Citywire Brussels Breakfast Briefing 2023

Welcome to Citywire Brussels Breakfast Briefing 2023!

Following the success of our previous editions, we are proud to announce that Citywire will return to Brussels on Thursday 12 October 2023 to bring a group of leading fund selectors together again for our Brussels Breakfast Briefing.

Like so much of the financial world, the business of investment selection is changing faster than any of us can remember. Providing an energising morning, portfolio managers and investors will meet and interact, before we wrap up with a quickfire panel session. A sharp, clean new format that makes the very best use of everyone’s time.

We very much look forward to welcoming you in Brussels!

Sponsors

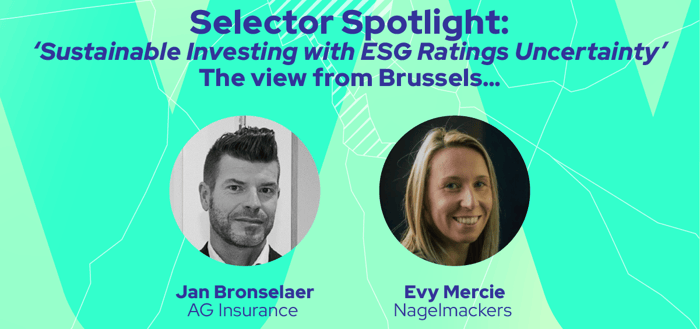

Selector Spotlight

Sustainable Investing with ESG Ratings Uncertainty

One of the biggest concerns related to ESG investing is inconsistency across ESG indexes and ratings, which makes it difficult for fund managers and investors to draw reliable insights and comparisons across firms. ESG ratings agencies have been criticized for a lack of standardization in what should be measured and how, as well as a lack of transparency concerning procedures used in the rankings process. Some opponents have called for ESG ratings to be overhauled or abandoned, while The Economist made the case that financial institutions should retreat from ESG and focus only on the environmental dimension, specifically carbon emissions.*

Furthermore, data is king and according to The Aggregate Confusion Project by MIT**, the correlation among prominent agencies’ ESG ratings is on average 0.54; by comparison, credit ratings from Moody’s and Standard & Poor’s are correlated at 0.92. This ambiguity around ESG ratings creates acute challenges for investors trying to achieve both financial and social return.

In a nutshell, ESG ratings vary widely so...

What is your biggest challenge when it comes to fund selection? Are there impacts on your fund & manager selection? How do you tackle the ESG ratings divergence? Do you have any ESG ratings provider (ESG corporate ratings and ESG fund ratings) you prefer? Why?

What’s the feedback from the fund managers you are invested/monitoring? What are you hearing from them? How do they tackle the ESG ratings divergence? How do they choose their ESG ratings provider and the ESG ratings? And, do they use more than one provider?

Should EU wide measures be implemented in order to limit the mis-selling and misuse of ESG ratings? In a nutshell, given their increasing importance, should ESG Ratings be regulated?

Investors use ESG ratings voraciously. This has a cost, with a recent ERM research study finding that 33 institutional investors spent an average of $487,000 per year on external ESG ratings, data, and consultants. Are ESG Ratings expensive?

Furthermore, companies trading on major exchanges in North America and Europe are far more likely to get properly rated than those trading elsewhere, especially those in emerging markets as well as SME, companies that have recently gone public, unlikely to be rated during their first year of listing, and not listed companies. Even within the ranks of stocks listed on major exchanges, companies with a higher market cap or free float get covered by more raters and have their ratings refreshed more frequently than other companies. Do ESG ratings narrow too much the investment universe?

But also, recent studies have highlighted investors’ criticism of ESG ratings including claims that they are not reliably predictive of future sustainability success and that they do not correlate with ESG risk management capability. What do you think? What would like to see happen in the future to ensure ESG ratings better serve companies, investors, and other stakeholders?

Lastly, what's your best advice to fund managers to tackle the ESG ratings divergence? And what's your best advice to your fund selector peers?

In this new session, our guests will drill down on these burning questions, bringing our audience precious food for thought and sharing also best practices and learning lessons.

