhil in Economics from the University of Cambridge, St Catharine’s College and a BEconSc in Economics from Manchester University.

Representatives

Daniel Neep

Key Account Manager

Daniel is responsible for sales and relationship management with key intermediaries and wealth managers in the North of England. Daniel joined LGIM in 2022 from AXA Investment Managers where he was Regional Sales Manager for the North of England. Daniel has also held senior sales positions at Close Brothers Asset Management, Aegon, AXA Wealth and Cofunds. Daniel holds the CFA Investment Management Certificate and CII Diploma in Financial Planning.

Praveen Jeyakumar

Regional Account Manager

Praveen is a Regional Account Manager responsible for supporting the growth of LGIM’s Wholesale Distribution in the North of England. Praveen joined LGIM in 2022 from LGBR Capital where he held the title of Strategic Sales Executive, where he was responsible for distributing single strategy equity funds for a range of boutique managers. Prior to that, he completed a Wealth Management Internship at HSBC. Praveen graduated from UCL in 2021 and holds a Bsc in Economics.

UK Equities

Rising interest rates have exacerbated a cost-of-living crisis in the UK with many residents feeling the pinch. However, with consumer confidence defying expectations and UK inflation looking like it has peaked, Martin Currie UK Mid Cap Portfolio Manager, Richard Bullas, presents his case for FTSE 250 investment - long considered a play on the domestic economy despite the international origin of around 50% of earnings. Richard will discuss why investors should consider the index which has significantly outperformed UK large cap counterparts over the last decade, and the extent of resilience engrained in the quality businesses that he has selected in his high conviction, actively managed portfolio.

Workshop Objective: Attendees will learn how UK mid cap businesses have performed historically after periods of drawdown, as well as prevailing merits of investing in a high conviction, FTSE 250 focussed portfolio.

Company Profile: Martin Currie is a global active equity specialist headquartered in Scotland and part of the Franklin Templeton Group. They are a modern, vibrant investment firm with a truly global presence. Martin Currie create concentrated, best-idea investment portfolios that retain conviction in fast-changing markets. These are delivered through innovative strategies, powerful conversations and a high stewardship philosophy. In everything we do we are investing to improve lives.

Martin Currie provides the environment and infrastructure for talented investors and teams to succeed, removing them from all distractions and to focus on generating investment returns.

Investing to Improve Lives lies at the heart of their purpose as an investment firm.

Speakers

Richard Bullas

Co-Head, UK Equities (Small & Mid-Cap)

Richard is Co-Head, UK Equities (Small & Mid-Cap) at Martin Currie. He is lead portfolio manager of the FTF Martin Currie UK Mid Cap Fund and manages the mid cap portion of the FTF Martin Currie UK Manager's Focus Fund. Richard has worked with the fund management team for over 20 years, secialising in UK Small and Mid-Cap Companies.

He joined the company when the Franklin UK Equity team transferred to Martin Currie in 2022, but previously worked at Rensburg Fund Management when it was acquired by Franklin Templeton Investments in 2011. Richard joined the team in 2000 as a Trainee Fund Manager, supporting the fund managers on a range of equity unit trusts while studying for his professional investment qualifications, going on to manage a number of UK equity funds there. Richard has considerable experience in managing small and mid-cap portfolios and conducting in-depth research and analysis. Richard previously worked at AVIVA Plc as a Market Analyst in the life and pensions department. Prior to that he spent a short time working at a chartered accountant in its audit team.

Richard holds a BSc (Hons) in business and management studies from Bradford University School of Management. He holds the Investment Management Certificate (IMC) and is a Chartered MCSI (Chartered Institute for Securities and Investment).

Representatives

Mark Elliott

Head of UK Business Development

Mark Elliott recently joined Martin Currie after ten years at Franklin Templeton as Head of UK Strategic Partnerships, where he was responsible for managing relationships with some of the UK's largest distributors. His 35+ years in UK Financial Services spans various roles at Blackrock, including Head of UK Sales, five years with Lazard Asset Management and 12 years with Sedgwick Noble Lowndes in various Advisory and Management positions.

Dan Williams

Business Development Director

.jpg)

Dan Williams is a Business Development Director at Franklin Templeton, responsible for investment fund distribution in the North of England and Scotland. He joined as a Sales Support Executive in Leeds in 2013. He previously worked at RBS Global Banking & Markets in roles within Derivatives Operations and FX Prime Brokerage. Dan studied at the University of Huddersfield and holds the CFA Level 4 Investment Management Certificate and CISI Level 3 Certificate in Investments.

Are you running too much of a home bias in your fixed income allocations?!

Many investors have accepted that it makes sense for the home bias to be reduced within their equity buckets, with the trend from UK equities towards global equities being played out for many years, the implication here being investors have accepted there are better opportunities outside the UK. But that trend hasn’t played out in fixed income markets, with investors still preferring from a strategic perspective a big overweight to the home market: we will be exploring – perhaps unintended – risks to holding UK assets at the moment, as well as dealing with some of the myths with going beyond the UK. We believe you can get a similar total return profile, but with more diversification, by thinking with a truly global lens and will hence give our views on opportunities and outlook for fixed income markets as a whole.

Workshop Objectives: Learn about (i) unintended risk creeping in by maintaining a large home bias within fixed income (ii) currency hedging costs and implications (iii) diversification benefit (iv) opportunities beyond UK.

Company Profile: Mirabaud Asset Management is part of a private owned partnership, originally founded in 1819. We provide a range of investment solutions to Institutional and Wholesale investors in the UK and Europe. Our investment capabilities cover domestic equities in Europe, including the UK, alternatives and fixed income, encompassing multi-asset credit, high yield and emerging market debt. A common philosophy applies across each of these areas of expertise, which is an active, high conviction approach to generating long term risk adjusted returns. A focus on managing risk and a commitment towards environmental, social and corporate governance principles are important constituents of our heritage.

Speakers

Al Cattermole

Portfolio Manager & Global Credit Analyst

Al joined Mirabaud in November 2013 from Goldbridge Capital Partners where he was responsible for corporate credit research. Al has previously covered global corporates at JP Morgan Asset Management and ECM, having started his career at the Bank of England in 2004.

Al is a CFA Charterholder and has a BA in Economics from the University of Durham.

Representatives

Elliot Fowles

UK Wholesale Sales

Elliot Fowles, UK Wholesale Sales, joined Mirabaud Asset Management in 2022. Elliot, who has nearly thirty years of experience in

the industry, joined from Aviva Investors where he spent the last ten years as Senior Business Development Director. Prior to this, he held sales positions at HSBC Global Asset Management and DWS Investments, among others.

Deji Ijaiya-Harvey

UK Wholesale Sales

Deji Ijaiya-Harvey, UK Wholesale Sales, joined Mirabaud Asset Management in 2021. He joined from River and Mercantile Asset Management, where he was a Sales Support Associate. Previously he held Client Reporting roles at Jupiter Asset Management and Henderson Global Investors. Deji holds a BA in Politics & Economics from the University of Leicester.

(Fixed) Income is back

2022 needs no introduction. It was one of the worse years on record for fixed income.

We believe 2023 is different. Through our 50 years of bond investing, this is one of the most exciting times we have experienced for the asset class.

After years of being starved for income, today’s entry yield levels mean that investors in multi-sector bond strategies can once again aim for attractive income distributions and capital appreciation.

This is what PIMCO’s flagship strategy, the GIS Income fund, is all about. With a 10-year track record of delivering consistent income and strong risk-adjusted returns, the Income fund is that Strategic Bond allocation that takes you through any market environment and helps you go global.

Workshop Objectives: To explain the core considerations for investors looking to allocate to income-generating investment strategies, focusing on multi-sector fixed income.

To highlight PIMCO’s flagship strategy, the GIS Income Fund.