Our panellists are:

- Jan Bronselaer, AG Insurance

- Evy Mercie, Nagelmackers

* ESG ratings: Don’t throw the baby out with the bath water, Beth Stackpole Feb 2023. MIT MANAGEMENT SLOAN SCHOOL

** MIT SLOAN SUSTAINABILITY INITIATIVE, The Aggregate Confusion Project

Presentations

Workshops

Investing in the energy and ecological transition

The acceleration of climate change and the evidence of a rapidly declining biodiversity, requires moving towards a lower carbon economy that is less energy-consuming, more resilient and more circular. In order to help investors capture the growth dynamic of this new economy supported by governments, Mandarine has developed an investment strategy based on a scientific approach. It selects companies present in eco-activities identified by the European taxonomy and featuring an active climate approach involving ambitious and coherent objectives for the reduction of greenhouse gas emissions, approved by Science Based Targets initiative. This strategy has been classified under article 9 according to the European SFDR and has received Belgian (Towards Sustainability), French (Greenfin), Austrian (Ecolabel) and German (FNG) labels.

Workshop Objective: Present an investment solution whose objective is to finance and capture the growth dynamics of companies across the world actively involved in the ecological and energy transition, leading to a decarbonised economy.

Company Profile: specialising in equity investing, within LFPI Group.

Mandarine uses a fundamental stock-picking approach based on the qualitative analysis of companies and including financial and sustainability considerations, as a responsible investor. The company is also committed to the active financing of projects involving the social and solidarity economy.

Mandarine’s conviction-based investment strategies cover French, European and Global equities over the entire range of market caps (micro, small, mid and large caps), offering different investment styles (Growth, Value, Dividend Yield, Blend).

The company offers its expertise to all types of clients.

Speakers

Adrien Dumas

Chief Investment Officer

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis eget lectus nulla. Nunc lobortis quam at lacinia interdum. Donec euismod id urna ut ornare. Pellentesque dictum nulla est, vehicula egestas lorem venenatis sed. Proin eu efficitur sem, eget rhoncus nunc. Nunc facilisis interdum accumsan. In a magna ut lectus posuere placerat vel id lorem. Nulla eget nisl sem. Etiam et scelerisque nibh. Aenean ligula enim, tincidunt sit amet blandit in, mollis sit amet velit. Aenean in neque congue, semper nisl eget, varius erat. In hac habitasse platea dictumst. Duis commodo id enim at sollicitudin.

Representatives

Jean-Philippe ABOUGIT

Sales Director for Key Accounts and Belux

Jean-Philippe joined Mandarine in 2013 as Third-Party Distribution Development Manager. Today he is Sales Director in charge of Institutional Investors and Key Accounts in France and responsible for Belgium and Luxembourg distribution. Jean-Philippe was previously Sales Manager at Natixis Multimanager, then senior Project Manager (private banks, networks and multi-asset managers) at Neuflize Private Assets. He holds a Degree in Corporate Finance and Markets from ESA (Ecole Supérieure des Affaires).

Jean-Philippe joined Mandarine in 2013 as Third-Party Distribution Development Manager. Today he is Sales Director in charge of Institutional Investors and Key Accounts in France and responsible for Belgium and Luxembourg distribution. Jean-Philippe was previously Sales Manager at Natixis Multimanager, then senior Project Manager (private banks, networks and multi-asset managers) at Neuflize Private Assets. He holds a Degree in Corporate Finance and Markets from ESA (Ecole Supérieure des Affaires).

What can a global equity portfolio that blends Low risk, Quality and Value add to an investor portfolio in a high yield environment?

Will inflation be structurally high in the years to come? Can the global economy withstand persistently higher levels of rates? What will be the impact of a potential slowdown/recession in the already historically high margins levels and on somehow demanding equity valuations? Will the same assets/strategies that performed well in the ultra-low yield environment that followed the global financial crisis, also be able to deliver attractive returns going forward? These and many other questions are top of mind for investors today. During this session, our aim is not to give insights on our outlook for the global economy and markets, but to explain how a global equity portfolio that blends Low risk, Quality and Value styles can help investors navigate an environment where slowdown/recession risks, inflation and higher rates might be here to stay.

Company Profile: Nordea Asset Management has a global business model and manages asset classes across the full investment spectrum. A total of 930 employees are employed in asset management, of which 1/4 are dedicated investment specialists within four investment centres in Bergen, Copenhagen, Helsinki and Stockholm. With EUR 241 bn in assets under management, Nordea is naturally one of the leading investment manager in the Nordic Region but has also developed a large global business servicing clients across continents (Europe, Americas and Asia). Social responsible-oriented thinking is inherent in the Nordic mentality and so it is not surprising that the Scandinavian countries are global leaders in numerous related aspects. In November 2007, Nordea signed, as one of the first major banks in the Nordic Region, the United Nations Principles for Responsible Investment (PRI). By signing, Nordea commits itself to incorporate environmental, social and corporate governance issues into investment analyses and decisionmaking processes

Speakers

Cristian Balteo

Head of Investment Products - Multi-Asset

Cristian leads an international team of 10 Investment & RFP Specialists focused on Nordea Asset Management's (NAM) Multi-Asset and Risk Premia investment solutions. The team services NAM's Institutional and Wholesale clients across the globe. Prior to joining NAM, back in 2013, Cristian worked for six years as a Fund Selector at a leading Spanish independent financial advisory firm. He also has several years of experience as a U.S. Equity Trader in both Europe and America. Cristian holds a Bachelor’s Degree in International Studies (Magna Cum Laude) from Universidad Central de Venezuela, a Msc in International Relations from IBEI and a MBA from ESADE Business School.

Cristian leads an international team of 10 Investment & RFP Specialists focused on Nordea Asset Management's (NAM) Multi-Asset and Risk Premia investment solutions. The team services NAM's Institutional and Wholesale clients across the globe. Prior to joining NAM, back in 2013, Cristian worked for six years as a Fund Selector at a leading Spanish independent financial advisory firm. He also has several years of experience as a U.S. Equity Trader in both Europe and America. Cristian holds a Bachelor’s Degree in International Studies (Magna Cum Laude) from Universidad Central de Venezuela, a Msc in International Relations from IBEI and a MBA from ESADE Business School.

Representatives

Anouk Slock

Sales Director Belgium

Anouk Slock joined Nordea in 2020, and manages customer relationships in Belgium with a special focus on the insurance segment. Anouk previously worked at the Sales desk of Degroof Petercam Asset Management, having held the position of Specialist in Sustainable Investing. Anouk began her career as an intern in the ETF Sales team at BlackRock Investment Management. Anouk obtained an MSc in Business Economics from the Solvay Brussels School.

Anouk Slock joined Nordea in 2020, and manages customer relationships in Belgium with a special focus on the insurance segment. Anouk previously worked at the Sales desk of Degroof Petercam Asset Management, having held the position of Specialist in Sustainable Investing. Anouk began her career as an intern in the ETF Sales team at BlackRock Investment Management. Anouk obtained an MSc in Business Economics from the Solvay Brussels School.

Filip Spitaels

Country Head Belgium

Filip Spitaels has joined Nordea Asset Management in February 2020 and is Head of Distribution for our distribution activities in Belgium. Filip has more than 19 years of experience in the asset management industry covering wholesale clients in the Benelux region. He previously held positions at Invesco, OYSTER Funds, DWS Investments and ING IM. Filip holds a degree in Business Management (option Languages) from the School of Economics in Ghent.

Filip Spitaels has joined Nordea Asset Management in February 2020 and is Head of Distribution for our distribution activities in Belgium. Filip has more than 19 years of experience in the asset management industry covering wholesale clients in the Benelux region. He previously held positions at Invesco, OYSTER Funds, DWS Investments and ING IM. Filip holds a degree in Business Management (option Languages) from the School of Economics in Ghent.

Redefining the Decarbonisation Opportunity

Viewing decarbonisation investing through a strictly green lens leaves a lot out of the picture. Raj Shant, Client Portfolio Manager at Jennison Associates, PGIM’s active equity manager, will outline a holistic approach employing a broader scope to reveal a diverse $2.5 trillion opportunity set with abundant alpha potential. Find out how to make the most of the multi-decade movement to decarbonise the planet while the carbon reduction revolution is still in its early stages.