Company Profile: PIMCO is a global leader in active fixed income. With our launch in 1971 in Newport Beach, California, PIMCO introduced investors to a total return approach to fixed income investing. In the 50+ years since, we have worked relentlessly to help millions of investors pursue their objectives – regardless of shifting market conditions. As active investors, our goal is not just to find opportunities, but to create them. To this end, we remain firmly committed to the pursuit of our mission: delivering superior investment returns, solutions and service to our clients.

Speakers

Tina Adatia

Executive Vice President, Fixed Income Strategist

Ms. Adatia is an executive vice president and product strategist in the London office, focusing on global fixed income and ESG strategies. Previously, she was an account manager focusing on the Middle East and North Africa region and servicing institutional clients. Prior to joining PIMCO in 2004, she was on the consultant relationship team at Henderson Global Investors and was also an investment associate at Hewitt in London. She has 17 years of investment experience and holds an undergraduate degree in economics and actuarial science from the University of Southampton.

Representatives

Joseph McCurdy

Vice President, Account Manager - EMEA GWM

Mr. McCurdy is a vice president in global wealth management based in the London office. He is responsible for overseeing the development of PIMCO's business across the U.K. and Ireland, focusing on wealth managers, multi-managers and financial advisers. Prior to joining PIMCO in 2018, he was an investment director at Standard Life Investments. He has 21 years of investment experience and holds an undergraduate degree from the University of Dundee.

Valerie Furman

Vice President, Account Manager - EMEA GWM

Ms. Furman is a vice president and account manager on the global wealth management team in the London office, covering PIMCO’s business across U.K. and Ireland wealth managers, multi-managers, and banks. Prior to joining PIMCO in 2018, she worked at J.P. Morgan in the Private Bank in New York. She has nine years of investment experience and holds an undergraduate degree from the University of Pennsylvania.

Marginal gains not stamp collecting

The benefits of marginal gains have been used in sport for years. Our philosophy is to use marginal gains in the fixed income markets to drive similarly successful outcomes and consistent outperformance. We will describe how portfolio optimisation helps navigate changing market environments.

Workshop Objectives: We aim to provide a useful insight into current macro trends within the Fixed Income markets and how our process helps us overcome these challenges.

Company Profile: Premier Miton is a genuinely active investment manager offering a range of funds and investment trusts, as well as a portfolio management service, covering equity, fixed income, multi asset and absolute return investment strategies.

Our clients’ investments with us are actively managed by our different specialist investment teams, who are empowered to employ their own proven and distinctive investment approaches; with the aim of generating good investment outcomes. In total we are responsible for £11.1bn of client assets under management (as of 31 Dec 2022), split across 18 differentiated investment teams managing 48 distinct investment products (as of 30 Sep 2022).

Speakers

Lloyd Harris

Fund manager and Head of Fixed Income

.jpg)

Lloyd Harris joined Premier Miton in August 2020. He was previously at Merian Global Investors (2012-2020), where he was manager of the Merian Corporate Bond Fund and co-manager of the Merian Financials Contingent Capital Fund. He has also worked at Cutwater Asset Management (2007-2011), initially as an asset-backed CP/MTN trader, then as a European financials credit analyst, and before this, he worked in structured capital markets at Deutsche Bank (2002-2007).

Representatives

Joe O’Donnell

Regional Sales Director

Prior to joining Premier Miton, Joe spent 13 years at Legg Mason, latterly as Head of Wealth Manager and Investment Trust Sales. During that time he worked with clients across the UK and Ireland. Prior to moving into asset management, Joe worked as a Portfolio Manager for Barclays and Investec.

Joe is responsible for the development of Premier Miton's distribution business across the North of England, Scotland and Northern Ireland.

Jonathan Willcocks

Global Head of Distribution

.jpg)

Jonathan was previously Global Head of Distribution for M&G Investments, prior to Premier Miton, where he spent 17 years building up M&G’s UK and International distribution business. Jonathan began his career in 1986 at Hambros Bank. During his career he has held positions at Prolific, Aberdeen, and MFS in a variety of Sales roles with responsibility for both UK and internationally before joining M&G Investments in February 2005.

.jpg)

Rules of the game - protecting and growing capital then, now and in the future

“It is a bad habit to become over reliant on one skill or way of doing things just because it has in the past worked well” – Garrey Kasparov, Chess Grandmaster. A game of chess offers a good parallel to the problem we face as investors. It is a complex game in which strategy is vital. It is a thoughtful analogy for how we approach our investment strategy at Ruffer. Rather than operate in a static framework, we seek to identify what game we are playing and evolve to understand the rules that are required to succeed. In our presentation, we will outline some of the rules of the game that we aim to follow to protect and grow capital in this new, more challenging investment environment, cover some examples of how we have applied these rules in the past, and how we are positioned today

Workshop Objective: Guests to understand the evolution of the Ruffer strategy and the important role that the protection assets play. Introduce guests to some examples of current protection assets used and how they relate to current short and long-term outlook.

Company Profile: At Ruffer, our aim is to deliver consistent positive returns through an unconstrained approach regardless of how financial markets perform. We seek to achieve this by maintaining an offsetting balance of growth and protective assets and have achieved a long, successful track record of protecting and growing the value of our clients’ assets. Our approach has been successful through periods of market fragility including the bursting of the dot.com bubble, the credit crisis and covid-19. We aim to continue this success, whatever the future holds.

Speakers

Jasmine Yeo

Investment Manager

%20(1).jpg)

Joined Ruffer in 2017, having graduated with a degree from Warwick Business School. She is a member of the CISI, following completion of the CISI Masters in Wealth Management. She has managed private client portfolios and now works with wealth managers and advisors as part of Ruffer’s UK wholesale team. She is co-manager of Ruffer’s investment trust.

Representatives

Garrey Hamilton

Business Development Manager

Joined Ruffer in 2021, having spent the previous 14 years at RLAM and Standard Life Investments. He holds the Diploma in Regulated Financial Planning (CII) and the Investment Management Certificate (CFA). He is also a trustee of the Agnes Hunter Trust (SCIO), sitting on the investment committee.

Joined Ruffer in 2021, having spent the previous 14 years at RLAM and Standard Life Investments. He holds the Diploma in Regulated Financial Planning (CII) and the Investment Management Certificate (CFA). He is also a trustee of the Agnes Hunter Trust (SCIO), sitting on the investment committee.ghamilton@ruffer.co.uk

+44 (0)20 7963 8047

ASIAN EQUITIES – Why the Chinese index never goes up but why we believe actively managed Asian equity funds can

We will also touch upon valuations and whether current market levels provide an attractive entry level.

Workshop Objectives: At the end of the presentation you should have an appreciate of some of the key issues driving Asian markets, why we are cautious on China and have an understanding of the case for taking a very unconstrained approach to investing in Asian equities.

Speakers

Robin Parbrook

Fund Manager, Asia Equity

-Over 30 years of experience of managing Asian Equities

- Joined Schroders in 1990 as a graduate trainee on the Asian equity desk

- Moved to HK in 1992 as an analyst and then fund manager on Asian and Japanese equities

- Moved to Singapore in 2001 as deputy CIO of the Asia ex Japan region, subsequently moved to HK to head up the Equity team

- 2007 Launched the Asian Total Return Fund with colleague Lee King Fuei

- Head of Asian Equities and fund manager on several Asian institutional and retail mandates (Asian Opportunities, Asian Total Return) from 2010-2017

- 2018 Returned to London to concentrate on running the Asian Total Return Fund and Asian Total Return Investment Company, along with an Asian Equity Long-Short strategy

Representatives

Jamie Fowler

Fund Manager, Asia Equity

Samuel Furlonger

Business Development Executive – Regional Client Group

Samuel works with financial advisers/ DFMs in the North of England & Scotland, covering the entire scope of the Schroders proposition. Prior to joining Schroders in February 22, Samuel has over 10 years experience working in the financial sector and has previously worked at Fidelity International, Verbatim Asset Management (part of SimplyBiz) and Kin Capital (a leading EIS/VCT firm).