Workshop Objective:

Company Profile: At PGIM Investments, we think globally and execute locally. We provide access to active investment strategies in the pursuit of consistent outperformance and local market expertise to meet our clients’ needs.

We’re part of PGIM, the global investment management business of Prudential Financial, Inc. (PFI)1—the world’s 14th-largest investment manager with more than $1.3 trillion in assets under management (AUM)2 and a company that individuals and businesses have trusted for over 140 years.

1PFI of the United States is not affiliated in any manner with Prudential plc, incorporated in the United Kingdom, or with Prudential Assurance Company, a subsidiary of M&G plc, incorporated in the United Kingdom.

2PGIM is the investment management business of Prudential Financial, Inc. (PFI). PFI is the 14th-largest investment manager (out of 434) in terms of global AUM based on the Pensions & Investments Top Money Managers list published on 12/06/2023. This ranking represents assets managed by PFI as of 31/12/2022.

Speakers

Raj Shant

Portfolio Specialist, Jennison Associates

Raj Shant joined Jennison Associates in 2019 as Client Portfolio Manager. Prior to Jennison, Raj spent 17 years with Newton Investment Management, where he was a global equity portfolio manager and portfolio specialist. Previously, he spent five years with Credit Suisse Asset Management, most recently as head of European equities. He began his career in investment banking before moving to become an investment analyst and portfolio manager. Raj earned a BA with honors in economics and management from Leeds University.

Representatives

Steve Beckers

Senior European Sales Manager, Belgium & Luxembourg

Steve Beckers is a director for PGIM Investments, where as Senior European Sales Manager, he is responsible for developing the firm’s presence with financial intermediaries including global, regional and local private banks across Belgium and Luxembourg. He also focuses on business development with wealth managers, family offices and insurance companies through which PGIM’s investment strategies are distributed. Before joining the firm, Steve spent nearly seven years as a Sales Director at Invesco Asset Management, responsible for the wholesale channel in Belgium and Luxembourg, including banks, wealth managers, and family offices. Prior to that, he held a number of roles at BNP Paribas Fortis including covering private banking as a discretionary investment manager and handling structured product sales in the dealing room environment.

Steve Beckers is a director for PGIM Investments, where as Senior European Sales Manager, he is responsible for developing the firm’s presence with financial intermediaries including global, regional and local private banks across Belgium and Luxembourg. He also focuses on business development with wealth managers, family offices and insurance companies through which PGIM’s investment strategies are distributed. Before joining the firm, Steve spent nearly seven years as a Sales Director at Invesco Asset Management, responsible for the wholesale channel in Belgium and Luxembourg, including banks, wealth managers, and family offices. Prior to that, he held a number of roles at BNP Paribas Fortis including covering private banking as a discretionary investment manager and handling structured product sales in the dealing room environment.Steve received a Master’s degree (cum laude) in Applied Economic Sciences from the Catholic University of Leuven with a major in Finance and Portfolio Management and a minor in Managerial Economics and Strategy.

Georgina Poole

Director, Senior Account Manager

As a senior account manager for PGIM Investments, Georgina is responsible for strategic sales assistance and relationship management with Benelux-based financial intermediaries. Prior to joining PGIM Investments in 2016, Georgina held two positions at BlackRock, Inc. as a retail sales assistant and relationship manager, and as an institutional account management service associate. Preceding BlackRock, she worked at Goldman Sachs International as a client valuations and collateral management analyst, covering fixed income and over-the-counter derivatives products.

As a senior account manager for PGIM Investments, Georgina is responsible for strategic sales assistance and relationship management with Benelux-based financial intermediaries. Prior to joining PGIM Investments in 2016, Georgina held two positions at BlackRock, Inc. as a retail sales assistant and relationship manager, and as an institutional account management service associate. Preceding BlackRock, she worked at Goldman Sachs International as a client valuations and collateral management analyst, covering fixed income and over-the-counter derivatives products.

Agenda

08:00 - 08:55

Registration and Breakfast

08:55 - 09:00

Welcome

09:00 - 09:30

Presentation 1

09:35 - 10:05

Presentation 2

10:10 - 10:40

Presentation 3

10:45 - 11:15

Selector Spotlight